We discussed all of this in this blog, including what Monero is, its background and history, its key privacy features, its additional technical features, and how it compares to Bitcoin. Below are Use Cases and challenges, Legality, and How to Mine Monero.

What is Monero (currency symbol: XMR)?

Monero (currency symbol: XMR) is a decentralized cryptocurrency that prioritizes anonymity and was introduced in April 2014. It seeks to maintain the security and confidentiality of user funds. In contrast to Bitcoin, which makes all addresses and transactions publicly available, Monero is made to obscure transaction information in order to provide fungibility and privacy. As a result, they are unable to discern addresses, trade Monero, transaction history, balances, or amounts.

Also Read About What Is A Cold Wallet Crypto?, Cold Wallet Benefits Overview

- Privacy, security, and decentralization are Monero values. It is referred to as a “cash-like” transaction mechanism that seeks to conceal transaction information from the general public.

- A decentralized community of hundreds of researchers and volunteers runs the open-source protocol. The project does not have venture capital backing or a pre-mine.

- One can privately and cheaply swap Monero for goods, services, and other currencies.

History and Background

- In a 2013 white paper, Nicolas van Saberhagen, a pseudonymous man who deemed Bitcoin’s traceability a “critical flaw” and privacy and anonymity fundamental to electronic currency, described CryptoNote v2, which was the basis for Monero.

- “Thankful_for_today,” a Bitcointalk user, created BitMonero.

- Other forum members forked BitMonero in 2014 because they disagreed with its course, becoming Monero. The Esperanto word “Monero” means “coin”.

- At the Monero Research Lab (MRL), cryptographers and researchers improve Monero.

Important Privacy Features

Monero uses a variety of cryptographic techniques to implement privacy, and these are automatically implemented:

Ring Signatures

This method combines the real transaction outputs from a sender with additional randomly selected “decoy” outputs from other users. Because of this, it is impossible to determine the actual source of funding in public. The concealment increases with the size of the “ring” (group of possible signers). To avoid double-spending, the genuine sender creates a key image because a duplicate key picture would render the transaction invalid.

Stealth Addresses

For every transaction, the sender creates a fresh, distinct one-time stealth address in order to conceal the recipient. Because this address is generated using the receiver’s public keys and a random number, network observers are unable to identify its owner.

Ring Confidential Transactions (RingCT)

Encrypting and concealing the transaction amounts is the Ring Confidential Transactions (RingCT) feature, which was introduced in 2017. Without knowing the precise value, miners can verify the transaction by doing a “range proof” that is, determining whether inputs equal outputs and amounts are non-negative.

Dandelion++ Protocol

By first sending new transactions to a single node and then using probability to decide when to broadcast them to several nodes, the Dandelion++ Protocol hides the IP address of the devices creating the transactions.

Additional Technical Features

- Consensus Mechanism: Monero’s Proof-of-Work (PoW) paradigm, based on CryptoNote, uses the RandomX hash function, which replaced CryptoNightR in 2019.

- ASIC-resistant RandomX and CryptoNightR enable more efficient mining on consumer-grade CPUs and GPUs. The goal of this design decision is to counteract mining centralization.

- Accounting approach: Monero uses the same UTXO (Unspent Transaction Output) accounting approach as Bitcoin.

- Monero handles transactions in a unique way by dividing the sent cryptocurrency into several amounts and treating each as a discrete transaction with a one-time address. When paired with ring signatures, this makes it even more difficult to track down the precise amount owed to the recipient.

- View and Spend Keys: Transparency is optional with Monero. Users have a “view key” that enables preferred parties (parents, auditors, etc.) to access particular transactions, account holdings, or past transactions. A distinct “spend key” gives someone the ability to take money out of the account and spend it.

Comparison to Bitcoin

- Although they are both peer-to-peer, decentralized currency, Monero is far more focused on privacy than Bitcoin.

- The blockchain of Bitcoin allows the public to observe all transaction addresses and data. On the other hand, these details are by default obscured by Monero’s features (ring signatures, stealth addresses, and RingCT).

- Since Monero transactions cannot be linked or traced, it is “exponentially difficult” to identify the source or recipient of the money. In contrast, Bitcoin makes all transaction information, user names, and wallet balances open and visible to the world.

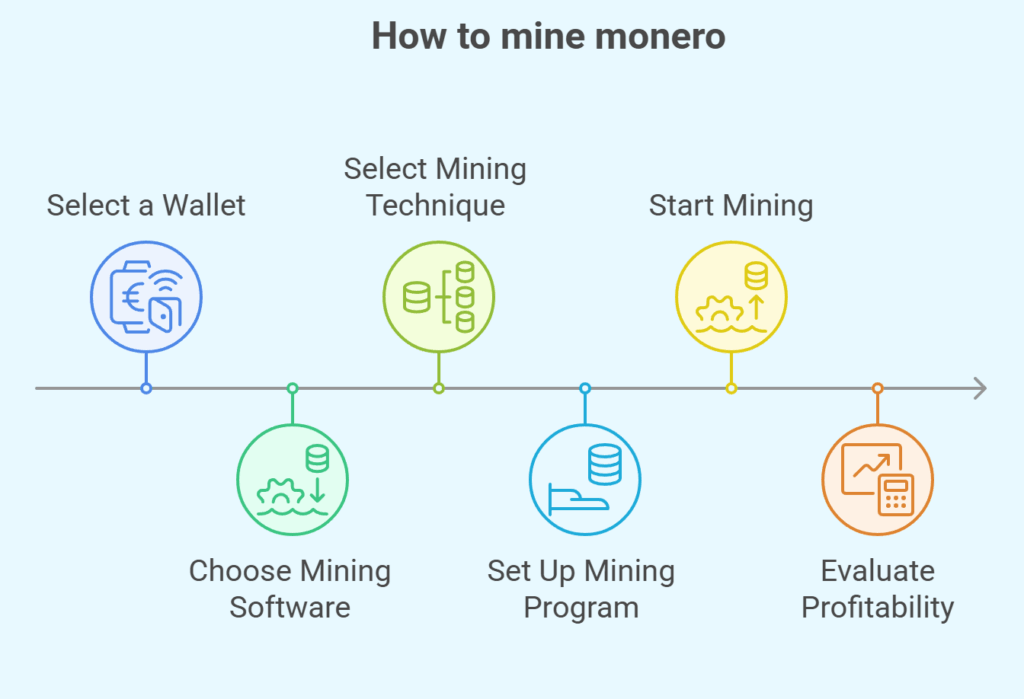

How to mine monero?

A Monero wallet, mining software, and maybe a mining pool are required in order to mine Monero (XMR). Since Monero uses the RandomX method, CPUs are the recommended mining hardware, while some GPUs may also be utilised. For more reliable payouts, you can mine alone or join a mining pool.

This is a detailed guide:

Select a wallet for Monero

To keep your mined coins safe, create a Monero wallet. Exodus, Monerujo (for Android), and the Monero GUI Wallet are well-liked choices.

Choose Mining Software

Download and install XMRig, SRBMiner, or XMR-Stak.

Select Your Mining Technique

- Network issues could make solo mining difficult and require a powerful CPU or GPU.

- Combining computer power in a mining pool increases your chances of locating blocks and earning rewards.

- Monero’s sidechain, P2Pool, offers a decentralised pool experience with pool mining incentives.

Set Up Your Mining Program

- Enter the address for your Monero wallet.

- If applicable, pick the mining pool of your choice.

- Adapt the settings to the capability of your hardware.

Get Mining Started

Start your mining program and keep an eye on your power usage, temperature, and hash rate. To see your earnings, look at the dashboard for your mining pool.

Take Profitability into Account

Consider your gear and electricity costs to evaluate Monero mining profitability.

Also Read About Blockchain Immutability and Blockchain Immutability Benefits

Monero blockchain size

The Monero blockchain is constantly growing, hence its size is unknown. The entire blockchain will be about 225GB by 2024. The size of a pruned blockchain is roughly 86GB.

Use Cases and Challenges

Privacy Advocates: Cypherpunks, crypto anarchists, and users seeking privacy characteristics not offered by other cryptocurrencies have been drawn to Monero because of its privacy features. It enables people to purchase goods and services without leaving a digital “paper trail” and in an anonymous manner.

Illicit Activities:

- Monero’s alleged untraceability has led to a rise in its use in illegal operations.

- Darknet Markets: On darknet markets, it is a popular means of exchange. In 2021, the black market AlphaBay reopened with Monero as the only accepted currency.

- Mining Malware (Cryptojacking): Monero is well-liked by non-consensual miners that use malware. Websites and applications have been infiltrated with malicious JavaScript miners, such as Coinhive, which use users’ CPUs for mining without their permission.

- Ransomware: Because Monero increases the risk of Bitcoin traceability, certain ransomware groups, such as REvil, insist that only Monero be utilized.

- Money Laundering: Money laundering and other organized criminals find it appealing due to its privacy advantages.

Regulatory Responses and Traceability Efforts:

- Some exchanges have delisted Monero and other privacy currencies as a result of regulatory pressure brought on by its illegal uses. Citing regulatory compliance, exchanges such as Binance and Kraken have delisted Monero in specific locations.

- Beginning in 2027, the EU announced plans to forbid financial institutions and suppliers of crypto-asset services from keeping anonymous accounts linked to privacy-preserving coins such as Monero.

- Contractors who can create systems to track Monero transactions have been offered incentives by law enforcement organisations including the US Internal Revenue Service (IRS). These contracts have gone to blockchain analysis firms like Chainalysis and Integra FEC.

- Monero is “untraceable for now,” according to a 2022 research, but it’s “probably only a matter of time and effort before it changes.” Studies have indicated possible weaknesses in Monero’s traceability.

Also Read About Blockchain Security Architecture, Types and Challenges

Legality

Due to its alleged usage in unlawful activities, Monero was prohibited in several other nations but not in the United States as of June 2024. Although it isn’t “blacklisted” everywhere, several nations forbid it because of the anonymity it offers. The way Monero mixes transactions makes tracking money transfer “very difficult” despite efforts to trace it.