Oracle manipulation attack

Oracle manipulation attacks take use of flaws in blockchain oracles to provide smart contracts with inaccurate or out-of-date data, which results in invalid execution and favors malevolent parties. Projects may lose millions of dollars as a result of these attacks, which can also result in unjustified liquidations and malicious arbitrage trades. Because they supply the off-chain data required for proper on-chain smart contract execution, oracles are essential for Web3 infrastructure and serve as the foundation for numerous DeFi applications, including decentralized money markets, algorithmic stable coins, synthetic asset markets, and decentralized insurance.

What Is Oracle Manipulation?

Oracle manipulation is the practice of taking advantage of flaws in a blockchain oracle to make it publish stale or erroneous information regarding off-chain occurrences. This is frequently a component of a more extensive attack on a protocol, where the objective is to get smart contracts to operate in a way that favors the attacker by using these incorrect inputs. Oracles are essential for hybrid applications that integrate on-chain execution with real-world data, such synthetic asset markets that require the most recent prices of assets like gold or fiat currencies, because blockchains are insulated from the outside world for deterministic consensus. Data submitted by an entity is accepted, validated, and stored by an oracle, which is a smart contract that other on-chain contracts can query. Oracles typically share a high-level architecture made up of six modules.

- Ground Truth: The crucial data needed to execute an on-chain contract, such as the weather, election outcomes, and the price of USD or ETH.

- The decentralized exchange (DEX) or centralized exchange (CEX) for token pricing, is known as the data sources.

- Data Feeders: Organizations in charge of gathering and sending the ground truth to the Oracle contract from a variety of sources.

- Data Feeder Selection: This is how Oracle services decide which entities have the authority to process data requests, which can be either permissioned (only authorized entities) or permissionless (anyone can submit).

- Aggregation: A means of combining several data points into a single output for decentralized oracle networks with many data feeders, frequently through the use of consensus or statistical techniques (average or median).

- Dispute Phase: This feature enables users to contest data from other nodes. Malicious challenges or erroneous submissions are penalized, usually through reputation or staking mechanisms.

How Oracle Manipulation Attacks Work?

Oracle manipulation attacks force misreporting and cause dependent smart contracts to execute invalidly by taking advantage of flaws in one or more oracle architecture components.

Data Sources

Since data sources determine the calibre of information an oracle reports, attackers usually target them.

- Spot Price Manipulation: A traditional weakness is relying solely on a decentralized exchange’s (DEX) spot price to determine prices. An attacker can use a flash loan to drastically deplete one side of the pool if a smart contract bases the value of an asset on the spot price of a DEX (from a Uniswap pool, for example). This enables the attacker to carry out advantageous operations like arbitrage or establishing a favorable position by manipulating the protocol’s internal price (for example, to 100 times its initial value).

- The issues are twofold: smart contracts continue to function on modified data in spite of anomalies, and reliance on a single price feed source facilitates on-chain manipulation via flash loans.

- In order to inflate the price of one asset and depress the price of another, the method may entail taking out a flash loan on one asset and exchanging it for another with a high volume on a Uniswap pool. The attacker receives an excessive number of shares when the inflated asset is deposited into a function that is vulnerable. These shares can then be withdrawn, depleting the pool. The money earned is subsequently used to repay the flash loan.

- This attack can potentially be carried out via compromising API services that provide pricing data or by using centralized exchanges (CEX).

- Caution: Direct price discovery should never be done using spot prices on decentralized exchanges. Assuming adequate liquidity, solutions such as time-weighted average prices (TWAPs) over longer periods significantly raise the cost of manipulation, rendering it impossible. A secure price discovery example can be found in the Uniswap V3 Oracle Library documentation.

Off-Chain Infrastructure

Smart contracts depend on conventional software since data feeds deliver off-chain information to them. Attacks on database security, transport, cryptographic implementations, and access control may be possible for these systems. Even if on-chain aggregation functions properly, on-chain oracle data feeds may be impacted if an off-chain component fails. In the Synthetic sKRW event, for instance, an arbitrage bot made over $1 billion USD after an off-chain component reported the Korean Won’s price 1000 times higher than it actually was. Oracle services, particularly those without community-driven dispute phases, need to be hardened and follow security best practices such as OWASP Secure Coding Practices.

Also Read About CeFi Centralized Finance And Decentralized Finance DeFi

Centralized Oracles and Trust

Projects may use a centralized oracle, in which an entity, frequently secured by an only Owner modifier, controls data updates. This creates centralized trust, which may encourage authorized users to submit false information or misuse their position. Additionally, centralized systems are inherently vulnerable to compromise via compromises of private keys. A “single point of failure” is presented by these oracles.

Decentralized Oracle Security

By diversifying data collectors, decentralized oracles seek to improve security by making it more difficult for attackers to interfere with a quorum. However, participation incentives and unpunished misconduct give rise to security concerns. Participants are encouraged to provide the least expensive service feasible since they are financially compensated for supplying accurate data.

- Freeloading Attacks: In order to reduce effort and increase revenue, nodes use off-chain components (such as APIs) or other oracles to replicate values without validation. Data accuracy may be significantly impacted by this centralization of the data source, particularly if sampling rates differ (e.g., duplicating hourly API updates for a 10-minute sample rate requirement). A “price race to the bottom” and the takeover of a data stream by a few freeloading nodes are two consequences of freeloading. Consistency checks can discourage copying from public services for simpler data, while commit-reveal schemes can stop freeloading for complicated data streams.

- Misbehaving nodes save work by reading from a centralized data source (maybe with a lower sample rate) and replicating those values across other “mirroring” participants in mirroring attacks, a sort of Sybil attack. As the number of mirrored players increases, this considerably weakens error correction processes and boosts the incentive for a single data read. Unintentional mirroring can also occur when a sizable, ignorant group depends on a single data source. Due to their inability to stop private data transfers between Sybil nodes, commit-reveal methods are useless against mirroring and make these attacks challenging to identify.

Data Aggregation

Multiple reporters provide data to decentralized oracles, but the client smart contract only requires one value. Data tampering is possible if the aggregation method is defective.

- A malicious node reporting an unusually high or low number can influence an off-chain oracle that naively determines the mean of a dataset. In a similar vein, an attacker might alter the median by inserting an inaccurate value.

- Time-Weighted Average Price (TWAP) is used by on-chain oracles such as Uniswap. Although short-term manipulation is made more expensive by TWAPs, this may not be the case for low-liquidity assets, where manipulation can remain inexpensive over extended periods of time.

Insufficient Input Validation

An attacker could alter parameters to alter the perceived value of assets if a smart contract function fails to properly validate input. An attacker may be able to overwrite the oracle-provided data, for instance, if user-provided data and Oracle price information are serialized. This would enable value drainage and allow the function to use attacker-defined pricing.

Smart Contract Errors

Attackers can manipulate prices by taking advantage of additional flaws or logical mistakes in a smart contract. An attacker could be able to directly alter pricing information if appropriate access control is not put in place. Unusual price manipulation attacks include the Vow hack in August 2024, in which a brief modification in price setter code during testing allowed a MEV bot to generate billions of tokens.

The Effects of Oracle Manipulation on DeFi Security

Attacks using Oracle tampering have serious repercussions for DeFi protocols:

- Protocol Insolvency: They have the potential to cause widespread insolvency in lending protocols, resulting in “bad debt positions” where the value of the collateral is less than the debt, hence requiring the supplier of liquidity to bear the losses.

- Poor User Experience: DeFi money markets may be unjustified if they are founded on inaccurate oracle data, even when they liquidate debt to prevent insolvency.

- Economic collapse: In some situations, such as when algorithmic stable coins and rebase tokens lose their price pegs as a result of falsely reported price changes, Oracle exploits can result in complete economic collapse.

Also Read About Swarm Blockchain: Decentralized Marketplaces & Communities

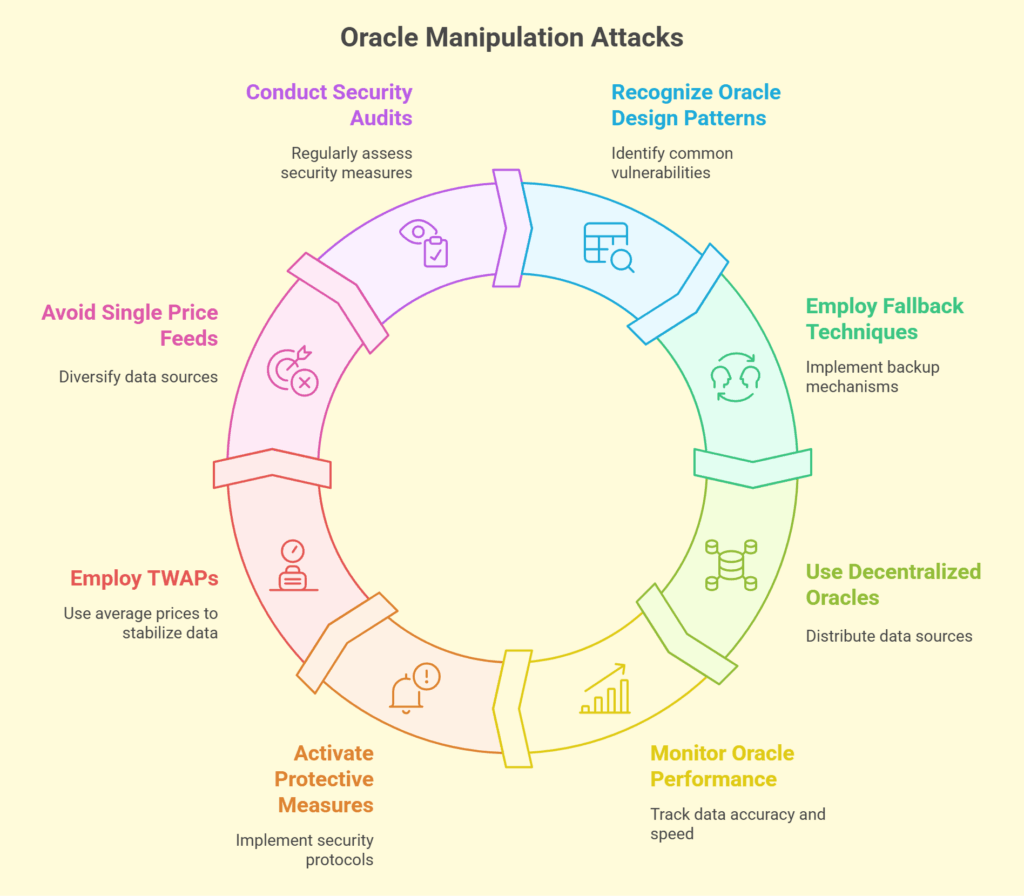

How to Protect Against Oracle Manipulation Attacks

To defend against these threats, a complete strategy is needed:

Recognize Oracle Design Patterns

To make wise choices and prepare for the worst-case situations, developers and auditors need to be aware of the advantages, disadvantages, and attack points of various Oracle designs.

Employ fallback techniques

Combining an off-chain oracle, such as Chainlink Price Feeds, with an on-chain oracle, such as Uniswap V3 TWAP, offers security and fault tolerance by enabling the system to switch in the event that the data from one oracle is compromised.

Use Decentralized Oracles

Compared to centralized oracle services, decentralized oracle systems that use numerous reporters greatly raise the cost and difficulty of manipulation attacks, albeit they are not completely impervious. To discourage misconduct, such oracles should ideally incorporate robust crypto economic incentives (such as staking on data veracity or reputation scores).

Monitor Oracle Performance and Activate Protective Measures

Don’t rely solely on Oracle data. Use monitoring scripts to periodically check for significant differences between Oracle-provided prices and those from other sources. Have safeguards against the attack in case there is no backup, like halting the smart contracts of the protocol if the oracle or its data source is suspected.

Employ Time-Weighted Average Prices (TWAPs)

By averaging prices across several time periods and sources, this technique reduces front-running risk and prevents manipulation by making short-term price impacts more costly. Low-liquidity assets, however, might not be covered by it.

Avoid Single Price Feed Sources

By making it more difficult and costly to attack, using a median of several oracles increases security. Additionally, it guarantees data availability even in the event of an oracle failure.

Comprehensive Security Audit

Conduct a thorough security audit of the oracle’s business logic and implementation prior to launching a smart contract tied to it. This is necessary because vulnerabilities are frequently hard to find in isolation and necessitate examination of the entire smart contract ecosystem.

Also Read About Web3.shh: Decentralized Messaging With Whisper On Ethereum