Discover the diverse Types Of Tokens In Blockchain: learn about utility, security, governance, and non-fungible tokens (NFTs), their characteristics, and how they power various decentralized applications and economies.

In the blockchain ecosystem, tokens and tokenization are essential ideas, especially when it comes to digital asset representation and management.

What is a Token?

A token is a digital representation of the ownership rights to assets and products in the context of blockchain technology. Like tokens in economics and computers in general, it is an item that symbolizes anything of value. Blockchain tokens work cryptographically and reside digitally on a blockchain, in contrast to conventional tokens that may signify eligibility or replace sensitive data. Cryptographic procedures are used in their creation, protection, and transmission. Like fiat money or cryptocurrencies, tokens may be moved, traded, swapped, regulated, and controlled. They may be developed and used on a blockchain platform, frequently with the use of smart contract programming.

Token vs. Cryptocurrency/Coin

Making the distinction between a token and a cryptocurrency or coin is crucial.

- Like Bitcoin (BTC) for the Bitcoin blockchain or Ether (ETH) for the Ethereum blockchain, cryptocurrencies (or coins) are native digital currencies of their own independent blockchains. Usually, mining produces them.

- Conversely, tokens are constructed on top of pre-existing blockchains. They lack a local blockchain of their own. Ethereum, for instance, has thousands of tokens designed for different uses.

You can also read What Are The Characteristics Of Blockchain And Core Concepts

What is Tokenization?

The act of turning property rights into a digital token that can be monitored on a blockchain is known as tokenization. On a blockchain, it is the process of turning an asset into a digital token. In essence, it refers to the digital representation of an item on a blockchain.

What Assets Can Be Tokenized?

On a blockchain, practically any asset may be tokenized and displayed. This comprises:

- Bonds and stocks.

- Property.

- Cars, oil, or any other asset you wished to purchase or sell.

- Storage or production capacity.

- Calculating digital media files, images, and artefacts.

- Collectibles.

- Intangible ideas like performance and security.

- Commodities.

- Money.

- Loans.

- Intellectual property.

- Assets that are fictitious, tangible, or virtual.

- Shares of a business.

You can also read What Are The Blockchain Transaction Steps And Types?

Types of Tokens in Blockchain

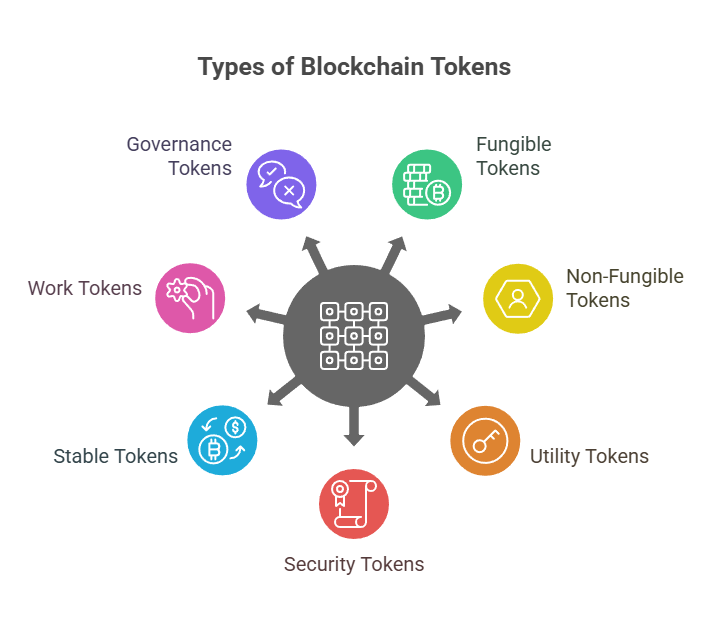

Tokens can be grouped according to their characteristics and applications:

In general, tokens fall into two major categories:

Fungible Tokens (FT): For the same class of tokens, these have the same value as all other tokens. Any other token in the specified class can be exchanged for a fungible token in an equivalent manner. The US dollar, one Ethereum, or one Bitcoin are a few examples. Tokens that are fungible can be divided into smaller pieces. One often used standard for fungible tokens is Ethereum’s ERC20.

Non-Fungible Tokens (NFT): These tokens belong to a certain token class and are unique. No NFT in the same class is equivalent to another NFT. Digital scarcity is made possible by the fact that each token may have unique characteristics. A particular picture or a virtual pet, such as those seen in CryptoKitties, are two examples. Many NFTs are indivisible. On Ethereum, ERC721 is the major non-fungible token standard. ERC1155 supports fungible and non-fungible tokens.

Beyond these two main categories, other types of tokens include:

Utility Tokens: These stand for the privilege of using a certain kind of resource or service. A certain service or asset is available to the owner. The demand for the good or service they make available may determine how much they are worth. Filecoin and StorjCoin are two examples that provide decentralized cloud storage. Work tokens, a subset of utility tokens, like Augur’s REP and Keep Network’s KEEP, need to be staked in order to generate revenue.

Security Tokens: These get their value from outside tradable assets, such commodities or corporate stock. They may grant the investor a stake in the company. They are subject to the customary rules and regulations of the relevant countries as they are securities. Take tZERO as an example.

Stable Tokens (Stablecoins): To keep their price steady, these tokens are linked to the value of another asset, such as fiat money or precious metals. They appeared as a remedy for cryptocurrency price volatility. Collateralization is frequently used to preserve stability. Examples are DAI (issued by Maker DAO) and Tether (backed by the US dollar).

Work Tokens: A theory that requires service providers to stake a certain number of native tokens in order to operate profitably on the network. Since suppliers have “skin in the game” that might be cut, they encourage honest labour. Their worth is correlated with anticipated future service provider cash flows.

Governance Tokens: Within a network, they offer the chance to affect factors such as pricing and development goals. They are worth considering a type of fork insurance.

Benefits of Tokenization

When it comes to managing and representing assets, tokenization offers the following benefits:

- Increases blockchain technology’s wider usability.

- Quicker transaction processing by cutting down on clearing and settlement procedures or counterparty wait times.

- More adaptability, especially for usage across borders.

- Is frequently less expensive than conventional financial products.

- Makes use of blockchain technology’s decentralization.

- Offers security since tokens are safeguarded by cryptography.

- Increases transparency since blockchain technology makes it easy to audit activities.

- Increases trust by providing assurances of security and transparency.

- Facilitates partial ownership of assets (such as real estate or artwork), which is quicker, simpler, and less complex than using conventional techniques.

- Leads to creative uses, such as decentralized markets, insurance, and unique loan systems.

- Makes assets more accessible and available, which raises liquidity. It is possible to make even illiquid assets tradeable.

- May result in better asset management.

You can also read Consensus Mechanisms In Blockchain: How Networks Agree

Challenges of Tokenization

- Notwithstanding the advantages, tokenization has drawbacks.

- Because it might be challenging to hold someone accountable in decentralized systems, regulatory problems are an important topic of discussion. Rules are changing, especially with regard to security tokens. There is worry about new types of financial crime.

- In certain countries, the legitimacy of tokens is a matter of concern.

- Because of potentially challenging software programs and interfaces, the common user may encounter a technological barrier.

- The legal stance on evidence of ownership for tokens backed by physical assets may not always be obvious.

Token Standards

Token standards enable blockchain ecosystem interoperability and acceptance. They make it simple for wallets and apps to handle various tokens without requiring special adjustments for every new kind of token.

- ERC (Ethereum Request for Comments): When utilizing the Ethereum platform, smart contract programmers adhere to these guidelines. They outline the regulations that must be followed by tokens based on Ethereum.

- ERC20: The most well-known and widely used Ethereum token standard for fungible tokens. It lays up a set of guidelines that let tokens to communicate, trade, and do business on the network. The standard specifies events like Transfer and Approval as well as functions like balanceOf, transfer, approve, and allowance. The standard also includes optional features like name, symbol, and decimals. One canonical implementation is offered by OpenZeppelin.

- ERC721: The norm for Ethereum’s non-fungible tokens, or digital collectibles. It specifies methods like balanceOf and ownerOf for accessing token ownership and information. A tokenURI function in the metadata extension enables linking to off-chain information about the token.

- There are further standards, including ERC-1404 (for regulatory transfer limitations), ERC-1400 (for security tokens), and ERC1155 (supporting both fungible and non-fungible).

- A unified classification system for tokens and their characteristics is what the Token Taxonomy Framework (TTF) seeks to offer.

Token Offerings (Fundraising Methods)

Mechanisms for distributing new tokens to the general public, sometimes for fundraising purposes, are known as token offers.

Initial Coin Offering (ICO): A crowdfunding process that distributes tokens to investors’ wallets, usually in return for fiat money or other well-known cryptocurrencies. Because ICOs are frequently unregulated, there are worries about fraud and Ponzi schemes.

Security Token Offering (STO): Entails trading tokenized securities, which fall in the securities category and are subject to legal regulations. Compared to ICOs, STOs are thought to be more reliable and safe.

Initial Exchange Offering (IEO): The tokens are distributed via a cryptocurrency exchange, much like an initial coin offering (ICO). IEOs are often more transparent and reputable than ICOs because of the exchange’s participation and due research.

Equity Token Offering (ETO): A particular kind of STO in which the tokens stand in for stock in a business or enterprise.

Decentralized Autonomous Initial Coin Offering (DAICO): A hybrid ICO-DAO meant to empower investors and make the offering more automated and safe.

Airdrops: Airdrops are a cryptocurrency distribution strategy that involves giving tokens to a sizable user base for free or at a minimal cost. Initial Coin offers (ICOs) and other comparable token offers for distribution can be replaced by this method.

Leveraging the network effects of current blockchains is the main goal of airdrops. Airdrops are intended to encourage the adoption of a new project or cryptocurrency by quickly giving it a starting user base from the outset.

Airdrops do have several disadvantages, though:

- Users who obtain cryptocurrency assets for free or at a reduced cost may be subject to tax consequences; the details of a taxable event resulting from the sale of such an airdropped asset would vary according on the applicable jurisdiction.

- A token’s future worth may suffer if it is distributed for almost nothing since this could dilute the value of the underlying coin being airdropped. The sources emphasise that there are no “free lunches” in economics, suggesting that airdrops might come with extra or compensating expenses.

The Stellar Foundation’s $125 million distribution of its XLM coin via the Blockchain.info wallet is a noteworthy example of an airdrop and is cited as the largest one to date.

Tokenization expands blockchain technology beyond cryptocurrencies to represent and control a variety of digital and real-world assets, enabling ownership, trade, and financial applications. Smart contracts and Ethereum ERC series specifications enable this.

You can also read What Is Tokenization In NLP? How Does Tokenization Work?

Purpose and Impact of Tokens

- A vast array of applications and economic models on blockchains are made possible by tokens.

- They facilitate the development of new business models and encourage involvement in decentralised ecosystems.

- They promote transaction data accuracy and openness.

- Tokens facilitate decentralized finance (DeFi), a blockchain-based ecosystem of financial applications.

- By enabling stakeholders, they support self-sustaining decentralized apps (DApps).

- Tokens have allowed for a wide range of decentralized applications and new economic models, transforming blockchain from a monetary platform to a trust foundation.

Getting Details about Tokens

- Users can view details of all tokens created on a network, classified as fungible, non-fungible, or hybrid based on their token standard (ERC-20/ERC-777, ERC-721, and ERC-1155, respectively). Block explorers such as Chainlens offer statistics and summary information about deployed tokens.

- The information that is accessible comprises the name, symbol, transaction history, underlying contract address, and holder details of a token.