Fungible tokens (FTs): definition, principles, creation and deployment, common operations and functions, impact and use cases, and fungible vs non fungible tokens are all covered in this blog. The following lists the main differences.

Fungible tokens (FTs)

A fundamental idea in the blockchain ecosystem, fungible tokens (FTs) stand for digital assets that can be swapped out for one another. The word “fungible” emphasizes an asset’s capacity to be swapped out for another one of the same kind and worth.

A gram of gold is an example of a fungible asset in the real world since its value is constant and independent of the particular piece of gold you hold. Because their particular denominations do not change their equal value in pounds, a ten-pound note can be exchanged for any other ten-pound note or two five-pound notes. Since any coin of the same currency has the same value at any given time, cryptocurrencies like Bitcoin (BTC) and Ether (ETH) are excellent instances of fungible tokens.

Fungible tokens definition

- On a blockchain, fungible tokens are an exchangeable representation of an asset.

- Tokens of the same type cannot be distinguished from one another since they are indistinguishable.

- One FT can be entirely swapped for another token of the same value because they are interchangeable.

- Additionally, FTs can be divided into smaller fractions; for example, Bitcoin can be divided into satoshis, and Ether can be divided into wei.

Relationship with Cryptocurrencies

- A “cryptocurrency” and a “token” are two different things, even if the majority of native cryptocurrencies, such as Bitcoin and Ether, are fungible.

- Typically, a cryptocurrency is a separate blockchain’s native coin.

- On the other hand, a token is an asset representation that functions on top of an existing blockchain, frequently utilizing smart contract functionality.

- Because many fungible tokens reside as smart contracts on other blockchains, not all native cryptocurrencies are fungible tokens. Instead, all native cryptocurrencies are fungible tokens.

How Fungible Tokens Are Stored and Managed

- Fungible tokens are not kept in a user’s account like native tokens (like the NEAR native token) are, which may be kept there.

- Rather, each FT operates on a separate contract that handles bookkeeping. This contract manages transfers internally and keeps track of each user’s token count.

Principles for Fungible Tokens

- FT contracts must follow certain guidelines to guarantee interoperability across different platforms and services.

- The most well-known and extensively used standard for fungible tokens on the Ethereum platform is ERC20, which was first released in November 2015. In order to ensure compatibility across wallets, exchanges, and blockchain services, it specifies a minimal interface and desired functionality.

- The NEP-141 and NEP-148 standards, which outline the minimal interface and anticipated functionality, must be adhered to by FT contracts on the NEAR environment.

- The define-fungible-token function is used to generate new fungible tokens for Clarity smart contracts, which are utilized on the Stacks blockchain.

Creating and Deploying Fungible Tokens

Individuals are able to produce their own fungible tokens.

Using a Token Factory Tool

Token factory tools are available on platforms such as NEAR’s Dev Portal. Users can engage with these tools using a graphical user interface or by calling their contract. This entails specifying attributes like metadata (including spec, name, symbol, icon, and decimals), owner_id, and total_supply. The address where the generated FT will reside is .Primitives.near.tkn.

Using Your Own Contract

Using a canonical FT contract and initialising it is an additional approach. The token’s metadata (such as its name, symbol, and total quantity) are defined at initialization, and an owner is chosen to store the tokens’ initial total supply. After deployment, this usually entails calling a new method.

Also Read About FastBFT in Blockchain, Purpose, How It Works and Features

In Clarity Smart Contracts

To create new FTs in a Clarity smart contract, the (define-fungible-token token-name ) function is essential. While the token-name is necessary, the total-supply, which is an unsigned integer, is optional. This feature facilitates token-related operations and aids in the establishment of a token economy. The use of descriptive names, careful consideration of the entire supply (omitting it can result in infinite minting), putting this description at the top of the contract, and putting in place appropriate access controls for minting and burning are all examples of best practices.

Common Operations and Functions

- Querying Metadata: You can use name(), symbol(), decimals() (ERC20 optional functions) or ft_metadata (NEAR) to query an FT’s metadata.

- Checking Balance: You can utilize query methods like ft_balance_of (NEAR) or balanceOf(address _owner) (ERC20) to find out a user’s token holdings.

- Users may need to register in the contract by calling a storage_deposit method and attaching a tiny amount of local currency (e.g., 0.00125 NEAR) before they can own and transfer tokens on certain platforms (like NEAR). This enables other people to signup as well.

- Transferring Tokens: To send FTs, methods such as transfer(address _to, uint256 _value) (ERC20) or ft_transfer (NEAR) are used, with the recipient and amount specified. If authorized, transfer From (ERC20) permits token transfers on behalf of another user. ft-transfer? is used in Clarity.

Burning and Minting

By producing new tokens, minting expands the amount in circulation. Admin-only access control is frequently used for functions like ft-mint? (Clarity). It’s usual to overlook access constraints for delicate tasks like minting.

Tokens are destroyed by burning, which lowers the quantity in circulation. Clarity uses the ft-burn? function.

- Attaching FTs to Calls (ft_transfer_call): The FT standard allows fungible tokens to be connected to function calls by use of the FT-contract, which acts as a middleman. Native tokens, such as NEAR, can be directly linked to function calls. This indicates that the FT contract calls a function and makes a transfer on your behalf. For instance, you would use ft_transfer_call, supplying the recipient, a message, and the amount, to deposit FTs on a decentralised exchange such as Ref Finance.

- Managing Deposits (Contract Only): The ft_on_transfer method must be used if a contract is required to accept FT deposits. This approach must return any FT tokens that must be returned to the sender, and it gives details about the FT sent, the sender, the amount, and any encoded messages.

- Allowance and Approval (ERC20): Allowance(address _owner, address _spender) returns the amount that a spender is still permitted to withdraw, whereas approve(address _spender, uint256 _value) permits a third party to withdraw a specified maximum value of tokens from an owner’s account.

Impact and Use Cases

- For many applications, fungible tokens particularly those that adhere to the ERC20 standard act as decentralized money.

- They enable liquidity pools and other financial services without the need for middlemen, making them essential to the Decentralized Finance (DeFi) ecosystem.

- In networks, FTs are also utilized as payment tokens.

- They make it possible for ideas like token burns and buybacks, which have the potential to raise value by reducing supply.

- The applicability of blockchain technology has been greatly expanded by the simplicity of constructing FTs using existing protocols.

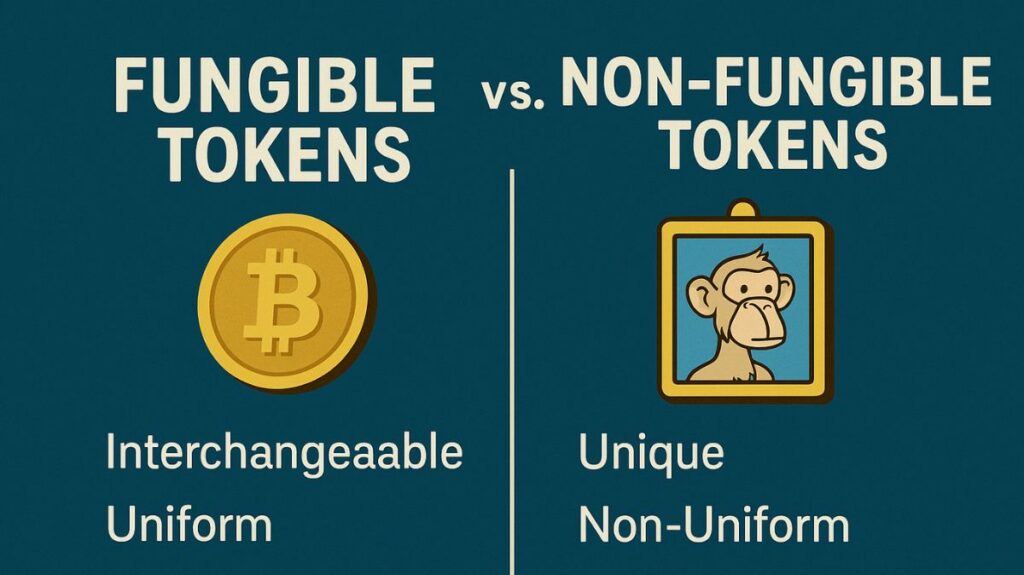

Fungible vs non fungible tokens

- Non-Fungible Tokens (NFTs) are distinct and not interchangeable with FTs, which are interchangeable and identical.

- NFTs are usually applied to real-world assets, art, or unique digital artefacts where each object has unique qualities and worth. For NFTs, standards such as ERC721 and ERC1155 are utilized.

- The main difference is that, although you can transfer a portion of an FT (for example, 0.5 ERC20 tokens), it is nearly hard or not practicable to transfer most NFTs in part.

Also Read About Understanding The Honey Badger Of BFT Protocols (HBBFT)

| Feature | Fungible Tokens (FTs) | Non-Fungible Tokens (NFTs) |

| Interchangeability | Identical and interchangeable (1 unit = 1 other unit) | Unique and not interchangeable (each unit is distinct) |

| Divisibility | Often divisible into smaller units | Usually indivisible (you own the whole unique item) |

| Uniqueness | No unique identifying characteristics | Each token has unique metadata and an identifier |

| Value Basis | Value is based on market supply/demand for the token type | Value is based on the uniqueness, rarity, provenance, and demand of that specific item |

| Use Cases | Currency, store of value, medium of exchange, governance, utility | Digital art, collectibles, gaming items, virtual land, identity, certificates, tokenized real estate |

| Examples | Bitcoin, Ether, USDT, DOGE | CryptoPunks, Bored Ape Yacht Club, digital art, and unique in-game swords |