Dive into Bitcoin: learn its defining characteristics, the transformative benefits of bitcoin it offers for financial freedom, and the crucial disadvantages to consider for users and investors alike.

Bitcoin

Bitcoin is a novel form of currency and an inventive payment network. Offering a peer-to-peer (P2P) electronic cash system that functions independently of a financial institution or central authority, it is the first real-world use of blockchain technology.

Origins and Core Concept

Creation: The October 31, 2008 Satoshi Nakamoto white paper “Bitcoin: A Peer-to-Peer Electronic Cash System,” debuted Bitcoin. Nakamoto is unknown. Nakamoto mined Bitcoin’s genesis block on January 3, 2009.

Purpose: In his vision, money would be spent without middlemen, restrictions, friction, or faith in others. The double-spending issue that plagues electronic cash systems was addressed by the creation of Bitcoin. Libertarians and anarchists are drawn to its philosophy, which seeks to free money from social and governmental control.

Open-Source: Since Bitcoin is open-source software, anyone can use it, its design is open, and no one owns or controls it.

Core Design and Units

Decentralization: With the use of peer-to-peer (P2P) technology, Bitcoin functions independently of banks and a central authority. Bitcoin issuance and transaction management are handled by the network. This implies that anybody can generate a new Bitcoin address and conduct transactions without requiring authorization.

Units and Divisibility:

- Bitcoin, denoted by BTC and ₿ (Unicode: U+20BF), is the unit of account. Some publications capitalise “Bitcoin” (the technology or network) and use “bitcoin” (the unit of account).

- Bitcoin is divisible to eight decimal places.

- The satoshi (sat), the smallest unit of value, is 1/100,000,000 of a bitcoin, and the millibitcoin (mBTC) is 1/1,000 bitcoin. 1 million bitcoin = 100,000 satoshis.

Pseudonymity: Bitcoin addresses are used to identify funds. Even though owners are anonymous, blockchain transactions are public.

Underlying Technology: Blockchain

Blockchain technology forms the foundation of Bitcoin.

Distributed Ledger: Blockchain is a public transaction ledger. No single central authority controls it because it is replicated to every participating computer (node) in the network.

Structure: An ordered list of “blocks” makes up the blockchain. Every block is linked in chronological order by including a SHA-256 hash of the one before it. Public information that is available for inspection includes individual blocks, public addresses, and transactions inside blocks.

Immutability and Tamper Resistance: New data cannot be removed or altered once it has been added to the chain and placed into a block. It is an auditable and verifiable record because to its “write-once, append-many” format. It would be extremely difficult and computationally demanding to change one block without also affecting all succeeding blocks.

Cryptographic Security

- Hashing is employed in the Proof of Work (PoW) process in addition to chaining blocks. To guarantee the authenticity of a transaction, the block header contains the Merkle root, a hash that represents every transaction in the block.

- Asymmetric-keying Bitcoin employs cryptography (Public Key Infrastructure, or PKI) and consists of two keys: a public key and a private key.

- In order to digitally sign transactions and demonstrate ownership of funds, a private key a randomly selected integer must be kept hidden. The bitcoins are inaccessible if a private key is lost.

- The private key is the source of the public key, which is distributed to the general public. It is employed to create a Bitcoin address. An alphanumeric string used as the transaction destination is called an address. An address’s private key is never at risk while it is published.

How Bitcoin Works: Transactions and Mining

Transactions between users take place directly, without the need for middlemen, over the peer-to-peer Bitcoin network.

Transaction Initiation: The address of the recipients and the amount for each output are specified when a user creates a transaction. Then, in order to verify ownership and guarantee security, they digitally sign it using their private key. Every input must make reference to a prior unspent output in order to avoid double-spending. The transaction fee is made up of the unallocated input satoshis in a transaction.

Broadcast and Mempool: Broadcast to the whole network, the signed transaction gathers in a transaction pool (also known as a “mempool”) as it awaits inclusion in a block.

Mining and Verification: The “miners” are a subgroup of users who offer transaction verification services.

- Miners create blocks from pending transactions.

- Participants compete to solve a difficult cryptographic challenge using Proof of Work (PoW). The block header is repeatedly hashed, containing a “nonce,” a random integer, until a “difficulty target” is reached. This technique requires sophisticated technology and a lot of processing but is easy to test. The Bitcoin consensus method uses PoW.

- Block Time and Challenge: New blocks are added every 10 minutes on average. This average time is maintained by changing block generation complexity every 2,016 blocks, or two weeks.

- Miner’s Rewards: A set amount of freshly created bitcoins (the “block reward”) is awarded to the first miner to solve the puzzle and contribute a valid block. Transaction fees are also frequently collected. This procedure has produced all of the bitcoins that are currently in use. Until the entire supply limit of ₿21 million is reached, which is anticipated to happen in the year 2140, the block reward is divided in half roughly every four years, or every 210,000 blocks. After then, miners’ only source of income will be transaction fees.

Consensus: Other nodes confirm the newly mined block when the miner broadcasts it. The block gets appended to the blockchain if the majority of nodes confirm and approve it. Nodes trust the longest chain, which took the most work to build, in the event of a dispute.

Confirmation: A transaction gets its first confirmation when it is a part of a block and that block is put to the chain. The transaction gets more secure and challenging to reverse as more blocks are stacked on top of it.

Security and Trust

Double-Spending Prevention: Time-stamping and cryptographically connecting transactions into an unchangeable chain is how Bitcoin solves the double-spending issue, making it simple for the network to identify and reject any attempt to spend the same bitcoins twice.

Sybil Attack Prevention: The PoW technique protects the network from Sybil attacks, in which a malicious actor attempts to influence others by assuming multiple false identities. An attacker would be unable to economically control a majority of the network’s computer power (a “51% attack”) required to change the blockchain due to the computational cost of PoW.

Blockchain Modification Security: Changes to the blockchain are extremely challenging due to the proof of work mechanism and block chaining; if one block is changed, all future blocks must also be changed. The Bitcoin blockchain is safe due to the enormous cost needed to control the majority of the global hashrate.

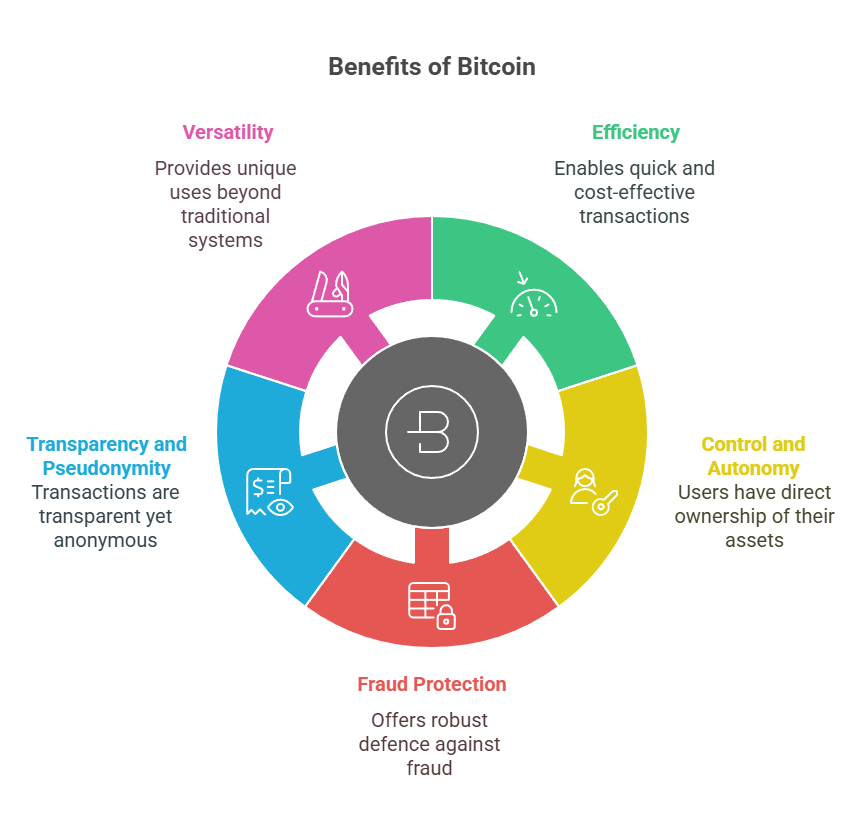

Benefits of Bitcoin

Efficiency: In contrast to traditional transnational transactions, it enables quick peer-to-peer transactions and international payments with little processing expenses. Rather than value, fees are frequently determined by the magnitude of the transaction.

Control and Autonomy: Without middlemen, users have direct ownership of their assets.

Fraud Protection: It offers robust defence against fraud because to its immutability and cryptographic security.

Transparency and Pseudonymity: Because accounts are created without the need for personal identification, users can retain some anonymity yet all transactions are transparently displayed on the ledger.

Versatility: Bitcoin provides “exciting uses that could not be covered by any previous payment system” . It has drawn attention as a fundraising method in circumstances when access to traditional banking channels may be limited, as the 2022 trucker protests in Canada.

Limitations and Challenges

Scalability: In contrast to centralized payment networks like Visa (65,000 TPS), the Bitcoin network can only handle a small number of transactions per second (e.g., 3 to 7 TPS). This may result in traffic jams and delays. One possible scalability solution is the Lightning Network.

Energy Consumption: The Proof of Work (PoW) consensus process uses a lot of electricity more than whole nations do each year which raises issues with electronic waste and environmental effects.

Volatility: Since Bitcoin has no inherent value and is mostly determined by supply and demand, its value is extremely erratic. Although some refer to it as a “pure bubble” or “epidemic,” others view it as a digital rival to gold or as a possible asset class.

Limited Smart Contract Functionality: The programming language used by Bitcoin is purposefully restricted and not “Turing complete,” providing only the most fundamental features.

Loss and Theft Risk: Since the protocol doesn’t accept any other kind of ownership verification, losing a private key results in losing access to the bitcoins. Theft may result from exposing a private key. An estimated 20% of all bitcoins are thought to have been lost.

Centralization Concerns: Research shows Bitcoin mining pools are centralising, despite the network’s decentralisation. If one miner or pool controls over 50% of hashing power, they can double-spend and censor transactions. Online wallets, client software, and simplified payment verification (SPV) clients are likewise controlled by a small number of businesses.

Regulatory Attention: Authorities have taken notice of criminals’ usage of Bitcoin, and as a result, numerous nations have banned it. For instance, as of November 2021, 42 countries had an implicit ban and nine countries had an absolute ban.

Low Usage for Payments: Bitcoin is rarely utilized in everyday transactions with businesses. High expenses, the incapacity to handle chargebacks, high price fluctuation, lengthy transaction durations, and transaction fees are typical causes of this. Nevertheless, it is widely used for illegal activity and in the black market.

Market Characteristics and Usage

Trading Hours: Unlike conventional financial markets, bitcoin markets are open twenty-four hours a day, seven days a week.

Institutional Adoption: Bitcoin has been bought or supported by a number of significant businesses and organizations, including PayPal, MassMutual, Square, Inc., and MicroStrategy.

Legal Tender and Government Use: Although it is still not widely used, Bitcoin was made legal in El Salvador in September 2021. Certain member states, including Colorado (US) and Zug (Switzerland), accept Bitcoin as payment for taxes, and some governments, like Iran, use it to get under sanctions. A sizeable portion of the Bitcoin that was confiscated is also owned by the US government.

Investment: The main uses of Bitcoin are as a store of value and an investment. Exposure to the asset is permitted by exchange-traded funds (ETFs) and regulated Bitcoin funds. The wealth of Bitcoin is extremely concentrated as of 2021, with 27% of the money in circulation held by 0.01% of the total.

Market Volume: As of 2025, Bitcoin transactions on all exchanges average $50 billion per day.