After Bitcoin’s “hard fork,” Bitcoin Cash (BCH) was launched. It debuted in 2017. We described what Bitcoin Cash (BCH) is in this article. Bitcoin Cash’s history, how does Bitcoin Cash works, advantages, and disadvantages.

What is Bitcoin Cash (BCH)?

Bitcoin Cash was created to fulfil Bitcoin’s “Peer-to-Peer Electronic Cash” promise. The low-cost payment method was devised to restore cryptocurrency’s decentralization. Bitcoin Cash functions according to its own set of regulations and blockchain. Critics occasionally refer to it as Bcash, while proponents insist it is the “pure form of Bitcoin”.

History of Bitcoin Cash

Satoshi Nakamoto’s October 2008 whitepaper “Bitcoin: A Peer to Peer Electronic Cash System,” debuted Bitcoin. First Bitcoin software released in 2009. The network performed smoothly for years with cheap fees and speedy transactions.

Bitcoin became unreliable and expensive between 2016 and 2017. Longer approval periods and increased fees for customers were the main results of its incapacity to scale and manage an increasing volume of transactions. The primary reason of the transaction queue was Bitcoin’s 1MB block size restriction. The Bitcoin community, which consists of developers, investors, consumers, and companies, disagreed greatly about how to address these scaling issues.

SegWit, or segregated witness

In July 2017, a group of Bitcoin developers and miners that accounted for between 80 and 90 percent of the cryptocurrency’s processing power decided to integrate SegWit. By relocating signature data from the main block to the coinbase transaction field, this approach sought to decrease the amount of data that needed to be verified in each block. Through a “block weight” update, the Bitcoin code was modified to enable blocks to scale up to 4MB. The Lightning Network and other second-layer solutions were made possible by SegWit.

Larger Block Size

SegWit was opposed by a different group of Bitcoin developers, activists, and miners located in China who felt it departed from Satoshi Nakamoto’s original plan for Bitcoin as a peer-to-peer electronic cash system and failed to solve scalability. They promoted a hard fork that would directly raise the block size limit.

There was a “hard fork” as a result of this fundamental dispute. Bitcoin Cash was created on August 1, 2017, in block 478,559 (or 478,558, depending on the source). An equal portion of Bitcoin Cash was automatically distributed to anybody who had Bitcoin at the moment of the fork (a 1:1 split).

The maximum block size of Bitcoin Cash was raised from 8MB to 32MB in 2018 after it was created, and research is still being done for even bigger increases in the future. Additional contentious hard forks occurred inside Bitcoin Cash itself, resulting in the creation of BCHA (now eCash or XEC) in November 2020 and Bitcoin Satoshi Vision (BSV) in November 2018.

How Does Bitcoin Cash Works

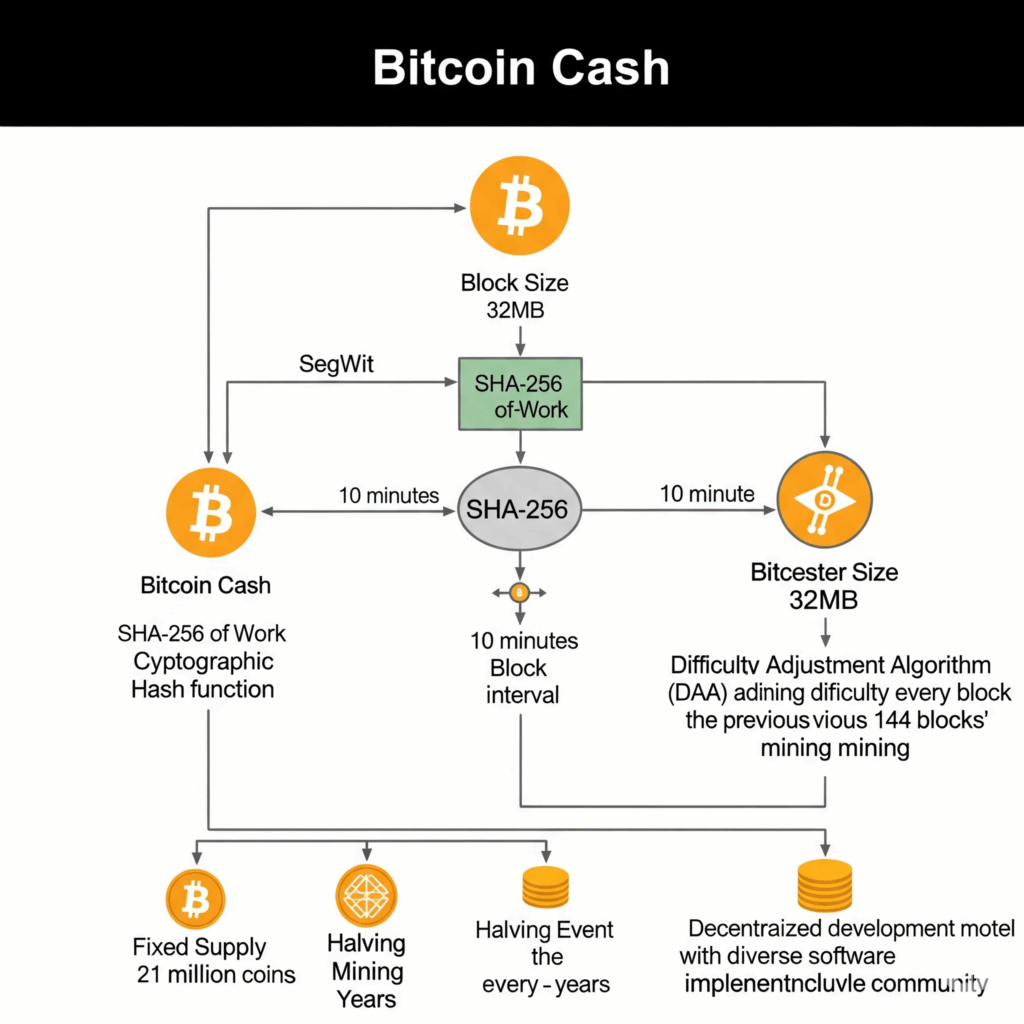

Bitcoin Cash is a cryptocurrency with a number of important features:

Block Size

Bitcoin Cash’s bigger block size, which was first 8MB and subsequently extended to 32MB, is its main technological difference from Bitcoin. The Bitcoin Cash blockchain can handle more transactions per second thanks to its bigger block size.

No Segregated Witness (SegWit)

The SegWit scaling solution is not included in Bitcoin Cash, in contrast to Bitcoin.

Proof-of-Work Algorithm

Every new block in Bitcoin Cash is timestamping using a proof-of-work algorithm (SHA-256 in this case). A hash function is partially inverted in this approach.

Block Time

On average, the network aims to generate a new block every ten minutes.

Difficulty Adjustment Algorithm (DAA)

Bitcoin Cash uses a Difficulty Adjustment Algorithm to keep the average block production time at 10 minutes. At first, it employed an extra Emergency Difficulty Adjustment (EDA) in addition to the same DAA as Bitcoin. But because EDA created instability, it was cancelled, and on November 13, 2017, a new DAA was put into effect. After each block, the updated DAA modifies the mining difficulty based on a moving window of the previous 144 blocks.

Fixed Supply

A maximum of 21 million coins are guaranteed by the Bitcoin Cash system.

Halving Event

About every four years, Bitcoin Cash undergoes a halving event that lowers the block reward by 50%, much like Bitcoin. The reward was lowered to 3.125 BCH on April 3, 2024, the most recent halving.

Decentralized Development

Several separate teams provide software implementations for Bitcoin Cash, which is developed in a decentralized manner. This architecture offers redundancy for 100% network uptime and makes it immune to social and political threats.

Bitcoin Cash Benefits

The following Benefits of Bitcoin Cash demonstrate its potential as electronic money:

Reliability and Speed

Confirmations are made within minutes, and transactions can happen in seconds. The network is dependable because it is built to function without congestion.

Minimal fees

Using Bitcoin Cash to send money internationally usually results in fees of less than one penny. When using merchant processors to convert BCH to fiat cash, this is substantially less expensive than credit card processing fees.

Simplicity

It is made to be hassle-free and simple to use.

Stability and Security

Bitcoin Cash uses the most reliable blockchain technology available for security and is regarded as a tested store of wealth.

Global Accessibility

Like the internet, users can send money to any location in the world, day or night, year-round, without requesting authorization or consent.

User authority

By giving individuals complete, sovereign authority over their money, Bitcoin Cash enables people to act as their own bank. This guards against problems like traditional banks blocking transactions, freezing accounts, or seizing capital (bail-ins).

Scarcity and Sound Money

With a fixed quantity of 21 million coins, Bitcoin Cash provides “sound money” protection against inflation brought on by increases in government printing.

Privacy and Anonymity

Since it’s usually impossible to determine who controls a Bitcoin address, it offers greater privacy and anonymity than conventional payment methods. Users ought to familiarize themselves with its privacy-related aspects.

Benefits for Merchants

- Ultra-Low Fees: When compared to credit card processing, merchants save a substantial amount on transaction fees.

- No Chargebacks: Unlike credit cards, Bitcoin Cash transactions come with built-in fraud protection that is free for the merchant and do not result in automatic voids, refunds, or chargebacks.

- New Clients & Marketing: By taking BCH, you can draw in more and more customers that favor this mode of payment. Additionally, merchants can generate press for their businesses and obtain free listings in online directories.

Token Ecosystem

By supporting token protocols, Bitcoin Cash makes it possible to store and manage assets on its blockchain with more transparency and integrity.

Support for Freedom

It is an open, decentralised, voluntary, permissionless, and non-aggressive network that gives people power and can promote a nonviolent revolution by undermining established hierarchies of power.

Bitcoin Cash’s drawbacks

Notwithstanding its benefits, Bitcoin Cash has certain drawbacks and issues.

Less Volume and Popularity

Compared to Bitcoin, Bitcoin Cash has not attained the same degree of trading volume or popularity. Bitcoin Cash’s daily transaction volume was roughly a tenth of Bitcoin’s as of May 2018.

Network Security and Size

In comparison to Bitcoin, Bitcoin Cash has a far smaller network, a smaller market capitalisation, and a much lower daily trading volume. Although this susceptibility decreases as the network becomes economically impossible to target, a smaller network may be less secure and more vulnerable to assaults.

Liquidity Risk

It may be more difficult to enter or exit positions rapidly when there is less trading traffic.

Limited Acceptance

Despite being designed as a payment method, Bitcoin Cash has not yet been widely accepted by consumers.

Price Volatility

Given the competitive cryptocurrency market, its price has seen notable fluctuations, and its long-term prospects for retaining a sizable value are still up for debate. By August 23, 2018, its price had dropped 88% to $519.12 from its intraday peak of $4,355.62 on December 20, 2017.

Historical Instabilities

Prior to a fix being put in place in November 2017, Bitcoin Cash was thousands of blocks ahead of Bitcoin due to mining difficulty instability brought on by the original Emergency Difficulty Adjustment (EDA) algorithm.

Software Bugs

Although it was later addressed, a bug in the Bitcoin ABC software was discovered in 2018 that might have enabled an attacker to construct a block that would have caused a chain split.

Investor vs. Payment Focus

Despite being created as a payment method, Bitcoin Cash has grown in popularity among investors, which may not be in line with the community’s initial objectives.

First-Mover Advantage

Bitcoin’s first-mover advantage established its dominance, making it difficult for Bitcoin Cash to garner the same level of attention and involvement from the cryptocurrency community and investors.