DEXes enable peer-to-peer cryptocurrency and digital asset trading without a middleman. Unlike middleman-managed centralized exchanges (CEXes). The following topics are covered in this article: DEX Essential Features and Functions, Decentralized Exchange Benefits, Decentralized Exchange Drawbacks and Risks, and Comparison with Centralised Exchanges (CEXes).

DEX Essential Features and Functions

- DEXes allow customers to trade directly, while CEXes allow users to trade through the exchange’s infrastructure. This supports the blockchain’s purpose of empowering individuals without intermediaries.

- Many DEXes use Ethereum smart contracts to match buyers and sellers and handle deposits, withdrawals, and trades. This means that DEX “backend code” is public and auditable, unlike centralised exchanges’ secret code.

- Order Books on Smart Contracts: Some DEXes utilise smart contracts to manage their order books, which list bids (buy orders) and requests (sell orders), whereas CEXes keep their order books in their proprietary databases.

- User Custody of Funds: One major distinction is that DEX users do not deposit their cryptocurrencies to the exchange, lowering counterparty risk. Instead, they maintain custody over their private keys and funds. The custody of user funds is controlled via smart contracts.

- On-chain transaction execution: Every trade on DEXes usually takes place on-chain, which means that every transaction is noted on the underlying blockchain.

Also Read About What Are The Two Types Of Forks In Blockchain: Simple Guide

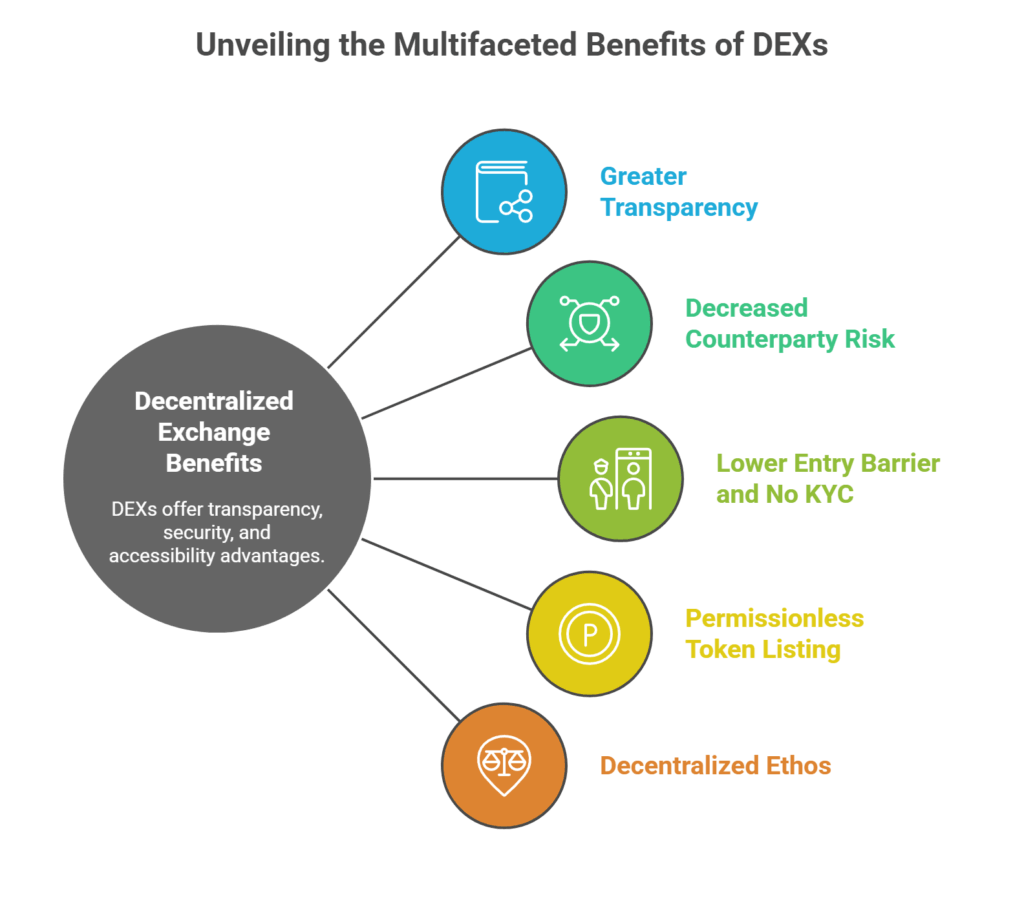

Decentralized Exchange Benefits

Greater Transparency

Due to publicly auditable smart contracts, DEX backend code can be viewed and inspected before use, increasing trust. The blockchain records every transaction publicly.

Decreased Counterparty Risk

Users don’t have to rely on a single organisation to manage their money. The exchange cannot lose customer funds as a result of internal mismanagement or exchange hacking because the smart contract retains custody and is auditable. This removes the possibility of losing money in the event that the exchange goes bankrupt or embezzles money, which is a major worry with centralised exchanges.

Lower Entry Barrier and No KYC

DEXes typically do not require users to go through Know Your Customer (KYC) or Anti-Money Laundering (AML) procedures, which means that anyone possessing cryptocurrencies can use them without disclosing personal information. This lowers the entry barrier. This increases privacy.

Permissionless Token Listing

Decentralized Exchanges (DEXs) allow token creators to list their tokens without authorisation or negotiations. This promotes digital resource access.

Decentralized Ethos

By providing censorship resistance and granting users greater sovereignty over their assets and data, DEXes exemplify the fundamental ideas of decentralisation.

Disadvantages and Risks of Decentralized Exchanges

Limitations on Speed and Scalability

DEXes are limited by the underlying blockchain’s transaction throughput and block confirmation timeframes. As of 2020, for instance, Ethereum’s highest transaction rate was less than 20 transactions per second, which is much less than the 65,000 transactions per second of centralised systems like Visa. Trade execution may be delayed.

Higher Transaction Costs(Gas Fees)

Every DEX action, such as placing or cancelling an order, requires a new blockchain transaction, which means gas fees are paid to the network. This makes frequent trading more expensive than on centralised exchanges, where internal order adjustments are free.

Complexity for Non-Technical Users

DEXes may be tougher and slower for non-technical users because each action requires a transaction.

Lack of Fiat Currency Support

DEXes generally allow crypto-to-crypto transactions, not USD or EUR conversions. Fiat currencies are linked to conventional banking systems, which are centralised, which explains why.

No Protection Against Fund Loss Due to Platform Hacks

Even though user custody reduces counterparty risk from the exchange itself, users’ money could still be lost without a central authority to retrieve it if a fault in the underlying smart contract or blockchain is exploited.

Market Manipulation Issues

Although the code is clear, there is still manipulation and the bitcoin market infrastructure is still developing. Particularly for cryptocurrencies with small market capitalisation, large cryptocurrency holders (sometimes known as “whales”) can still affect pricing.

Also Read About Features, Advantages Of Symmetric Cryptography In Blockchain

Centralized Vs decentralized exchanges

| Feature | Centralized Exchanges (CEXes) | Decentralized Exchanges (DEXes) |

| Custody of Funds | Exchange holds users’ private keys and funds | Users retain control of their private keys and funds |

| Intermediary | A company acts as the central intermediary | No central intermediary; peer-to-peer trading via smart contracts |

| Regulation & KYC | Highly regulated, often requires KYC/AML | Generally less regulated, often no KYC required |

| Speed & Scalability | High transaction throughput, low latency (e.g., Visa: 65,000 TPS) | Limited by underlying blockchain’s speed (e.g., Ethereum: <20 TPS) |

| Transparency | Backend code and database are private | Backend logic in publicly auditable smart contracts |

| Fiat Integration | Crucial “on-ramps” and “off-ramps” for fiat-to-crypto conversion | Primarily crypto-to-crypto trading; no direct fiat support |

| Order Types | Supports market, limit, and often expiration options | Similar basic order types, but execution is slower due to blockchain |

| Token Listing | Requires permission and negotiation for new token listings | Permissionless; anyone can list an ERC-20 token |

| Security Risk | Centralized attack vector; risk of exchange hacks/bankruptcy | Risk of smart contract bugs/exploits on the underlying blockchain |

| Ease of Use | Generally easier for non-technical users | Can be more complex for non-technical users due to transaction signing |

Uniswap and IDEX are two instances of DEXes. Despite providing a fully decentralized trading environment, DEXes have drawbacks in terms of speed, cost, and user experience all of which are currently the subject of ongoing blockchain research and development.