This article gives an overview of 51 Attack Examples, What is 51 Attack in Blockchain And How a 51% Attack Works.

What is 51 Attack in Blockchain?

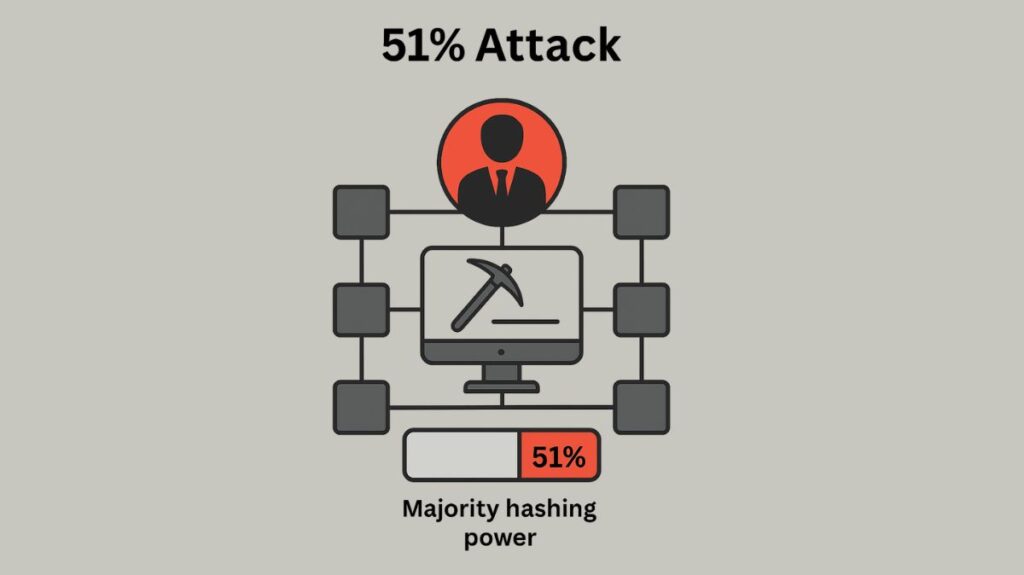

For blockchain networks, especially those that use a Proof of Work (PoW) consensus mechanism, a 51% attack poses a serious cybersecurity risk. It happens when one person or organization controls more than half of the hashing or processing power of a blockchain network. They are able to subvert the core decentralization tenet of blockchain technology because of this excessive power.

Here is a thorough breakdown of its causes, possible effects, and ways to avoid it:

How a 51% Attack Works

The entity with greater processing power has a better chance of resolving the intricate computational problem needed to produce the next valid block in blockchain networks that use a Proof-of-Work (PoW) consensus method, such as Bitcoin. Typically, an attack goes like this:

Accumulating Power: First, the attacker must gather over half (51%) of the network’s processing or hashing capacity. The attacker might do this by obtaining a lot of hardware or convincing many miners to join their pool.

Partitioning and Private Mining: The attacker successfully isolates their group from the main network after they have a majority of the hashing power. This hacker gang keeps up internal communication while mining, but it doesn’t disclose its progress or get updates from the wider network. Consequently, two concurrent iterations of the blockchain start to develop separately.

Fast-Paced Mining: The attacker’s group can add blocks to their own version of the blockchain more quickly than the rest of the network because of their higher hashing power. The private blockchain of the attacker will undoubtedly grow longer over time than the chain kept up to date by trustworthy nodes.

Reintegration and Dominance: Both rival blockchain versions spread throughout the system when the hacker group re-enters the network. The consensus protocol states that the nodes in the network will reject the shorter chain and accept the longest chain as the legitimate one. This implies that any blocks that the honest network adds during the time of separation are orphaned, and the transactions associated with them are returned to the Mempool.

Achievable Malicious Actions and Impacts

If a 51% attack is successful, it can have a number of negative effects that seriously impact the blockchain network and its users:

Double-Spending: The most dreaded outcome is this one. The same digital assets may be used by attackers more than once. In their private chain, they can spend the same money to an address they control after completing a transaction on the public chain. The first transaction is reversed, enabling them to spend the money once their private chain gains dominance. The digital counterpart of a perfect counterfeit is this vulnerability.

Censoring or Delaying Transactions: Attackers have the ability to completely block transactions from particular addresses or stop fresh transactions from being validated and added to blocks. This interferes with the network’s regular operation and may cause major delays.

Reversing Transaction History: In addition to double-spending, an attacker can successfully force a modified transaction history onto the network by rewriting blockchain data and undoing previous records or transactions.

Network Disruption: By causing blocks to become disorganised, postponing Proof-of-Work confirmations, and maybe stopping the entire system, a 51% attack has the ability to completely destroy a blockchain network.

Denial-of-Service (DoS) Attack: Attackers can prevent honest miners from regaining control and permanently build the dishonest chain by overwhelming the network and blocking their addresses.

Reduction in Rewards: Miners receive less money for updating transactions since, in theory, hackers steal their shares. Hackers can theoretically reverse transactions because 51% of attacks have the potential to result in double-spending.

Damage to Reputation and Market Capitalization: The reputation of a blockchain can be seriously harmed by a successful attack, which could discourage new users or investors, cause a major decline in the value of the cryptocurrency, and cause a loss of confidence.

Vulnerability and Feasibility

Smaller Blockchains are More Susceptible: Because it is simpler for one individual or group to gain majority control, these attack are typically restricted to smaller blockchains with fewer nodes or lower hash rates.

High Economic Cost for Large Networks: Given the enormous amount of computer power, energy, and money needed, launching a 51% attack on a larger network, such as Bitcoin or Ethereum, is regarded as prohibitively expensive and logically unfeasible. For example, the cost of purchasing the required ASIC miners alone not considering continuing maintenance and electricity expenses would surpass $7.9 billion in order to attack the Bitcoin blockchain.

Difficulty in Altering Historical Blocks: Even with 51% ownership, it becomes very difficult to change transactions that happened far back in the blockchain, particularly those that were validated after a specific number of blocks (checkpoints).

Hashing Power Rental Services: Theoretically, by renting hash power, services such as NiceHash can enable a 51% attack against smaller, GPU-only networks, drastically reducing the initial cost for attackers.

Real-World 51 Attack Example

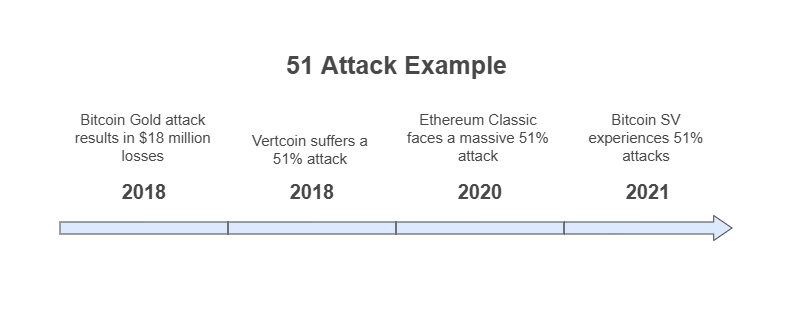

Numerous 51% attacks have happened on cryptocurrency networks in spite of security precautions, frequently focussing on hard forks or smaller blockchains:

Bitcoin SV (2021): Even the fork that is closest to Bitcoin is vulnerable to 51% attacks, as demonstrated by the 2021 attacks on the Bitcoin SV network. Attackers erased 10 hours’ worth of transactions (about 570,000), affecting more than 100 blocks.

Bitcoin Gold (2018, 2019): Suffered attacks in 2019 that resulted in losses of around $18 million, which caused numerous exchanges to delist and become unstable. A common target has been Bitcoin Gold.

Ethereum Classic (multiple attacks): Massive 51% attacks were encountered, including one in August 2020 in which hackers nearly doubled their spending of $5.6 million. Ethereum splits, in contrast to Bitcoin, have occasionally recovered their standing after an attack.

Vertcoin (2018): Despite being less well-known, Vertcoin was subjected to a 51% attack in December 2018. 603 VTCs, or almost $100,000, were double-spent by the attacker.

Litecoin, Bitcoin Gold, and other minor cryptocurrencies have been the target of more than 40 51% attacks (sometimes referred to as chain reorganizations or reorgs) since June 2019.

Prevention and Safeguards

A number of strategies are used to reduce the likelihood of 51% attacks:

Shift to Proof-of-Stake (PoS): Proof of Stake techniques, which are less vulnerable to 51% attacks, are being used by or are being adopted by many cryptocurrencies. PoS requires an attacker to obtain more than half of the total coin staked, which is unaffordable. The value of their own staked assets would drop in the event of an attack, resulting in large losses.

High Cost of Mining Equipment for PoW: It is not economically possible to launch and maintain a 51% attack due to the high energy needs and maintenance expenses of ASIC miners employed in large PoW networks.

Delaying Blockchain Confirmations: In order to reduce the possibility of double-spending, vendors frequently wait for a specific amount of block confirmations before shipping products. Since attackers would have to maintain control for a longer amount of time, which would greatly increase expenses, this allows time for the network to notice and possibly fend off an attack.

Penalty Systems: PoS blockchains have “slashing” conditions that increase the stakes for attackers by punishing bad actors who violate network rules by taking away some or all of their staked tokens.

Blockchain Protocol Audits: Frequent audits carefully examine the protocol for flaws, including possible paths for a 51% attack, enabling the early detection and correction of issues.

Community Response: As demonstrated by the DAO breach in 2016, which resulted in an Ethereum hard fork to restore losses, blockchain networks can execute hard forks to thwart malevolent users and undo harm.

Intrinsic Economic Deterrents: A safeguard is provided by the expense of carrying out a 51% attack, which frequently equals the price received via ethical mining. Because the marginal processing power used for an attack yields less than that of honest mining, attackers are less inclined to skew the ledger if the probability of detection is high.