This article gives an overview of Advantages Of DEXs, disadvantages, Features and Types.

A major development in the cryptocurrency business are Decentralized Exchanges (DEXs), which function as platforms that allow traders to trade cryptocurrencies with one another directly, peer-to-peer, without the need for a middleman or central authority. Centralized exchanges, which are run and controlled by a business, stand in stark contrast to this.

Core Characteristics and Operation

Decentralized Nature: DEXs are not managed by a single entity, in contrast to centralized exchanges. Rather, smart contracts usually on a public blockchain like Ethereum are used to run their order books. This indicates that the backend logic is publicly auditable because it operates under a smart contract.

Smart Contract-Driven: Important tasks including transmitting, receiving, and ETH and ERC-20 tokens, recording price requests, and transferring ownership of cryptocurrencies if price requests match are made possible via smart contracts. Trust is increased by allowing prospective users to inspect and audit the code in these smart contracts before they interact with the DEX.

User Custody of Funds: One of the main characteristics of DEXs is that they let merchants keep custody of their own money and private keys. In a DEX, the smart contract controls trades, withdrawals, and deposits while maintaining custody of user funds, in contrast to centralized exchanges where consumers deposit cryptocurrency and the exchange assumes custody. Because the user’s funds are protected from central entity failures and attacks, this arrangement helps lower counterparty risk.

On-Chain Transaction: Every DEX deal is recorded on the blockchain. On Ethereum, Uniswap’s transactions are public.

Token Listing and Access: Token makers can list their tokens on a DEX without obtaining permission because it is not governed by a single company. For example, the Uniswap Token Factory smart contract’s createExchange method can be used by anybody to list an ERC-20 token. In contrast, listing coins on centralized exchanges frequently entails drawn-out discussions, listing fees, and legal paperwork.

Decentralised exchange types

Three main categories of DEXs exist, which are as follows:

- Order books DEXs

- DEX aggregators

- Automated market makers (AMMs)

To put it briefly, each of them allows users to directly trade with one other through their smart contracts. A thorough description of these three is provided below:

Order books DEXs

Records of all open orders to buy and sell assets for specific asset pairs are compiled in order books. A trader’s desire to bid for or purchase an asset at a specific price is indicated by a buy order. Conversely, sell orders indicate that a trader is prepared to sell or ask for a certain price for that specific asset. Spreads affect currency rates and order books. Book of orders Off-chain order books and on-chain order books are the two categories of DEXs.

DEX aggregators

DEX aggregators employ a wide range of protocols and strategies to address liquidity-related problems. In essence, these platforms combine liquidity from various decentralised exchanges to avoid slippage on large orders, optimise token prices and swap fees, and give traders the best price in the shortest amount of time.

Automated market makers (AMMs)

A class of DEXs known as automated market makers (AMMs) determines a token’s price using mathematical calculations. AMMs have distinct trading pairings, like as Ether (ETH) to Dai, just like regular exchanges.

How is a DEX used?

There is no need to register in order to utilize a DEX. To use these services, you don’t even need an email address. Rather, as a trader, you will need a wallet that works with the exchange’s network’s smart contracts.

To use a decentralized exchange, take these actions:

- Step 1: Because there is a transaction charge associated with each trade, choose the network you wish to utilize.

- Step 2: Select a wallet for your network.

- Step 3: Tokens used to cover transaction fees on the selected network are added to the wallet. These tokens must be purchased on centralized exchanges. The ticker symbol they employ will make it easy for you to recognize them. For example, ETH stands for Ethereum.

After buying tokens, withdraw them to your wallets.

You should be aware that preventing funds from moving to the incorrect network is crucial. Once your wallet is financed, you can link it using a pop-up prompt or by clicking the “Connect Wallet” button on the decentralized exchanges’ website.

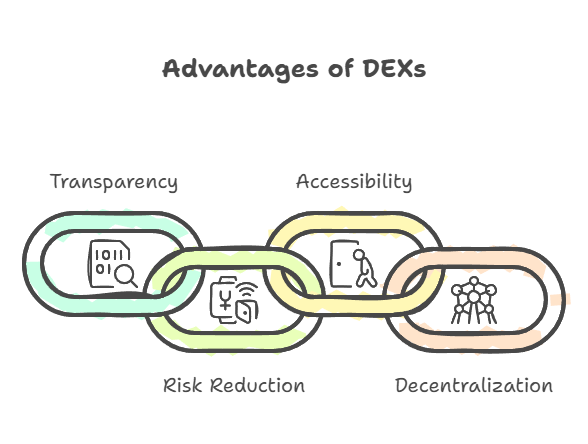

Advantages of DEXs

Greater Transparency: Trust in the exchange is increased because the backend code for DEXs is publicly auditable due to its inclusion in a smart contract.

Reduced Counterparty Risk: Through smart contracts, users maintain control over their money, removing the possibility of losing it in the event that the exchange is compromised or shut down.

Lower Entry Barrier: Due to the lack of conventional “Know Your Customer” (KYC) standards, DEXs frequently have low entry barriers, enabling anybody with bitcoin to utilize the platform without disclosing personally identifiable information. A cryptocurrency address is the only data exchanged.

Decentralization of Control: A distributed network of nodes/miners powers and records a DEX’s entire architecture, including smart contracts and transactions. This makes it extremely resilient to a single point of failure or arbitrary alterations by a single party.

Disadvantages and Challenges of DEXs

Speed and Scalability Limitations: Compared to centralized exchanges, DEXs are frequently slower. Waiting for a deal to be included in a block on a decentralized exchange might take anywhere from a few seconds to a minute. The underlying public blockchain’s maximum transaction speed sets a limit on their transaction throughput. In contrast to more established payment networks such as VisaNet (65,000 TPS), Ethereum’s maximum transaction rate as of 2020 was less than 20 TPS.

Higher Transaction Costs: Every DEX activity, such adding or removing an order, frequently necessitates creating a new transaction. In contrast to centralized exchanges where order modifications are usually free, this means users must pay petrol fees for every action, making frequent trading more costly.

Complexity for Non-Technical Users: For non-technical users, DEXs may be too complex and time-consuming due to the requirement that users sign a transaction for each action.

Limited Fiat Currency Support: Since fiat currencies are linked to the conventional banking system, which depends on central authorities, DEXs typically only permit the trade of cryptocurrencies and do not directly support fiat currencies like USD or EUR.

Risk due to Lack of KYC/Regulation: Although the low entrance barrier is a benefit, investors are not protected against losing their money if a DEX is hacked because there are no conventional KYC procedures.

Examples and Broader Context

WavesDEX, Bancor, Uniswap, and IDEX are a few types of DEXs. Decentralized Finance (DeFi), a blockchain-based financial app ecosystem, decentralizes financial services using DEXs. Cardano, Solana, Polkadot, Cosmos, and Avalanche are gaining popularity despite Ethereum’s DeFi and NFT lead.