The following list includes an overview of tpics centralized exchanges, core functionality and operation, benefits, risks, and disadvantages of centralized exchanges, as well as regulation and compliance.

Centralized exchanges

Centralized exchanges are online platforms that act as intermediaries for trading cryptocurrencies and other digital assets. Unlike decentralized systems, they operate under a central authority which controls the system and is responsible for all operations. This model is prevalent among major online service providers like Google and Amazon in traditional web services.

Also Read About Role Of Cryptography In Blockchain Explained For Beginners

Core Functionality and Operation

Intermediation and Trust

- Centralized exchanges serve as the “middleman” for transactions, similar to how banks operate in traditional finance. Users must trust these services to safeguard their keys and funds and to act responsibly.

- They typically collect fees from trading, often as a percentage of the transaction.

Custody of Funds

- One of their defining features is that they maintain custody of users’ private keys and funds. When users deposit funds, these are automatically swept to internal “warm” or “cold” wallets managed by the exchange.

- They use deposit addresses to credit funds to the correct user accounts.

Trading Mechanisms

- Centralized exchanges provide trading engines that match buyers with sellers.

- They feature order books, which are visual representations of outstanding buy (bids) and sell (asks) orders for a cryptocurrency.

- They support various order types, such as market orders (executed immediately at current market prices) and limit orders (executed at a specified price or better). Some exchanges allow limit orders to have an expiration.

- Most use a maker/taker model for fees, where liquidity providers (makers) may not pay a fee, while those taking liquidity (takers) do.

Fiat Currency Integration

- They serve as crucial “on-ramps” and “off-ramps” for converting traditional (fiat) currencies (e.g., USD, EUR) to cryptocurrencies and vice versa.

Also Read About CeFi Centralized Finance And Decentralized Finance DeFi

Advantages of Centralized Exchanges

Performance and Scalability

- They can handle a much higher transaction throughput (volume of transactions per second) and offer lower latency (time required to add data) compared to public blockchains. For instance, Visa’s network, a centralized system, can handle 65,000 transactions per second, whereas Bitcoin handles 3-7 and Ethereum less than 20.

- This is because their infrastructure runs on well-established technology and they do not have the additional complexity of distributed consensus mechanisms.

Ease of Use

They are generally easier for non-technical users due to their familiar interface and traditional account management features like password reset and recovery.

Liquidity and Market Depth

Well-established centralized exchanges often have greater liquidity, meaning they can handle larger trades with less price impact.

Enhanced Functionality

They provide a more comprehensive trading experience, including margin/leveraged products, options, swaps, and futures, that are still nascent or less developed in decentralized finance.

Also Read About What Are The Blockchain Transaction Steps And Types?

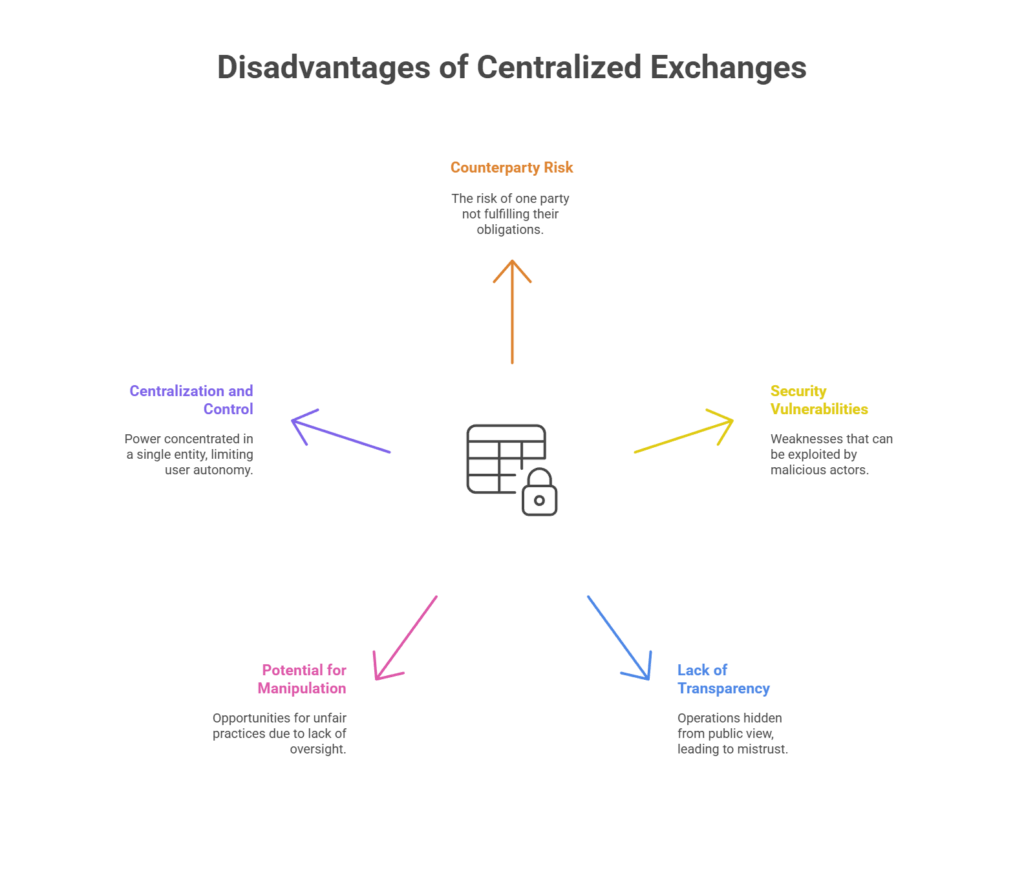

Disadvantages of centralized exchanges and Risks

Counterparty Risk and Security Vulnerabilities

- Storing funds on a centralized exchange exposes users to counterparty risk; if the exchange is hacked, goes bankrupt, or acts maliciously, users may lose their funds.

- They represent a single point of failure, making them attractive targets for hackers. Notable incidents include the Mt. Gox hack, where over 850,000 Bitcoin were stolen.

- Exchanges generally aim to keep less than 5% of customer funds in hot storage (connected to the internet) and over 95% in cold storage (offline) to mitigate hacking risks.

- Withdrawal delays can signal illiquidity and potential solvency issues for an exchange.

Lack of Transparency and Potential for Manipulation

- The backend code and database are kept private by the exchange, making it impossible for the public to audit them. This contrasts with decentralized exchanges where smart contract code is publicly auditable.

- Some exchanges may run trading bots to prioritize their own trades or engage in wash trading (artificially inflating trade volume), which is illegal in some jurisdictions.

- Whales (large crypto holders) can have an unpredictable impact and even control prices of low-market capitalization cryptocurrencies by creating large buy/sell “walls” in order books.

Centralization and Control

They are inherently centralized, meaning a single entity controls decisions, infrastructure, and user data. This is a departure from the decentralized ethos of many cryptocurrencies.

This control extends to token listing, where new tokens typically require permission and negotiation to be listed on a centralized exchange, unlike decentralized exchanges where anyone can list a token.

Also Read About Understanding Decentralized Identity Blockchain Projects

Regulation and Compliance

Centralized exchanges operate under regulatory oversight and must comply with the laws of the jurisdictions they operate in.

They are often required to implement Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, which involve collecting identifying information from users to prevent financial crimes. This contrasts with DEXes, which often have lower entry barriers due to a lack of KYC requirements.

Regulation: Centralized exchanges are heavily regulated and impose KYC rules, while DEXes often have lower regulatory burdens and no KYC.