Blockchain Fork Explained: Code Modification, Network Growth

Blockchain Fork Explained

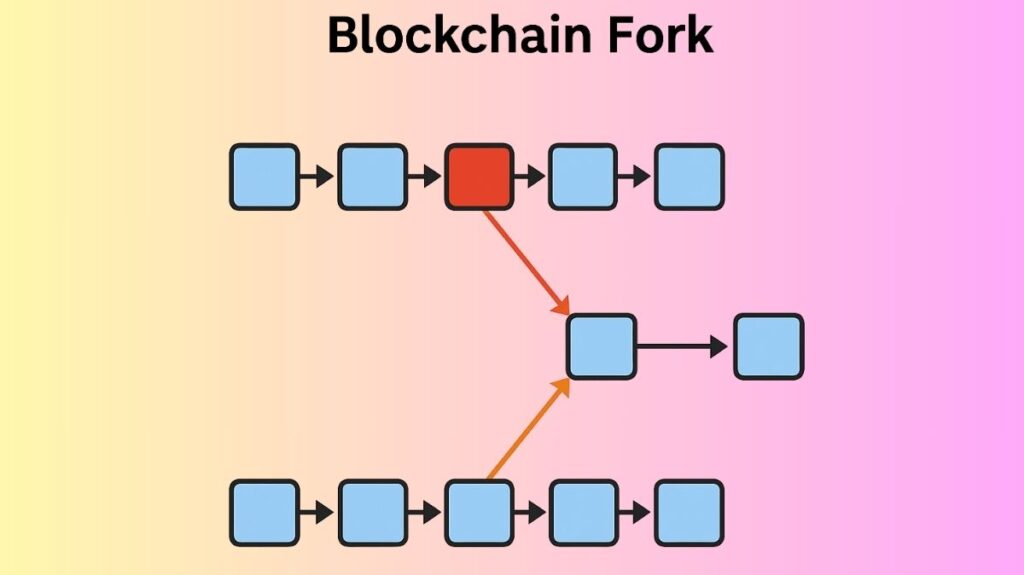

Within the blockchain environment, a fork is a modification to the protocol rules that causes the blockchain to split into two possible future directions. A point at which the ideal “single” chain of blocks divides into two or more chains, each of which is legitimate, is another way to conceptualize it. It could mean copying and modifying code to create new software or a product. Bitcoin and Ethereum, which are decentralized and open-source, rely on their communities to increase security, dependability, and usefulness. Such behaviour is characteristic with open-source initiatives.

Reasons for Blockchain Forks

A number of factors can cause forks, including:

- Incorporating additional features Most public blockchains are open-source, meaning that a worldwide community develops them, and the blockchain code is updated on a regular basis. New iterations are issued to address problems and add enhancements.

- Resolving security vulnerabilities Research on blockchain technology is still occurring because it is still relatively new. In order to fix potential security flaws, updates are published.

- Transaction reversals If transactions are discovered to have been compromised or malicious, the community can nullify them for a given time frame.

- Disputes Forks may result from community disagreements on the course of the blockchain’s development.

- Large-scale procedure improvements Typically, major protocol improvements lead to hard forks in particular.

- Problems with the software Mistakes in software can also result in unintended hard forks.

Types of Blockchain Forks

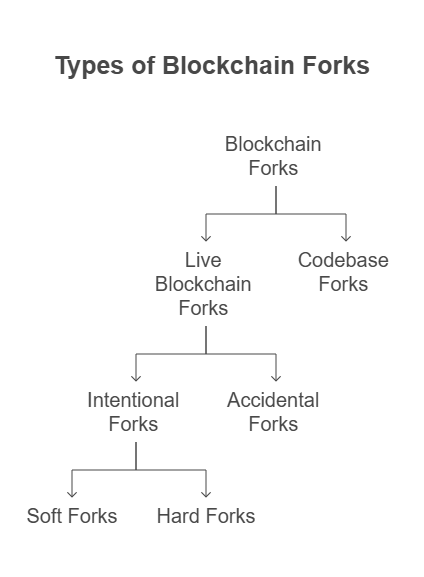

The two primary sorts of forks are Live Blockchain Forks and Codebase Forks. Live blockchain forks are further separated into two categories: intentional and accidental. Intentional forks are further separated into two categories: soft forks and hard forks.

Codebase Fork

A codebase blockchain fork allows you to replicate the complete code of already-existing software, like Bitcoin. This code can then be altered to provide a quicker or alternative software, for instance by reducing the block formation time or making other important adjustments. This updated code can then be released or made public as a brand-new, independent blockchain with a blank ledger. In this manner, numerous altcoins (alternative cryptocurrencies) have been developed by making minor modifications to the Bitcoin code.

Live Blockchain Fork

The splitting of an active blockchain into two or more sections from a certain moment is known as a live blockchain fork. This indicates that the chain splits after the software remains the same until that point.

Two things can cause a live blockchain fork:

Accidental Fork / Temporary Fork

Definition: These arise from a momentary dispute where the chain breaks as a result of several miners finding a new block almost simultaneously. There are differing views on the chronological sequence of events because information propagates around the blockchain network in a finite amount of time.

Characteristics: The block height of two or more blocks may be the same in this kind of fork.

Resolution: In most cases, temporary forks end on their own when one chain becomes the “one version of the truth” and gets heavier. This frequently occurs when the other chain dies out (becomes “orphaned”) because most complete nodes join and add new blocks to one chain. In order to be processed in later blocks, transactions from orphaned blocks are typically returned to the mempool.

Control: By varying the mining difficulty, the frequency of unintentional forks is controlled and fresh blocks are allowed to spread widely enough before another block is created.

Intentional Fork

These forks are defined as deliberate modifications to the blockchain’s code that alter its laws. Two fork types are produced by this category according to the date of fresh block mining and backward compatibility.

- Soft Fork

Definition: Any modification to the blockchain protocol that is backwards compatible is known as a “soft fork.” Accordingly, unupdated nodes can continue conduct transactions with updated nodes.

Rule Change: By imposing a constraint on the rules, soft forks typically render blocks that were previously valid invalid under the new regulations. In a soft fork, the rules are tightened; new rules are added so they do not conflict with the previous ones.

Outcome: Its chain will expand more quickly and be accepted by all nodes, becoming the dominant version of the blockchain, if the updated nodes account for the bulk of the network’s hash power. The new, more stringent rules will prevent non-updated nodes from adding blocks to the network that violate them.

Disruption: Generally speaking, soft forks cause less disruption than hard ones.

Example: Although the SegWit update for the Bitcoin network introduced a new class of addresses (Bech32), it did not render P2SH addresses invalid, enabling nodes with various address types to carry out legitimate transactions.

- Hard Fork

Definition : A hard fork is a modification to the blockchain protocol that does not work with older versions. It signifies a lasting blockchain divergence.

Rule Change: Blocks that were previously invalid become legitimate when restrictions are loosened by hard forks. For example, splitting would result from non-updated nodes rejecting new, larger blocks if the maximum permitted block size was doubled.

Outcome: It is necessary for all publishing nodes to upgrade to the new protocol at a certain time, usually a block number, in order to prevent rejecting freshly formatted blocks. The blockchain will exist in two versions concurrently if nodes do not update. Both new blockchains use the data from the original chain up until the time of forking, but neither one makes use of data that was recorded on the other after the fork.

New Currency: Hard forks frequently result in the creation of new currencies alongside the original currency. Full nodes that decide to upgrade their software are given equivalent amounts of the new currency in an effort to stop material loss.

Community Split: The community is often divided as a result of hard forks. Because of the altered criteria, the community is essentially forced to select one of the forking paths and cannot go back to the other. Contentious forks like these can lead to disputes within the community.

Examples:

Ethereum’s DAO Hack (2016): Financial theft resulted from a smart contract vulnerability. The harm was essentially undone when a hard fork was decided upon, with most voting in favour of a new blockchain version that restored the stolen money. With the unaltered blockchain, Ethereum Classic (ETC) was created as a result of this contentious decision.

Bitcoin Forks: Bitcoin Cash (BCH) and Bitcoin SV were launched in 2017 and 2018 after block size disagreements caused dramatic hard forks. Each chain receives the history of the main blockchain before forking and creating its own blocks and transaction records. The latest Casper upgrade for Ethereum is another example. It suggests switching the consensus system from Proof of Work (PoW) to Proof of Stake (PoS), rendering nodes that don’t update incompatible with those who do.

Impact of Forks

Blockchain forks have a number of significant effects:

- New Cryptocurrency New cryptocurrencies, each with distinct communities and features, may emerge as a result of hard forks.

- Section of the Community Within the blockchain community, forks especially controversial hard forks can lead to disputes and divides over which version to endorse.

- Both intricacy and uncertainty Because forks can add complexity and unpredictability to the blockchain ecosystem, users must be aware of the ramifications of each kind.

- Reduce Hash Power Soft and hard splits can weaken the network’s hash power by creating orphaned blocks by non-updated nodes or dividing hash power between chains.

- Replay Attacks Replay attacks, in which a lawful transaction on one chain is reproduced on the other, may occur after a hard fork if both blockchains use the same signature technique.

- Immutability Blockchains can hard fork to combat crime or change protocols, therefore immutability is not absolute. This suggests that immutability can be contested by community consensus.

- Competitors By enabling forks and allowing information to be transferred between them, ledger rivalry is heightened, which incentivises authors (miners) to contribute to the blockchain that readers (users) prefer. This might potentially overcome adoption inertia for new, competing ledgers.

- Scalability Remedy State channels, sidechains, and sharding are just a few of the suggested solutions for blockchain scalability that entail altering the blockchain’s structure or transaction processing, which may be connected to or involve forks.

Future of Blockchain Forks

A lot of people are interested in the future of blockchain forks.

In the future, there might be a tendency towards more soft forks because they are typically less disruptive and require less agreement to deploy. Soft forks don’t need to create a new cryptocurrency to add features or increase efficiency. In contrast, conflicting community opinions over the blockchain may lead to more controversial hard forks, which could further divide the community. Recent advances in multi-chain topologies and interoperability protocols may make blockchain networks more data-sharing and less likely to fork. The blockchain ecosystem may change and use soft forks or other methods to improve and optimize. Market factors, community dynamics, and technology advances will likely shape blockchain forks.