Unlock the potential of cryptocurrency: discover Real World Use Of Cryptocurrency, defining features, and the underlying technology that powers secure, transparent, and peer-to-peer digital transactions.

Cryptocurrency

A digital form of money, cryptocurrency is intended to function across a computer network without the need for a centralized authority, like a bank or government, to maintain or enforce it. It is only an intangible currency online. Cryptography protects transactions and regulates the creation of new monetary units, hence the term “cryptocurrency”.

How Cryptocurrencies Work

Blockchain is the fundamental technology that underpins cryptocurrencies.

Blockchain as a Ledger: All transactions via a peer-to-peer network are recorded in a distributed, shared, and unchangeable digital ledger known as a blockchain. In order to ensure the security of transactions, this distributed database stores information in a digital format. The data in a block cannot be changed once it has been recorded without also altering all subsequent blocks, which would necessitate the cooperation of most of the network.

Cryptography:

Blockchain’s foundation is cryptography, which uses mathematical methods to protect data through code.

- Public-Private Key Pairs: A mathematically linked pair of keys is used by users. The public key, which is derived from the private key and may be made public without jeopardizing security, is kept secret and is used to digitally sign transactions, establishing ownership of an address.

- Addresses: These brief alphanumeric strings, which are used to transfer and receive digital assets, are generated from a user’s public key.

- Digital Signatures: Private keys encrypt and sign transactions. To prove the signer possesses the private key, anyone with the matching public key can decrypt and confirm the signature.

- Hashing: Long numerical values are compressed via hash functions, which link each block to the one before it by producing a distinct secure code.

Transactions

Usually including the exchange of cryptocurrencies between users, transactions are representations of interactions between parties. They are collected, disseminated over the network, signed with private keys, and entered into the distributed ledger. Transactions with cryptocurrencies do not pass via a financial institution, in contrast to traditional banking.

Consensus Mechanism

This is how users concur that a transaction is legitimate and how the blockchain is updated with new information.

- Mining (Proof of Work PoW): To validate transactions and add new blocks to the chain, “miners” utilize computer power to solve challenging mathematical problems, sometimes known as cryptographic riddles. Miners who are successful receive fresh cryptocurrency as payment.

- Proof of Stake (PoS): Another technique is for holders of the related cryptocurrency, occasionally gathered into stake pools, to validate transactions. Ethereum moved from PoW to PoS in 2022 to save energy.

Key Features and Characteristics

Among the characteristics that set cryptocurrencies apart are:

Decentralization: This is an essential characteristic because cryptocurrencies run on an open network that isn’t governed by a single organization. The distributed consensus method serves as virtual currencies’ apparent central authority. Bitcoin began open peer-to-peer networks with Proof of Work and Nakamoto Consensus.

Immutability: A blockchain transaction cannot be removed, modified, or destroyed, ensuring an auditable record. Any transaction change would be detected by the blockchain community due to the new hash value.

Anonymity/Pseudo-anonymity: Although bitcoin transactions are frequently regarded as anonymous, they are actually more appropriately characterized as pseudo-anonymous. All transactions on the blockchain are openly accessible, but users are not forced to provide their identity in order to trade. On-chain analysis occasionally identifies the owner of an account.

Finite Supply: Value is impacted by the fact that most cryptocurrencies have a fixed, finite quantity that may be mined or exist. The protocol of Bitcoin, for instance, controls its supply rather than a central bank.

Irreversibility: Due to the lack of a central authority, transactions cannot be undone after they have been transmitted.

Security: Cryptography is crucial to cryptocurrencies. Network integrity and transaction security are protected by cryptography. This requires digital signature and secure system transactions using public and private keys.

Transparency: Each transaction is publicly recorded on the blockchain, making auditing easier.

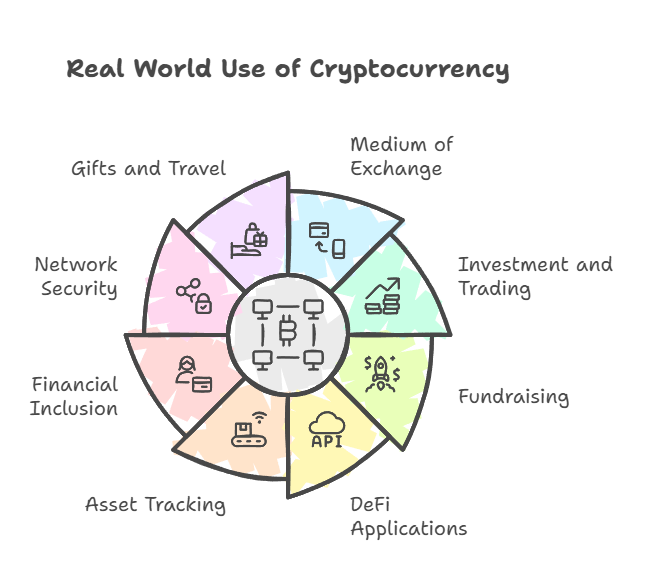

Real World Use of Cryptocurrency

There are several applications for cryptocurrencies:

Medium of Exchange: Initially designed for everyday transactions, it allowed for peer-to-peer payments without the need for banks. Some businesses accept cryptocurrency as payment, including luxury merchants like Bitdials for watches and AT&T, Microsoft, Overstock, and newegg.com. Certain auto retailers and even insurance providers accept it as well.

Investment and Trading: A lot of interest in cryptocurrencies is focused on making money through trading. Practically speaking, they are regarded as a separate asset class. Bitcoin mutual funds, blockchain stocks, and ETFs are all available for purchase by investors.

Fundraising: A contentious method of raising money for blockchain start-ups or new cryptocurrency endeavours is through initial coin offerings (ICOs), which sell digital “tokens” to early investors.

Decentralized Finance (DeFi) Applications: Smart contracts and applications for decentralized finance have been made possible by blockchain. For example, Ethereum’s blockchain supports decentralized apps.

Tracking Assets and Supply Chains: A blockchain network can track and trade anything of value. One such use is to track individual parts for visibility throughout a whole supply chain.

Financial Inclusion: With the help of cryptocurrencies, those who were previously shut out of the official financial system can now access capital and do business both domestically and abroad. Unbanked and underbanked people can be reached with their assistance.

“Gas” or “Fuel” for Networks: By requiring payment in the native token, participants operating decentralized applications on a blockchain network discourage malevolent actors and ensure network security.

Gifts and Travel: Since cryptocurrency isn’t restricted to any one nation, it can be a present for people who are interested in new technologies and can also save money on exchange fees when travelling.

Market Aspects and Volatility

Volatility: Stocks and other well-known financial assets are far less volatile than cryptocurrency prices. For instance, in May 2022, Ethereum dropped 26% of its value while Bitcoin lost 20% in a single week. That their value is “based on thin air” and that they are volatile have been pointed out by critics, including former US President Donald Trump.

Market Capitalization: The price multiplied by the quantity of coins in circulation is a crucial metric for investors to gauge stability and safety. Higher adoption and growth potential are typically indicated by a larger market capitalisation.

Transaction Fees: Network capacity and the need for speedier transactions determine fees. Nano is one cryptocurrency that has no transaction costs.

Market Operation: Rapid mood fluctuations are common in cryptocurrency markets, which are open around-the-clock. They are frequently characterized as markets with minimal liquidity and fewer participants, which leads to rapid price changes.

Historical Development

With his invention of ecash in 1983, David Chaum introduced the idea of encrypted electronic money, which he later adopted in 1995 with Digicash. One of the National Security Agency’s papers on cryptocurrency systems was published in 1996. Wei Dai and Nick Szabo both described “b-money” and “bit gold,” respectively, as electronic currency systems that required users to perform a proof-of-work function in 1998.

In January 2009, the anonymous developer Satoshi Nakamoto created Bitcoin. A decentralized electronic cash system was put into practice for the first time. Tokens and other digital assets that were not Bitcoin fell under the umbrella term “altcoins” after the invention of Bitcoin.