This article discusses Proof of Stake (PoS) and covers its definition, Works, features, advantages of proof of stake, drawbacks, and variations and implementations, as seen below.

Proof of Stake (PoS)

PoS can replace PoW in blockchain consensus. The premise is that people having a bigger “stake” in the system will want it to succeed and not undermine it.

Also Read About Decentralized Autonomous organization news include DAO Risks

How Proof of Stake Works

Staking is the technique by which users of a blockchain network lock a certain quantity of cryptocurrency into the network in a proof-of-stake mechanism. In most cases, the staked cryptocurrency can no longer be used.

Adding new blocks usually entails the following steps:

Validator Selection

When publishing new blocks, PoS blockchain networks take into account a user’s stake. The ratio of a user’s stake to the total amount of cryptocurrency invested in the network determines the possibility that the user will publish a new block. This implies that fresh blocks are more likely to be published by users who have a larger stake. Coin age, stake size, hash value, or pseudo-randomness can all be used in the selection process.

Block Creation and Validation

Since nodes in a proof-of-stake (PoS) network do not carry out computational “work” to find a block, they are referred to as validators, minters, or stakeholders instead of miners. A block is widely accepted after a validator has been chosen to suggest it. The block is verified by the validator and added to the blockchain if they are legitimate.

Rewards

Block rewards or transaction fees are given to validators as compensation. After a predetermined amount of time, a validator’s stake and reward are relinquished if they stop being one.

Coin Age

A staked coin may acquire a “age” property in certain proof-of-stake systems. The aged cryptocurrency may be taken into consideration for the owner’s selection to publish the subsequent block after a predetermined amount of time (for example, 30 days). After that, the coin’s age is reset, and it won’t be usable again until the required amount of time has passed. Because of a cooldown timer, this technique tries to keep users with greater stakes from controlling the system by allowing them to publish more blocks.

Also Read About Future Of The Blockchain And Ongoing Challenges for Future

Important Features and Qualities

Trust and Incentive-Based

The basic tenet is that those who have a large stake in the system are motivated to perform honourably in order to preserve its integrity.

Economic Disincentive

Some networks use “slashing” to discourage malevolent conduct. A validator’s committed bond (stake) may be erased if they do malevolent behaviours, such as certifying several branches that clash. This financial incentive makes it prohibitively expensive to attack the network and deters validators from verifying various branches.

Low Energy Consumption, No Mining

PoS does away with the computationally demanding mining challenges that PoW requires. As a result, PoS networks are much less resource-intensive and energy-efficient.

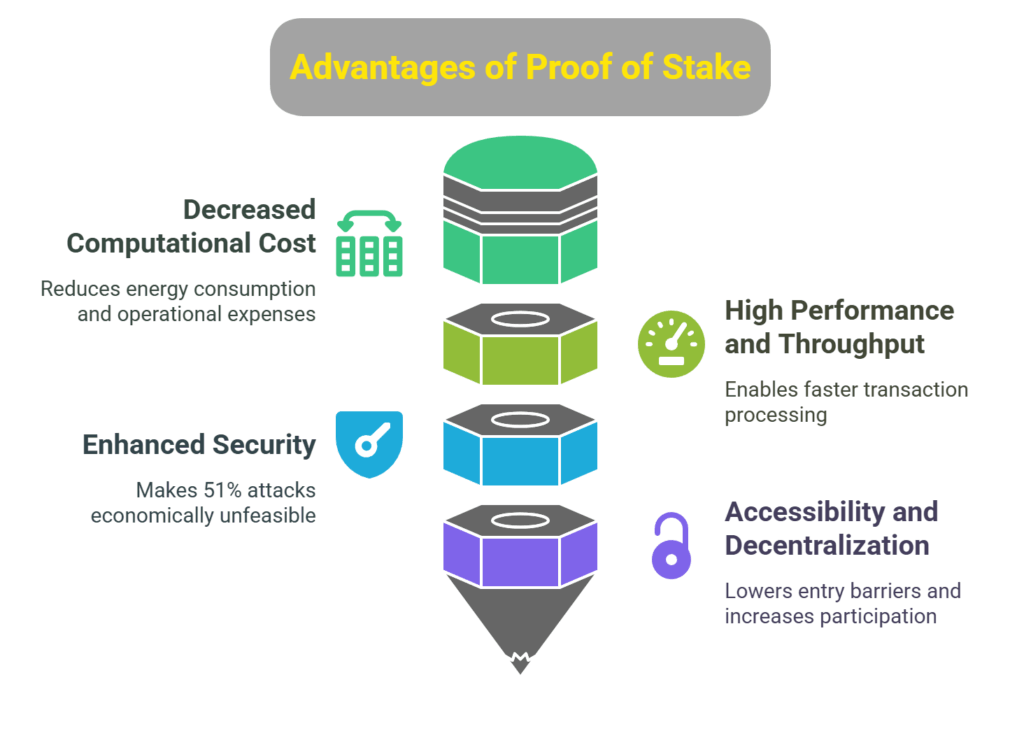

Advantages of Proof of Stake

- Decreased Computational Cost and Energy Consumption: PoS uses a lot less computing power than PoW, which results in lower operating expenses and energy consumption.

- High Performance and Throughput: Because PoS algorithms do not require computational problems that take a lot of time and energy to solve, they are inherently quicker than PoW algorithms.

- Enhanced Security and Fault Tolerance: Because cutting has a negative economic impact on an adversary’s staked assets, it is exceedingly expensive for them to launch a 51% attack.

- Accessibility and Decentralization: PoS can boost stakeholder participation by decreasing the barrier to entry by eliminating hardware consumption concerns, which could decentralize the network.

Limitations and Drawbacks

“Nothing at Stake” Issue

A PoS validator may be able to vote on both chains without incurring significant costs if a blockchain splits, which could jeopardise security. This is addressed by slashing mechanisms, which penalise malevolent behaviour.

Centralization Tendencies

“Stakeholders control the system” is a concern, even though PoS strives for decentralization. This can result in a situation where “the rich get richer,” since those who have more coins can stake more, which increases their odds of validating blocks and earning them more digital assets. This can result in a group of interested parties forming and consolidating power.

Grinding Attacks

A “grinding vulnerability” could be created if malicious parties employ computer resources to sway the election of a leader.

Trust Dependency

A PoS system’s security hinges on the economic incentives being properly balanced, which entails having faith that validators won’t band together to undermine the network.

Variations and Implementations

PoS is a popular substitute for PoW that has been implemented differently on several blockchain platforms:

- Ethereum 2.0 (Serenity): Ethereum is switching to PoS using the Casper algorithm. This transition involves the beacon chain tracking validators and managing the Casper PoS consensus.

- Delegated Proof of Stake (DPoS): Stakeholders choose a set number of “witnesses” or delegates to verify transactions and create new blocks. Although this approach is quicker and more effective, node diversity may decrease. BitShares, Steem, Steemit, and EOSIO are a few examples.

- Tezos uses Liquid Proof of Stake (LPoS), which enables XTZ token owners to stake their tokens for “Baking” the voting process and vote on protocol improvements.

- Algorand employs the Pure Proof of Stake (PPoS) architecture, which enables any user with ALGOs to take part in consensus. Block proposers are chosen at random according to their stake.

- Combining Proof of History (PoH), which offers a verifiable sequence of events, with a PoS-based election process to choose leader nodes is how Solana does it.

- Peercoin, Nxt, Dash, Neo, Cardano (using the Ouroboros protocol), Polygon, Polkadot (Nominated Proof of Stake), Cosmos (using Proof of Stake Tendermint), and Quorum are some more noteworthy implementations.

- Hybrid Models: Some models mix PoW and PoS, such as Proof of Activity (PoAc). Additionally, ByzCoin combines PBFT-based consensus and PoW with PoS.