What Is A Cold Wallet Crypto?

One kind of cryptocurrency wallet that is intended to keep private keys entirely offline that is, unconnected to the internet is called a cold wallet. One important difference between this offline storage and “hot wallets,” which are always linked to the network and thus more susceptible to hacks and vulnerabilities.

Primary Purpose and Security

Security is why cold wallets are used. It prevents thieves from copying private keys from ransomware, malware, viruses, and other online vulnerabilities. It is especially advised to use this strategy while storing a lot of cryptocurrency. This data protection method has been used for decades by individuals, governments, and businesses to save data for later use or to make it unavailable.

Also Read About Drizzle Blockchain: Simplify DApp Front-end Development

Why Cold Wallets are Needed

Traditional banking can track and recover lost or stolen money, but bitcoin transactions are irreversible. Because bitcoin is not backed by a government or institution, if your wallet is compromised and tokens are stolen, you cannot be repaid.

Thieves look for private keys, which are alphanumeric codes that are used to access cryptocurrencies. Your digital assets are completely accessible to anybody possesses your private keys. Since these private keys grant access to the tokens, they must be protected in all cryptocurrency storage techniques.

Since online devices are regarded as a “weak link” in a network because of their software’s vulnerability to hacker manipulation, private keys kept on an internet-connected wallet are susceptible to network-based theft. By storing keys offline, cold storage lowers this danger.

How Cold Wallets Work

- Generally speaking, cold storage entails moving your private keys to a media or device without an internet connection. By doing this, hackers are prevented from stealing them.

- The cold storage device receives a request from an owner wishing to start a transaction. After that, the gadget requests user authentication.

- If successful, the cold wallet builds and signs the transaction offline using the private key.

- This signed transaction is broadcast to the blockchain network by an internet-connected computer or smartphone.

- The offline wallet’s private keys are kept safe because it never connects to the internet.

Types of Cold Storage And Wallets

Custodial storage, in which your keys are kept by someone else, and non-custodial storage, in which you keep your keys, are the two main categories of storage. Since cold wallets are by nature non-custodial, you are in charge of protecting your recovery phrases and private keys.

Subtypes of cold storage include

Paper wallets

- Public and private keys are merely printed or written on these documents. Add a QR code for easy scanning to complete a transaction, but this exposes keys to other applications, increasing risk.

- Cons: Lost, damaged, or unreadable paper forfeits funds. No recovery phrase exists. In order to move cryptocurrency from a paper wallet, it is typically necessary to import it into a hot wallet, which exposes keys on the internet. They are vulnerable to loss or bodily harm. Although they are helpful in low-tech settings, they are mostly useless in the current crypto economy.

Also Read About Centralized Organization Definition, Advantages & Examples

Hardware Wallets

- Private keys are generated and stored offline by these tangible, impenetrable devices. The device never loses the key.

- TREZOR, KeepKey, and Ledger USB Wallet are a few examples. The user-friendly UI and security features of ledger devices make them an excellent choice.

- To keep private keys offline, they need a computer and a program (like Ledger Live), and they frequently resemble and work like USB drives.

- By offering a secret recovery phrase to restore accounts in the event that the device is lost, they guard private keys against theft and physical harm.

- In addition to being virus-proof and waterproof, several commercial hardware wallets allow multi-signature (“multi-sig”) transactions, which call for multiple users to approve a transaction.

- Devices that are air-gapped are more secure than those that can connect wirelessly since they are incapable of connecting. Retailers and merchants sell commercial hardware wallets, many of which are virus-proof and waterproof, and some of which even facilitate multi-signature (“multi-sig”) transactions. With multi-sig, a bitcoin signature technique, a transaction must be approved by multiple users using private keys.

- To guard against physical hacks such side-channel assaults and glitching, ledger devices employ a PIN code and a state-of-the-art Secure Element chip. Because of their ability to create an almost endless number of accounts, users can set up distinct accounts for engaging with smart contracts and storing valuable assets.

- The Ledger Stax, Ledger Flex, Ledger Nano S Plus, and Ledger Nano X are well-known Ledger hardware wallets.

Offline Software Wallets

- Some software wallets have offline capability, although the majority are “hot wallets” since they operate on devices with internet access.

- For consumers who are not as technical, this approach is more complicated. For private keys, it divides a wallet into two platforms: an offline wallet and an online wallet.

- Unsigned transactions are created in the online wallet, transferred to the offline wallet, signed using the private key, and then returned to the online wallet to be broadcast to the network.

- Examples of offline software wallets are Armoury and Electrum.

Also Read About Types Of Blockchain Wallets: Hot, Cold, Hardware And More

Sound Wallets

- Private keys are encrypted and recorded in sound files on media such as CDs or detachable USB drives in this esoteric and costly technique.

- An application called spectroscope can be used to decipher the hidden code.

- Cons: They’re difficult for novices to decode since they need specialised gear and are prone to physical damage, such as scratches on a CD.

Deep Cold Storage

- This describes any approach to getting your keys that is extremely inconvenient and takes a lot of time and work.

- Examples include employing a third-party service that keeps keys in a vault that requires several steps to access or hiding a hardware wallet in the garden.

- Cons: It can take hours or days to retrieve funds in deep cold storage, making them difficult to use for transactions. Identity verification is usually required for vault services.

Differentiations

Hardware Wallet vs Cold Wallet

Although hardware wallets fall within the category of cold wallets, the names are not interchangeable. Only when an account is not linked to a smart contract or decentralized application (dApp) does a hardware wallet turn into a “cold wallet” for that account.

Cold Wallet vs Hot Wallet:

Online threats like malware and viruses cannot affect cold wallets since they save private keys offline. They also avoid smart contracts to avoid malicious approvals. They are perfect for protecting valuable goods over an extended period of time.

Software wallets, also known as hot wallets, keep private keys on machines that are linked to the internet, leaving them open to malware, spyware, and hacking. They should not contain large sums of money and are better suited for short-term purchases.

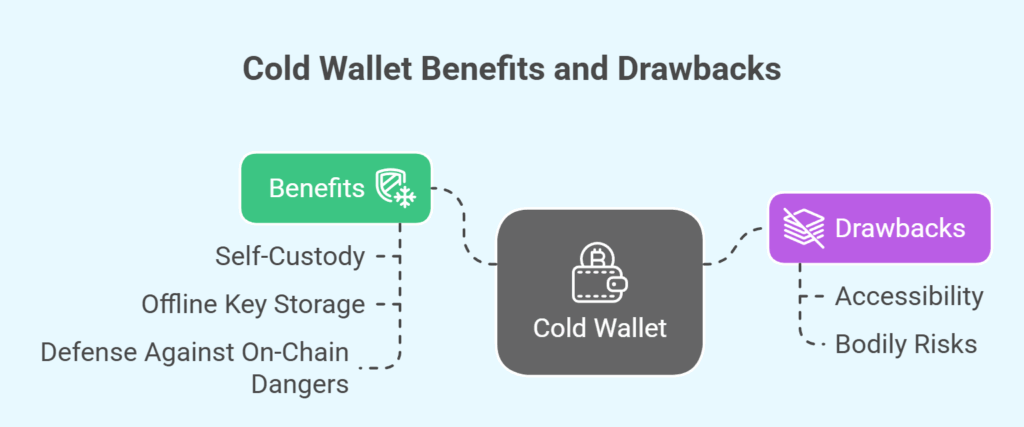

Cold wallet benefits and drawbacks

- Self-Custody: You have total control over your private keys and, consequently, your assets because all cold wallets are non-custodial. This indicates that you do not entrust your money to a third party, such as an exchange.

- Offline Key Storage: When signing transactions, private keys are generated and kept offline, shielding them from hackers using internet connections.

- Defense Against On-Chain Dangers: Since cold wallets don’t link to smart contracts, they shield assets against fraudulent smart contract apps and services. Malicious transactions that could result in large losses are prevented from “blind signing” because to this.

Drawbacks

- Accessibility: Due to the need for human intervention, cold wallets are typically more difficult to use than hot wallets, and money are less easily available for immediate transactions. The average transaction time is between 24 and 48 hours.

- Bodily Risks: Both paper and sound wallets are vulnerable to loss or bodily harm. Additionally, hardware wallets may be lost or damaged, which could result in the termination of bitcoin access if recovery phrases are not saved up.

Use in Centralized Exchanges

- Cold storage is frequently used as a crucial security feature in centralized exchanges. According to best practices, less than 5% of customer cash should be retained in “hot storage” for withdrawals, while the majority (more than 95%) should be kept in cold storage.

- Because hackers could only steal money from the hot storage, this tactic lessens the consequences of a breach. User-deposited funds are frequently “swept” to a warm wallet before being allocated to either hot or cold storage.

Cold wallet security

- Even though cold wallets are the safest way to store digital assets and private keys, they can fail.

- They do not eliminate human error, such as using a wallet whose private keys were previously made public online or accidentally exposing a cold wallet to a smart contract or dApp.

- How the cold wallet is configured and kept up to date also affects safety. Hardware wallets, like as Ledger devices, improve security by facilitating smooth switching between several accounts