Wrapped Ethereum (WETH) is a tokenized version of Ether (ETH), the native cryptocurrency of the Ethereum blockchain. It is essentially Ether that has been “wrapped” to comply with the ERC-20 token standard.

Here’s a detailed explanation:

What is Wrapped Ethereum (WETH)?

What is Wrapped Ethereum

- The tokenized version of Ether is called WETH. Wrapped tokens, such as Wrapped Bitcoin or WETH, are tokenized versions of cryptocurrencies that are subject to unwrapping at any time and are based on the value of the original coin. A wrapped version of the native cryptocurrency, such as Wrapped BNB, Wrapped AVAX, or Wrapped Fantom, is available on nearly all major blockchains. Like stable coins, these coins operate on a similar principle. Because they may be exchanged for FIAT dollars at any time, dollar-pegged stable coins are effectively “wrapped USD.”

- Pegged Value: Like other wrapped tokens such as Wrapped Bitcoin (WBTC) or Wrapped BNB, WETH is pegged to the value of the original coin (ETH) at a 1:1 ratio. This means that one WETH is equivalent in value to one ETH.

- Redeemable: For the original Ether, WETH can be unwrapped at any time. Stablecoins that are dollar-pegged, meaning they can be exchanged for fiat money, operate similarly.

You can also read Understanding Blockchain DDoS Attack And It’s Common Types

Why is WETH Needed?

The compatibility issue with native Ether (ETH) is the main cause of WETH’s existence.

- ERC-20 Standard Incompatibility: Ether does not adhere to the ERC-20 token standard, which was created in 2015 for fungible tokens on Ethereum. Certain requirements, including total Supply, balance of, transfer, and approve, must be met by ERC-20 tokens.

- Decentralized Application (dApp) Use: Many decentralized applications (dApps), crypto wallets, and exchanges natively support ERC-20 tokens. However, because ETH is not ERC-20 compatible, it cannot be directly used for exchanging with other ERC-20 tokens or for collateral in various decentralized finance (DeFi) applications that often only work with ERC-20 tokens.

- Interoperability: Low interoperability between blockchains is resolved by wrapping coins. By using the token standard of that blockchain, it enables the native currency of one chain to be tokenized and utilized on another. The use of ETH with different dApps that need ERC-20 compatibility within the Ethereum ecosystem itself is also covered by this.

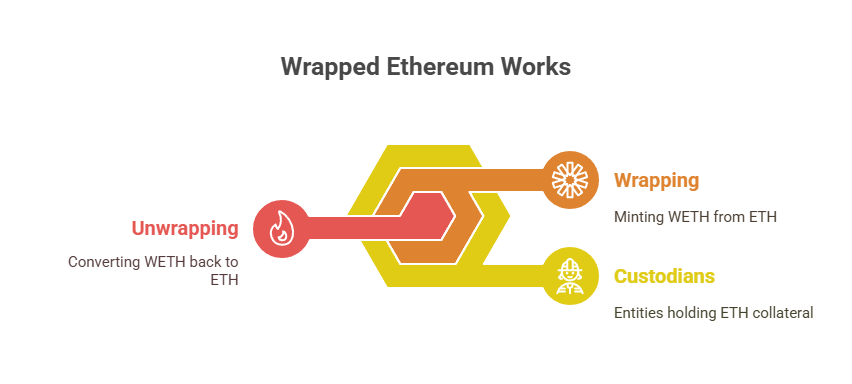

How Does Wrapped Ethereum Work?

Wrapped Ethereum Works

The steps include minting WETH and locking ETH:

- Custodians: In order to wrap tokens, custodians usually need to retain the collateral. Merchants, multi-signature wallets, or most frequently, smart contracts can serve as these custodians.

- Wrapping Process:

- Your initial Ether (ETH) is sent to a custodian, such as a smart contract.

- Then, this ETH is secured or kept as security.

- A matching quantity of WETH is coined and delivered to you in exchange. The value stays constant, much like stablecoins do.

- WETH is an ERC-20 token that is traded for other ERC-20 tokens on DeFi applications on the Ethereum network.

- Unwrapping Method:

- WETH is sent to the smart contract in order to be converted back to ETH.

- After that, the transformed WETH is “burned,” or taken out of use.

- After that, you receive the equivalent of the initial Ether (ETH) back from the collateral. The price of WETH is always fixed to the value of ETH to this technique.

What is WETH Used for?

WETH makes it possible for Ether to be utilised in more decentralized finance (DeFi)-related activities:

- Swapping on DEXs: Users can easily switch between tokens on decentralized exchanges (DEXs) like Uniswap or SushiSwap, which frequently feature WETH.

- DeFi Applications: It enables the use of Ether as collateral in a number of decentralized applications that are limited to using ERC-20 tokens.

- WETH can be put to liquidity pools in order to make trading easier and generate income.

- NFT Trading: It can be used to buy and sell NFTs, for example, through OpenSea and other online auction platforms.

- Cross-Chain Transactions: Although Ethereum is the primary platform for WETH, it is possible for WETH to exist on other significant blockchains as well, producing a mirror image of Ether on other networks. For purposes like yield farming, this enables investors to use Ether on other chains (like Avalanche or Binance Smart Chain), which could cut down on transaction times and fees, particularly when it comes to expensive Ethereum petrol expenses.

- Cannot Pay Gas Fees: It’s crucial to remember that native Ether (ETH) is still needed to pay gas fees on the Ethereum network.

You can also read DoS Attack vs DDoS: Understanding Differences In Blockchain

Methods for Wrapping and Unwrapping Ether

Users can use a variety of services to wrap and unwrap ETH:

- Decentralized Exchanges (DEXs): Platforms like Uniswap or SushiSwap allow users to swap Ether for WETH.

- NFT Marketplaces: OpenSea uses a WETH smart contract to convert Ethereum to WETH easily.

- Crypto wallets: A built-in swap function to convert ETH to WETH is another feature of wallets like as MetaMask.

- Centralized Exchanges: Binance is one example of a central exchange that makes it easier to convert WETH to ETH.

Typically, the unwrapping procedure is the opposite of the wrapping process, utilising the same platforms but choosing the “unwrap” or reverse switch option.

Risks of Using Wrapped Tokens

According to Ethereum co-creator Vitalik Buterin, one of the primary issues with wrapped assets is their vulnerability to centralization.

- Custodial Risk: The process isn’t entirely decentralized due to the presence of custodians, including smart contracts. A centralized platform or a smart contract with flaws could be the custodian, making it vulnerable to manipulation or hacking. The fundamental ideas of decentralization and transparency may be compromised by this.

- Dependency on Third Parties: Issued wrapped tokens are dependent on the platforms of third parties that issue them, which may result in central organizations making choices.

Future of Wrapped Tokens

WETH is often seen as a short-term fix. Updating the Ethereum network’s codebase to make Ether itself ERC-20 compatible is the long-term objective. This would directly achieve full interoperability of Ether by doing away with the requirement to package it for compatibility.

In the short to medium term, wrapped tokens will probably still be crucial because they offer liquidity and make cross-chain atomic swaps easier, even as blockchains grow more naturally compatible.

You can also read Blockchain Security Architecture, Types and Challenges