In this article, we learn about Avalanche, Avalanche Performance, Objectives, Consensus Mechanism, Architecture, Token, Scalability, and Use Cases.

Avalanche

Ava Labs introduced the well-known Layer 1 (L1) blockchain platform Avalanche in September 2020. Because builders need high performance at scale, this blockchain is made to be incredibly quick and low-latency. The primary objective of this platform is to facilitate the construction of decentralized apps (dApps) and custom blockchains with sub-second finality and minimal costs by offering an open, programmable, and highly scalable platform. All assets in the world are to be tokenized and digitized by Avalanche, which is designed to be adaptable enough for organizations, businesses, and developers to build scalable, compliant Web3 solutions for almost any use case.

Here is a detailed explanation of Avalanche:

Core Vision and Objectives

To solve the blockchain trilemma, Avalanche balances scalability, security, and decentralization. Its architecture balances security, decentralization, fast transactions, and minimal costs. Everyone can read and edit the open-source code.

Avalanche Consensus Mechanism

At the heart of Avalanche’s innovation is its unique consensus mechanism, often referred to as the Avalanche Consensus or Snowman Consensus (a variant used on the C-Chain and P-Chain). Unlike traditional Proof-of-Work (like Bitcoin) or classical Proof-of-Stake (like early Ethereum), Avalanche uses a probabilistic approach based on repeated sub-sampled voting and network gossiping.

- How it works: Avalanche combines conventional consensus and decentralization in the Nakamoto style, which is different from typical techniques. Randomized subsampling and repeated voting are employed. To verify a transaction, a validator selects a small subset of other validators at random. The validator who makes the query adopts that preference if a significant majority of the sampled validators concur. This “snowball” effect swiftly leads the network to consensus after repeated repetitions.

- Finality: This probabilistic approach allows for near-instant transaction finality, typically under one second.

- Robustness: The protocol can tolerate many malicious validators, making it resistant to Byzantine faults.

- Key Features: It offers high throughput (thousands of transactions per second), low latency, scalability, energy efficiency (as a Proof-of-Stake variant), and decentralization. The network should theoretically become faster as it grows.

Avalanche Architecture

Subnets and Chains Avalanche’s unique architecture follows a multi-chain approach. The network consists of a Primary Network and an entire network of Avalanche Layer 1 blockchains (Subnets).

- Primary Network: This serves as the economic and foundational hub, where liquidity flows easily. It is composed of three built-in blockchains, which all validators on Avalanche’s Primary Network are required to validate:

- X-Chain (Exchange Chain): Used for creating and transferring assets like AVAX. It operates on the Avalanche consensus mechanism.

- P-Chain (Platform Chain): Coordinates validators, manages Subnets, and handles staking operations. It adheres to the Snowman consensus protocol.

- The smart contract platform known as C-Chain (Contract Chain) is completely compatible with the Ethereum Virtual Machine (EVM). It facilitates the porting of Ethereum-based smart contracts for developers by supporting Solidity and the majority of Ethereum tooling (such as MetaMask, Hardhat, and Remix). The Snowman consensus protocol is another one of its uses.

- Avalanche L1s (Subnets): These are independent, sovereign Layer 1 blockchains built using Avalanche’s subnet architecture.

- Concept: A subnet is a dynamic collection of validators responsible for the consensus mechanism of one or more associated blockchains. Each blockchain is linked to only one subnet.

- Benefits: Subnets enable horizontal scaling, as each can run independently without congesting the main network. They offer customizability, allowing developers to define custom gas tokens, virtual machines, and compliance rules (e.g., KYC/AML for enterprise use cases). They also facilitate interoperability via Interchain Messaging (ICM), allowing subnets to interact and transfer assets. Subnets inherit a high level of security because all validators of a subnet must also be validators on the Primary Network.

- Use cases: Businesses, gambling initiatives, regulated assets, and applications needing particular blockchain environments are all best suited for subnets. To manage FEMA Public Assistance payments, for example, Deloitte employs an Avalanche subnet.

What is Avalanche Token?

AVAX is the native utility token of the Avalanche network. Its multiple purposes include:

- Staking and securing the network: Validators must stake AVAX to participate in consensus and earn rewards. The minimum staking requirement for the primary network is 2,000 AVAX.

- Fee payment: AVAX powers the Avalanche network, used for paying transaction fees across all chains and fueling custom blockchain operations.

- Governance: By casting votes on significant improvements and modifications, such as modifications to transaction fees and the rate at which new coins are created, AVAX holders can take part in network governance.

- Subnet Creation: When establishing new custom subnets, AVAX is needed as collateral.

- Deflationary Mechanism: All transaction fees on Avalanche are burned (permanently removed from circulation). This deflationary pressure helps offset inflation from staking rewards, aiming for a balanced token economy with a total capped supply of 720 million tokens.

You can also read Benefits Of SHA: Secure Your Data And Digital Transactions

Decentralization and Validator Participation

By enabling thousands of validators, Avalanche hopes to become one of the most decentralized Layer 1 platforms. Because nodes don’t need any specific hardware, anyone can participate. AVAX incentives are used to reward validators, and a large number of validators guarantees a more equitable distribution of rewards.

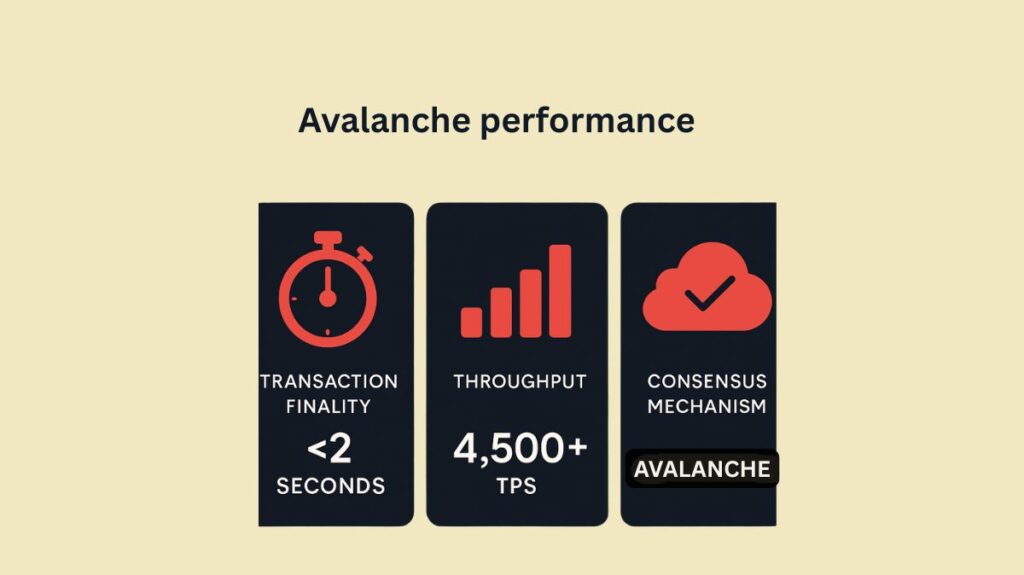

Avalanche performance and Scalability

Transaction finality can be reached in less than a second, and Avalanche can process more than 4,500 transactions per second (TPS). It outperforms Ethereum, which has historically had 15–30 TPS. Avalanche can scale horizontally, enabling the addition of new Avalanche L1s without causing network congestion, to its consensus design and multi-chain architecture. Even though Avalanche boasts a high TPS, its actual transaction rate has been lower on average, most recently hovering around 13.43 TPS, yet on its busiest day of the week, it reached 405 TPS.

Avalanche Use Cases

Avalanche supports a wide range of applications and has a rapidly growing ecosystem:

- Decentralized Finance (DeFi): It is optimal for contemporary DeFi applications, such as protocols like Aave, Benqi, and Dexalot, because of its speed, sub-second finality, high-throughput consensus, and EVM compatibility.

- Gaming: Players now have full ownership of in-game items through blockchain technology. With popular games like Off The Grid and Maplestory building upon it, Avalanche’s scalability and customizations offer the framework for engaging, player-driven gaming experiences. The Avalanche Foundation has started projects to promote AI-based apps and Web3 gaming.

- Enterprise & Consumer Apps: By facilitating the quick and scalable building of Web3 applications, Avalanche speeds up the expansion of blockchain businesses. FIFA, Uptop (with the Detroit Pistons), Sports Illustrated, and Balcony (for real estate) are some of the partners. Because of Avalanche’s quicker time to market, superior performance, reduced expenses, and enhanced security, businesses are selecting it.

- Institutions and Capital Markets: It offers purpose-built blockchains with the speed, security, and performance demanded by institutions today. Current partners include JPM, Citi, Republic, WisdomTree, Franklin Templeton, and BlackRock.

Recent Platform Developments Recent initiatives include

- Avalanche9000 upgrade: Made launching L1s more economically feasible, simpler to customize, smoother to maintain, and quicker to bring to market. In December 2024, Avalanche raised USD 250 million for this upgrade.

- Avalanche Octane: Enhances the C-Chain’s ability to maintain stable and predictable transaction fees by enabling dynamic gas limits and refining price discovery.

- Acceleration of new Avalanche L1s: Major brands like FIFA, Maplestory, Inversion Capital, and Nonco have launched their own sovereign, custom blockchains.

Development and Community

Avalanche offers a Developer Hub, a Builder Kit, Grants, Tools, thorough documentation, and hackathons. Its developer and validator community is worldwide, and it has robust community support via forums, Discord, and the global ambassador network known as Avalanche Team1.

Avalanche vs. Ethereum

While Avalanche is EVM compatible and competes with Ethereum, there are key differences:

- Consensus Mechanism: Avalanche’s consensus allows for much faster finality and higher throughput than Ethereum’s current Proof-of-Stake implementation.

- Architecture: Since Ethereum is working on Layer 2 solutions and sharding, Avalanche’s multi-chain (X-Chain, P-Chain, and C-Chain) and subnet architecture offer a more horizontally scalable and adaptable environment.

- Fees: Because of Avalanche’s scalability and efficiency, transaction fees are typically much lower. Ethereum burns a small portion of its fees, whereas all Avalanche fees are burnt.

- Ecosystem Maturity: Ethereum’s ecosystem has a longer history and is broader and more developed. Though relatively new, the environment of Avalanche is expanding quickly.

- Bridging: You can bridge Ethereum cryptoassets to Avalanche’s C-chain using the official Avalanche bridge, allowing for faster transactions and lower fees for similar DeFi activities.

Consider Avalanche to be a high-speed, multilane freeway infrastructure especially made for contemporary digital traffic. Unlike previous blockchain systems, which have a single, frequently clogged main road, this one has parallel specialised lanes (the X-Chain for assets, the P-Chain for coordination, and the C-Chain for smart contracts).

Additionally, its subnets function as private, specially designed toll roads that branch off the main highway. Each has its own set of regulations and traffic, allowing particular applications or businesses to run as efficiently as possible without interfering with the main network. An intelligent traffic control system called the Avalanche Consensus handles all of this, allowing cars to reach their destination (transaction finality) much more rapidly and with greater flexibility without requiring each car to validate the path.

You can also read What is SHA -1(Secure Hash Algorithm 1), how does SHA 1 work

Avalanche vs. Other Platforms

| Feature | Bitcoin | Ethereum | Avalanche |

|---|---|---|---|

| Consensus | Proof-of-Work | Proof-of-Stake | Avalanche |

| Throughput | ~7 TPS | ~30 TPS | 4,500+ TPS |

| Finality Time | ~1 hour | ~6 minutes | ~1–2 seconds |

| Smart Contracts | ❌ | ✅ | ✅ (EVM compatible) |

| Energy Efficiency | ❌ | ✅ | ✅ (high) |