In this article, we learn about what Digicash is in blockchain, history, Digicash Price, features, and Implementations

eCash was a pioneering digital cash system designed for anonymous electronic payments, conceived by cryptographer David Chaum. It predates Bitcoin and other cryptocurrencies, laying foundational ideas for digital money.

Origin and Development

History of Digicash

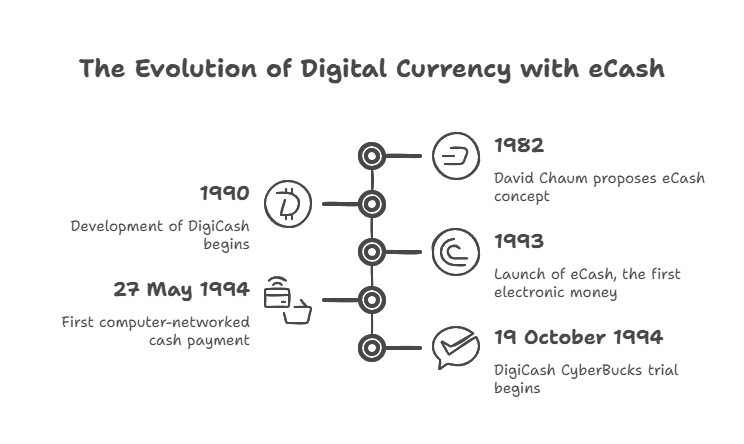

- The concept of eCash was first proposed by David Chaum in 1982 in his paper “Blind Signatures for Untraceable Payments”. He is widely considered the father of digital currency.

- To implement this notion, DigiCash was developed in 1990, and eCash, the first totally electronic money, was launched in 1993.

- DigiCash made the first computer-networked cash payment on 27 May 1994. The DigiCash CyberBucks trial began on 19 October 1994.

You can also read What Is Wrapped Bitcoin vs Bitcoin? Differences Explained

Core Design and Features

- eCash was an anonymous cryptographic electronic money system.

- Its core concept was blind signatures, a type of digital signature where the message content is invisible before signing. This design ensured unlinkability between withdrawal and spend transactions, meaning no user could link a withdrawal to a subsequent spending action, securing privacy.

- The eCash software stored money in a digital format on the user’s local computer, cryptographically signed by a bank.

- Users could spend this digital money at any shop accepting eCash without needing to open an account with the vendor or transmitting credit card numbers.

- Security was ensured by public key digital signature schemes.

- eCash systems needed to address two primary issues: accountability and anonymity. Accountability was crucial to prevent the double-spending problem, which was a significant challenge for digital currencies due to the ease of copying digital data.

- A refined version of eCash introduced in 1988 by David Chaum and others utilised blind signatures and private identification data. This scheme was capable of detecting double-spending, revealing the identity of the double-spender if a token was used multiple times, though it did not prevent it. This early eCash scheme also had a limitation: it could only represent a fixed amount of money.

- DigiCash featured its own currency called CyberBucks, which users received as tokens or coins upon signing up for the service.

- DigiCash also pioneered the development of secure microchipped smart cards (a system now common in modern credit cards) and the concept of a digital wallet to store these CyberBucks.

Implementations and Trials (Rise)

- By 1997, Nicholas Negroponte was DigiCash chairman after David Marquardt gave $10 million.

- It gained traction in the mid-1990s and struck deals with big names.

- In the United States, only one bank, Mark Twain Bank in St. Louis, Missouri, implemented eCash and tested it as a micropayment system from 1995 to 1998. The service was free for purchasers, while merchants paid a transaction fee.

- Globally, eCash was also issued under license by banks in national currencies.

- In Europe, where credit card usage was lower and cash transactions were more common, micropayment technologies like eCash were considered more suitable. eCash became available through:

- Deutsche Bank in Germany (pilot with 1500 clients starting August 1997).

- Bank Austria.

- Den norske Bank of Norway.

- Merita Bank/EUnet in Finland.

- Credit Suisse in Switzerland (June 1998).

- In Asia, Nomura Research Institute licensed eCash for use in Japan’s first electronic money system in April 1997 and marketed it to financial institutions.

- In Australia, St.George Bank and Advance Bank implemented eCash (Advance Bank from October 1996), though transactions were not free to purchasers there. DigiCash also opened an office in Australia in March 1996.

- Beyond banks, a variety of merchants accepted the CyberBucks currency, including American Book Center, Arkyo’s eCash Shop, Awesome Designs, Ericsson, MacZone Japan, NCSA Mosaic, and many more listed.

You can also read History, Types, Advantages and Disadvantages of Stablecoins

Decline and Fall

- Despite its innovations and initial interest from large banks and Microsoft (which aimed to incorporate eCash into Windows 95, though a deal was turned down), eCash struggled to gain widespread adoption.

- The trial with Mark Twain Bank signed up only about 5,000 customers and just over 300 merchants. The system was dissolved in 1998, one year after Mark Twain Bank was acquired by Mercantile Bank.

- A “plethora of problems” ultimately led to the demise of DigiCash.

- David Chaum noted that as the web grew, the average user’s sophistication dropped, making it difficult to explain the importance of privacy to them.

- DigiCash filed for bankruptcy in 1998, despite the flourishing electronic commerce of the time, largely because credit cards became the “currency of choice”.

Legacy and Current Usage of the Term

- After bankruptcy, DigiCash was sold to eCash Technologies, including its eCash patents. eCash Technologies was later acquired by InfoSpace (now Blucora) in 2002.

- Many consider Dr. Chaum’s work to be the foundation of modern cryptocurrencies. Bitcoin, created in 2009, is often seen as the first practical e-cash system to gain broad adoption due to its distributed nature and self-policing mechanism via blockchain and consensus.

- In 2018, Chaum launched a new startup called Elixxir, focusing on a cryptography network for communication anonymity, designed to be user-controlled to protect information.

- As of 2015, the term “eCash” is used more broadly for digital cash stored on electronically sensitive cards, online payment portals, and mobile applications.

- Today, “eCash” also refers to a specific cryptocurrency (XEC) that integrates the Avalanche consensus algorithm for fast, secure, and scalable transactions, supporting tokens and subnets. This modern eCash is programmable cash and allows users to create eTokens and develop applications.

Digicash Price

The original Digicash is not actively traded. The price of other tokens using the name would depend on the specific token and trading platform.

You can also read What Is Wrapped BNB, How It Works And Applications