In this article, we learn about Stablecoins in blockchain, History, Purpose and Motivation, Types of Stablecoins, Advantages and Disadvantages of Stablecoins.

Cryptocurrencies that are categorized as stablecoins are made to keep their value constant, usually by tying them to another, more reliable asset. Frequently, a fungible commodity like gold or a conventional fiat money like the US dollar serves as this reference asset.

Purpose and Motivation

In order to overcome the inherent volatility of conventional cryptocurrencies such as Bitcoin and Ether, which render them unsuitable for daily use or as a dependable store of value, stablecoins were introduced. In order to provide the advantages of cryptocurrencies such as decentralization, transparency, and immutability, stablecoins seek to do away with price swings and the necessity of fee-charging middlemen like banks. They allow users of cryptocurrencies to retain their assets in cryptocurrency instead of paying higher transfer costs when changing between fiat and cryptocurrency. A steady store of value and a stable medium of trade are the goals of stablecoins.

History

Since the beginning of the internet, there has been a need for a digital dollar and simplified permits for fiat. 2014 saw the release of BitUSD, the first stablecoin, on the BitShare blockchain, which Charles Hoskinson and Dan Larimer co-developed. BTS as well as other cryptocurrencies secured by smart contracts, supported it. Tether (USDT), which was also introduced in 2014, quickly rose to prominence. Originally designed to utilize the Bitcoin network, it later expanded to include Ethereum, Algorand, and Tron. Circle and Coinbase created USD Coin (USDC) in September 2018 to achieve more auditing and transparency than Tether.

In 2018, TrueUSD was introduced as an additional transparent and audited ERC-20 token that holds collateral in fiduciary partners’ audited bank accounts. Maker DAI, a stablecoin based on Ethereum that was introduced in 2017, keeps its value stable by using self-executing smart contracts that either create or burn DAI.

You can also read Dogecoin Alternatives Cryptocurrency: Next-Gen Meme Coins

Mechanism for Stability (Collateralization)

The main way stablecoin prices are kept stable is collateralization, which includes backing them with a reserve. This resembles how gold or foreign exchange reserves secure fiat currencies. Although blockchain is the underlying technology used by the majority of stablecoins, the collateral that goes along with them is frequently centralized. In order to guarantee price stability, stablecoins may use algorithmic supply-controlling formula or reserve assets as collateral.

Types of Stablecoins

The several types of Stablecoins based on their collateral are:

Fiat-collateralized Stablecoins

These are supported by conventional fiat currencies, such as the US dollar, Hong Kong dollar, Canadian dollar, British pound, Euro, Swiss franc, and others. The most prevalent kind of stablecoin is this one. As depositaries, regulated financial institutions retain the supporting currency, achieving the value connection off-chain. Tether (USDT), the biggest stablecoin in terms of market capitalization, USD Coin (USDC), Paxos (PAX), Gemini Dollar (GUSD), TrueUSD (TUSD), and Monerium EURe are a few examples.

For price stability, trust in the custodian of the underlying asset is essential because if the issuer does not have enough fiat to conduct transactions, the value of the stablecoin may increase. Despite having the most centralized structure, this type is the most basic. For example, Tether received fines and criticism for not always having complete fiat support. An AUDN stablecoin for international trade and carbon credit trading was announced by the National Australia Bank.

Commodity-collateralized Stablecoins

Fungible assets like gold or oil serve as the foundation for these stablecoins. As long as certain conditions are met, holders can usually exchange their stablecoins for the underlying assets. The expense of keeping the commodity stable is related to its storage and protection. Digix gold tokens and the gold-backed Tether Gold (XAUt) are two examples. Despite having physical asset support, they are centralized, which raises the possibility of hacks and calls for audit procedures.

Crypto-collateralised Stablecoins

Other cryptocurrency supports this kind. A more decentralized strategy is promoted by the fact that, in contrast to fiat collateralization, the backing of crypto assets is usually controlled on the blockchain using smart contracts. The value of the cryptocurrency held in reserve surpasses the value of the issued stablecoins, a phenomenon known as overcollateralization, which is caused by the volatility of reserve cryptocurrencies.

As an illustration, DAI from the Maker project, which was first supported by Ethereum’s ETH, now requires 150% collateralization and uses a variety of cryptocurrencies. By using smart contracts to lock assets and levying a stability fee, Maker preserves stability. Wrapped Bitcoin (WBTC), Havven, and DAI from the Maker project are a few instances. Because of the more complicated technological implementation, there is a higher chance of exploits because of errors in the smart contract code, and the stability of the system is largely dependent on the value of the collateral and supplemental tools.

Algorithmic Stablecoins (Non-collateralized)

Instead than having a reserve to support them, these stablecoins are kept stable by algorithms that regulate supply in response to market demand. In response to changes in price, the algorithms manufacture or burn tokens to modify the money supply. Despite their decentralized nature and lack of collateral, their method is more intricate. The value of a number of algorithmic stablecoins has historically fallen as a result of their inability to hold their peg. Notable failures include Tron’s USDD, which also lost its peg, and TerraUSD (UST), which lost its 1:1 peg with the US dollar in May 2022, causing a large wipeout of market capitalization. As another example of this kind, the Basecoin project is brought up.

You can also read Advantages and Disadvantages Of Cryptocurrency And Its Types

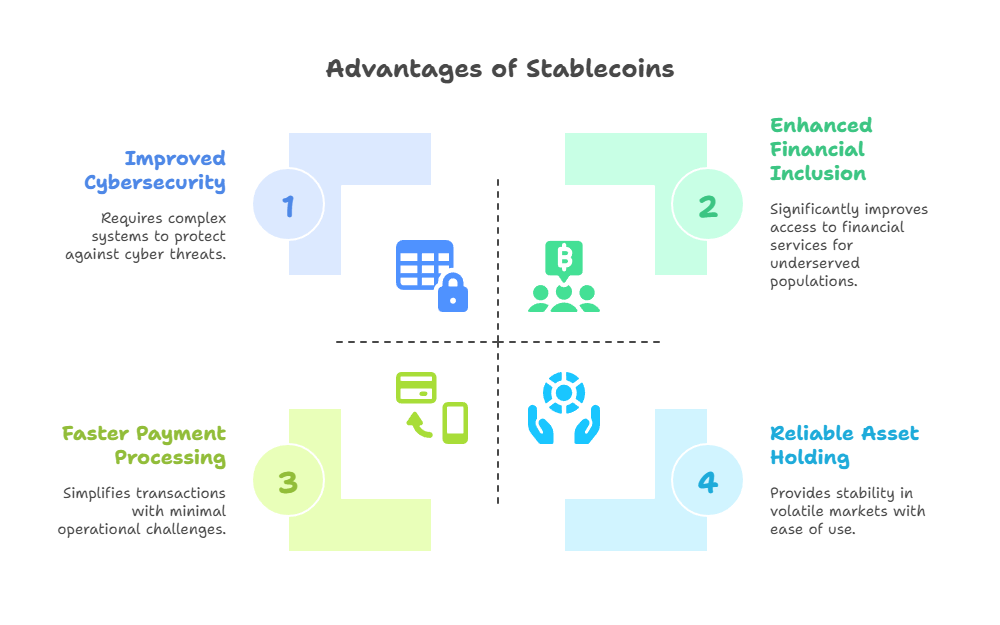

Advantages of Stablecoins

Advantages of Stablecoins

Through collateralization, stablecoins give consumers peace of mind, enable private money and transactions, and speed up the processing of both domestic and foreign payments, among other advantages. Traders can utilize them as a reliable asset to hold their assets in erratic markets without having to exchange them for fiat money. Financial inclusion, cybersecurity, operational resilience, consumer data protection, tax compliance, and anti-money laundering initiatives could all be improved by them. Stablecoins are frequently faster and less expensive than more conventional options like SWIFT or Western Union for cross-border payments.

Disadvantages and Criticisms

Even though stablecoins have advantages, they are criticized, especially for the centralization that occurs when one group uses fiat money to support the asset. If the value of the underlying collateral for a stablecoin changes, the value of the stablecoin itself may also vary. Due to concerns about their necessary backing or liquidity, several have encountered challenges or legal issues; for example, Tether’s reserve disputes and NuBits’ loss of their dollar peg. Also, uncontrolled exchanges can employ them.

The restrictions on regulation are another issue, as the market is expanding so quickly that Congress needs to act quickly to regulate it. Another critique is the issuers’ lack of openness about their reserves. De-pegging also carries a high risk, as evidenced by the collapse of TerraUSD, which cost investors close to $45 billion. Additionally, there is a risk of money laundering and terrorist financing associated with stablecoins, and the public’s growing holdings of them may deplete bank savings. Complex smart contracts increase the possibility of attacks because of vulnerabilities in crypto-backed stablecoins.

Market and Adoption

After reaching $133 billion, stablecoins now have over $250 billion in market value. The two largest stablecoins by market capitalisation are USD-backed Tether (USDT) and USD Coin (USDC). Algorand has gained popularity for creating stablecoins such as Tether and USDC. Visa Inc. made a significant announcement in March 2021 that it would start using USDC over the Ethereum blockchain to settle a limited number of transactions. Stablecoin payments are also made possible for US merchants by Stripe. In nations like Argentina, Nigeria, and Turkey where fiat currencies are erratic, stablecoins have also grown significantly as a means of transferring money across borders and protecting against local currency volatility. In fact, several stablecoins are starting to give their owners interest.

Technical Implementation and Standards

Many stablecoins follow the ERC20 standard requirements for fungible tokens and are deployed as ERC20 tokens on the Ethereum network. This standard outlines procedures for acquiring approvals, transfers, account balances, and total supply. TUSD and USDC may require users to provide personal KYC information to redeem their stablecoins for fiat currency because of banking relationships, but they can still be used pseudonymously within the blockchain. In the blockchain ecosystem, DAI and other stablecoins do not require KYC.

Regulation

Due to their rapid ascent and impact on the financial system, global regulators are watching stablecoins.

- The GENIUS Act and STABLE Act are being debated in Congress; however, the US lacks a nationwide regulatory framework. States have mostly overseen financial stability and consumer protection, passing new laws or applying existing restrictions. New York bitcoin businesses must get a BitLicense and fulfill capital and AML standards. New York clarified in 2022 that USD-backed stablecoin issuers must maintain comprehensive reserves of exceptionally safe and liquid assets and give monthly attestations. In order to regulate stablecoin issuers like banks, the Biden administration has suggested that they insure reserves and submit to federal inspection and auditing. Redeemable Wyoming Stable Tokens (WYST), backed by US Treasury bills, will be issued by a state commission authorised by Wyoming.

- Countries such as Switzerland, Japan, Singapore, the United Arab Emirates, Hong Kong, and the United Kingdom have either implemented or proposed stablecoin rules. The Markets in Crypto-Assets Regulation (MiCA) of the European Union, which goes into effect in 2023, effectively outlaws algorithmic stablecoins and mandates that all other coins have their assets kept in custody by a third party with liquid reserves at a 1:1 ratio.

You can also read History Of Meme Coins, What Is It, How It Works, & Examples