Solana blockchain development company

Scalable, decentralized apps were established on Solana (currency symbol: SOL), a public blockchain platform. In March 2020, Anatoly Yakovenko and Raj Gokal’s 2018 Solana Labs introduced it. Anatoly Yakovenko created Solana. The Geneva-based Solana Foundation manages the open-source project.

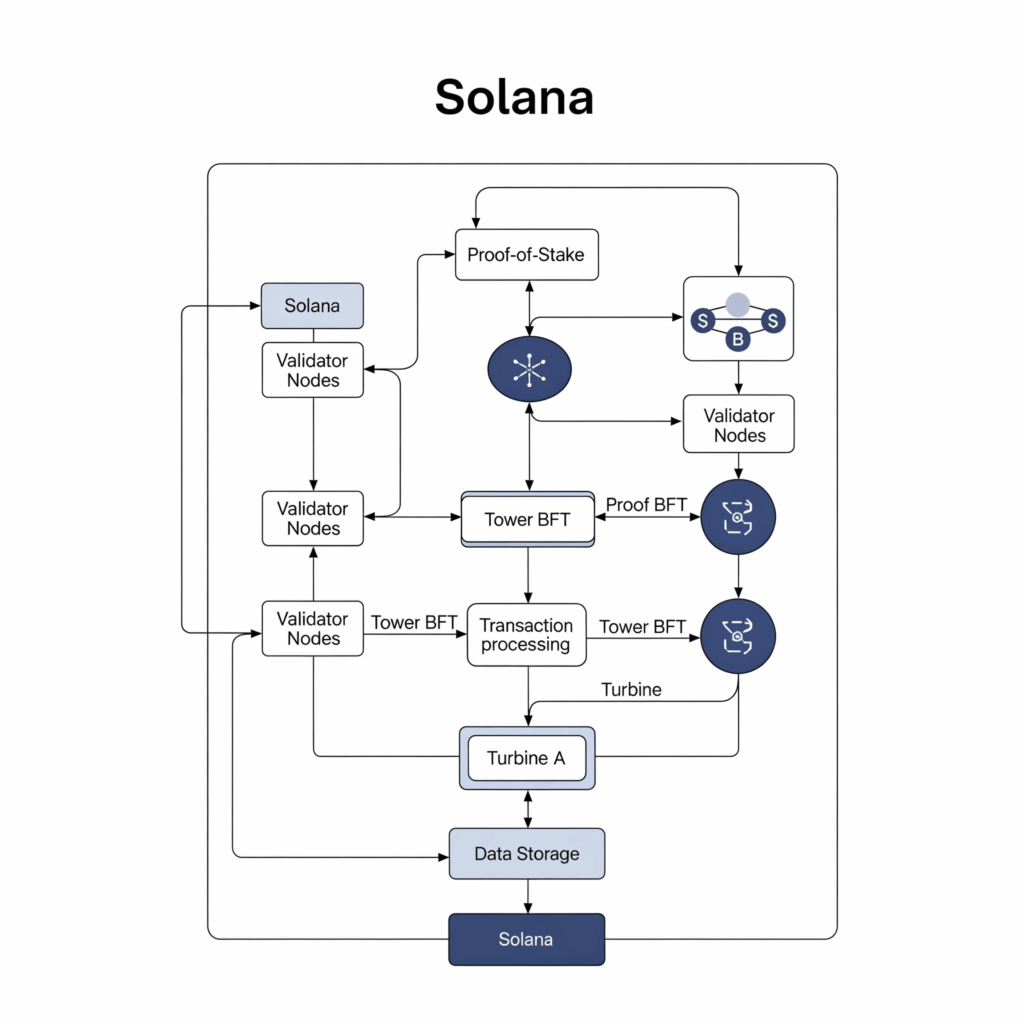

Solana blockchain architecture diagram

Solana blockchain architecture

- Proof of Stake (PoS) and Proof of History (PoH) are combined in Solana’s novel consensus model. The goal of this combination of tried-and-true cryptographic techniques and new developments is to fix the flaws in previous crypto solutions.

- By establishing a verifiable sequence of events, the Proof of History (PoH) consensus paradigm enables speedier processing. Transactions are routed to a leader node in PoH, which broadcasts them to other validator nodes and orders them. It aids in the creation of a historical record that demonstrates that an event took place at a particular time. According to Yakovenko, a dependable clock would make network synchronization easier and result in an immensely quicker network. PoH helps the blockchain reach consensus by recording event times. Before their revisions, Ethereum and Bitcoin lacked a trustworthy time source, making it difficult to guarantee uniform message acceptance among nodes.

- Proof of Stake (PoS): The network is operated by validator nodes in Solana, which also employs PoS. A PoS-based election process is used to choose one of these nodes as the leader node. Rather than investing in expensive hardware, validators stake in coins, and those with a larger stake are usually more likely to be chosen as the next proposer. Proposers receive transaction fees or block rewards, and validators independently confirm the status by voting. In particular, Solana employs a variant known as Delegated Proof of Stake (DPoS). Proof-of-Work (PoS) systems are generally thought to be less energy-intensive than PoS systems.

- Combined Mechanism: In order to achieve speeds that are on par with centralized payment systems like Visa, Solana uses DPoS and PoH in tandem to address security and scalability, two of the three problems in Vitalik Buterin’s blockchain trilemma. By timestamping every block, the PoH method offers an extra degree of protection.

Performance and Scalability

According to its boasts, Solana is the world’s quickest blockchain.

- On its Testnet, which has more than 200 nodes, it has been tested to manage 50,000 transactions per second (TPS) with a 400 ms block time latency.

- With current technology, it can theoretically achieve up to 710,000 TPS, provided that transactions are typically no longer than 176 bytes. For the near future, this architecture does away with the requirement for a Layer 2 solution.

- With transaction fees of only $0.00025 per transaction, they are incredibly inexpensive. Compared to Ethereum, where fees might be somewhat higher, this is far lower.

- Because Solana’s architecture has reduced financial and environmental costs, it can scale more easily. Solana is energy efficient; each transaction uses roughly the same amount of energy as a few Google searches.

Ecosystem and Development

- Smart Contracts and dApps: Solana is built to host decentralized apps (dApps) and has smart contract capability.

- Programming Languages: C, C++, or Rust are the languages in which Solana smart contracts, also known as programs, may be built.

- Wallets: Trust, Exodus, and Sollet are just a few of the hardware, web, and mobile wallet choices that are available. The Solana Foundation blamed Slope Finance’s digital wallet software for the August 2022 hack of 9,231 Solana wallets, which resulted in the theft of about $8 million.

- Token Standard: Like Ethereum’s ERC-20, Solana has its own tokenization standard called SPL Token.

- Adoption: With more than 400 projects previously developed on its platform in a variety of industries, including DeFi, NFTs, and Web3, Solana has received widespread adoption. It can process around 2,400 transactions per second as of September 2024.

- A payment system designed for instant USDC transactions, Solana Pay has a net-zero environmental impact and fractional cent fees.

- A subsidiary, Solana Mobile, began selling the Android smartphone Solana Saga in April 2023, which comes preloaded with Solana-based decentralized apps.

Recent Integrations

- Visa declared in September 2023 that it would accept payments to retailers using the stablecoin USD Coin (USDC) via the Solana blockchain.

- Users can now access Franklin Templeton’s Franklin Onchain U.S. Government Money Fund using its BENJI platform, which was extended to Solana in October 2024.

- Users can purchase goods from different brands and stores using stablecoins and memecoins during a “Onchain Holiday” shopping event.

- Due to heightened trading activity after US President Donald Trump’s memecoin, $TRUMP, was introduced on the Solana blockchain, Solana hit a new all-time high in January 2025.

Comparison Solana And Ethereum

- Solana is frequently referred to as an Ethereum substitute or a “Ethereum killer” alternative.

- Both platforms are utilized for NFTs, allow dApps, and have smart contract capabilities.

- Speed and Cost: When compared to Ethereum, Solana offers a clear edge in terms of transaction processing speed and cheaper transaction prices. Ethereum has historically handled fewer than 15 TPS with average fees of $0.30, whereas Solana can process hundreds of TPS with average fees of $0.026%.

- Consensus: Both currently employ a PoS consensus process, but Solana uses PoH to enhance it.

- Ethereum’s ecosystem and market cap are second only to Bitcoin’s, giving it a first-mover advantage. Ethereum’s 2022 Merge and danksharding, which aim to improve scalability, security, and sustainability, will affect Solana’s performance.

Market Value and Challenges

- There has been significant volatility in the value of Solana tokens (SOL). Its market capitalization increased by around 12,000% in 2021, surpassing $63 billion in September and reaching $74 billion in early November.

- Outages: There have been a number of significant service outages on the Solana blockchain, which have repeatedly caused the SOL token’s value to decline.

- September 14, 2021: The network forked as a result of an increase in transactions, going offline for almost 17 hours.

- May 1, 2022: Bots caused an approximate seven-hour outage.

- A flaw in the offline transaction processing caused the system to go offline for approximately four and a half hours on May 31, 2022.

- October 1, 2022: A consensus problem caused the network to go offline for six hours.

- Hacks: In August 2022, 9,231 Solana wallets connected to a digital wallet program from Slope Finance had about $8 million stolen from them.

Also Read About Proof of Space Time(PoST), How it works, Benefits & Examples

Legal Concerns

- July 2022: Solana Labs was sued in a class action for misrepresenting the number of SOL tokens in circulation and marketing unregistered securities.

- June 2023: The SEC sued Coinbase for violating disclosure standards and for failing the Howey Test, which made Solana and twelve other currencies securities. The Solana Foundation denies the token’s security classification.

- After the SEC’s June 2023 statement, SOL fell by around 30% in a single day, which prompted exchanges such as Robinhood to delist SOL and other named tokens. But for U.S. clients, Robinhood Crypto relisted Solana (SOL) in November 2024.

- Solana dropped 40% in one day after FTX filed for bankruptcy in November 2022. At the time, FTX owned $982 million in Solana tokens, Alameda Research’s second-largest stake. By the end of 2022, Solana’s worth had dropped by about $50 billion since the year started. But by March 2023, its market capitalization had increased by 100 percent to almost $7 billion.

Investing in Solana

- SOL tokens are available for trading on well-known exchanges such as Coinbase, Kraken, and Binance.US. They can be kept in cryptocurrency wallets, although offline storage, or cold wallets, are usually thought to be the safest choice.

- Peer-to-peer payments, trading, and serving as a validator incentive for protecting the Solana network are just a few of the applications for SOL tokens.

- SOL is seen as a dangerous investment, nonetheless, and is extremely volatile like all cryptocurrencies.