Let us discuss about How To Track Crypto Whales, How Much Crypto Is Needed to Be a Whale, And why it matters.

Crypto Whale

A person or organization that has a significant amount of bitcoin is referred to as a “crypto whale.” Although these whales are frequently linked to well-known cryptocurrencies like Ethereum and Bitcoin, they can also possess substantial quantities of other altcoins. Large investors can influence market movements through the sheer volume of their trades in traditional financial markets, which is where the idea first emerged.

Crypto whales may be private citizens, businesses, associations, or even teams. They are referred to as “whales” because, like the greatest marine animals, whose motions produce enormous waves, crypto whales can cause enormous price swings in cryptocurrency markets because of the scale of their holdings.

Types of Whales

| Type | Who they are |

|---|---|

| Early Adopters | People who mined or bought large amounts of crypto in the early days when prices were low. |

| Institutions | Hedge funds, publicly-traded companies (like MicroStrategy), and investment firms. |

| Exchanges | Crypto exchanges often hold massive reserves to provide liquidity. |

| Project Teams | Founders & developers of crypto projects often keep a significant share of tokens. |

Why Crypto Whales Matter

Because they have the power to greatly affect market sentiment and price fluctuations, cryptocurrency whales are important. They have an outsized influence on the market due to their substantial holdings.

Market Impact and Price Volatility:

- A “dump” is when a whale sells a significant amount of a certain cryptocurrency, which might cause the price to drop. On the other hand, a whale purchasing a large quantity might swiftly raise the price. Because other investors might imitate the whale’s behaviour, panic selling or FOMO (Fear of Missing Out) may result. This frequently has a cascading effect.

- Their activities have the potential to cause notable volatility and price swings, which smaller investors would find difficult to handle.

- The Terra collapse, which destroyed $40 billion from investors’ savings, is a real-world illustration of whale effect. An analytics business discovered that, despite being primarily blamed for a bank run and de-pegging incident, just seven whales started the bank run by liquidating their UST holdings, which resulted in additional de-pegging and a decline in investor confidence.

- The price is affected by the attention around a whale’s transaction, particularly on sites like X (previously Twitter), as well as the average quantity of a particular cryptocurrency being put into exchanges (exchange inflow mean).

Liquidity Impact:

- The liquidity of a particular coin on exchanges is impacted by whales’ substantial trades. They can use their trading activity to artificially create supply or demand.

- By trading slowly, whales can add liquidity; if they move too quickly, they can take it away. A coin’s liquidity may be lowered if a small number of whales own a sizable amount of its supply and stay dormant, reducing the amount in circulation. When they are aggressively buying and selling, on the other hand, their big trades may also help to boost liquidity.

Market Sentiment and Signals:

- The cryptocurrency community and investors keep a careful eye on what whales are doing. Many traders use whale movements as a predictor of future market moves.

- Whales, for instance, frequently signal that they may sell when they transfer money to exchanges, which can lead to panic selling among lesser investors. When big whales transferred thousands of Bitcoin to exchanges in May 2021, increasing the likelihood of a sell-off, the price of the cryptocurrency fell precipitously.

Governance Influence:

- Voting rights for network proposals and upgrades are granted to cryptocurrency holders in certain blockchain networks, especially those that use a Proof-of-Stake (PoS) consensus process. Due to their enormous holdings, whales have considerable influence over these governance choices, which could affect the blockchain’s future course. Whales may have the power to sway policies that increase their own gains or reduce decentralisation, which could affect the market viability and value of cryptocurrencies.

Market Manipulation:

- Unfortunately, some whales could use deceptive practices like “spoofing” placing big orders that are later cancelled to give the impression that supply or demand is higher or “pump and dump” schemes artificially boosting a price before selling off. This might be a serious challenge for regular traders.

How Much Crypto Is Needed to Be a Whale?

The minimum quantity of cryptocurrency required to qualify as a whale is neither clear-cut nor generally accepted. This is partially because of the volatility of cryptocurrency values.

- It’s generally accepted that a whale investor is one who has about 10% of a certain cryptocurrency.

- When it comes to Bitcoin, some people believe that having 1,000 BTC or more is whale-level.

- For other cryptocurrencies, the defining characteristic may be the holdings’ value, which is frequently expressed in millions of dollars.

On August 30, 2024, an account holding 17 Bitcoin, or roughly $1 million, would be deemed a whale by some, while others might save the moniker for accounts that are significantly more valuable. In August 2024, the top 113 Bitcoin wallets, each holding over 10,000 BTC, accounted for over 15.4% of the total amount of Bitcoin. Because they do not transact frequently, accounts with between 100 and 10,000 BTC are thought to have the greatest impact on liquidity, accounting for 44.49% of all circulating Bitcoin.

How Crypto Whales Protect Their Identities

Whales might like cryptocurrency’s anonymity, just like a lot of other investors. Nonetheless, some people can have “iniquitous reasons” for not disclosing their assets. Elon Musk, for instance, is not well-known for his current cryptocurrency holdings and has been charged with manipulating coins like as DOGE to raise their value before selling them.

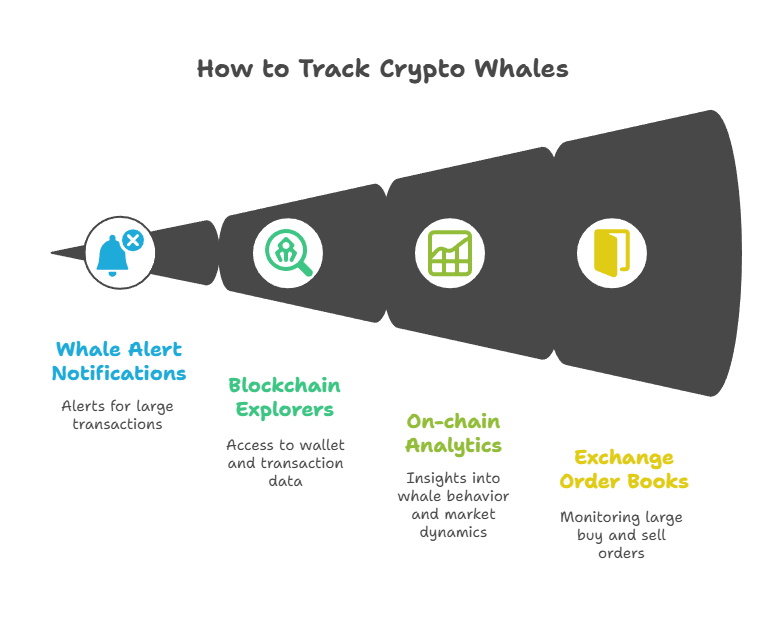

How to Track Crypto Whales

Given their enormous influence, a lot of investors decide to engage in “whale watching,” or tracking whales. All transactions are visible to the public due to blockchain technology’s transparency.

Whale activity can be tracked using the following tools and techniques:

Whale Alert: This platform is accessible on its website and Twitter, and it notifies users anytime a transaction exceeds a certain threshold.

Blockchain Explorers: It is possible for users to access wallet addresses and transaction histories across many blockchain networks by visiting websites such as Etherscan, Blockchain.com, BscScan, and Solscan.

On-chain Analytics Platforms: More complex platforms, like as Glassnode, Nansen, and Santiment, provide on-chain data-based analytics and insights into wallet balances, whale behaviour, and general market dynamics.

Exchange Order Books: Whales often use over-the-counter (OTC) desks for very big trades to minimise market disturbance, although occasionally tracking huge buy and sell orders on cryptocurrency exchanges can reveal whale activity.

These programs monitor the movements of huge wallets, transfers to and from exchanges, and newly formed whale wallets.

Strategies Employed by Crypto Whales

To manage investments and optimize profits, whales frequently use a variety of tactics. These might be anything from straightforward buy-and-hold strategies to more intricate trading methods. To determine sentiment, some people might employ automated trading platforms and algorithms, or they might participate in community forums. Typical tactics include arbitrage, staking, yield farming, capitalizing on price fluctuations, portfolio diversification, and dollar-cost averaging.

Advantages & Risks of Whales

| Advantages | Risks |

|---|---|

| Provide liquidity to markets. | Can manipulate prices (pump & dump). |

| Support ecosystems by staking or funding. | Cause volatility through sudden moves. |

| Often long-term holders stabilizing supply. | Can discourage small investors if seen as unfair. |

What Crypto Whales Mean to Investors?

Whales can have an impact on the market, but smaller investors shouldn’t always be alarmed by their movements. Early adopters or institutional investors that think that cryptocurrency will succeed in the long run make up a large portion of whales. Note that a whale may be making a big buy, switching wallets, or exchanging items, thus activity does not necessarily indicate that they are selling.

Here are some tips for surviving in a market that is impacted by whales:

Don’t Blindly Follow: Perform your own investigation and analysis because whales might have a variety of motivations and their behaviour does not ensure that smaller investors will make money.

Understand Risk Management: Use sensible risk management techniques, like as diversifying your portfolio and placing stop-loss orders, in light of the possibility of volatility.

Look for Accumulation/Distribution Patterns: Determine whether whales are regularly distributing (selling) or accumulating (purchasing) an asset over time to learn more about their long-term sentiment.

Be Aware of Potential Manipulation: Sudden, inexplicable price increases or decreases should raise suspicions of manipulation, particularly in less liquid assets.

Focus on Fundamentals: Always think about a cryptocurrency project’s long-term potential and core value.

Investors can gain an advantage in the market by monitoring whale activity.

How Much Makes You a Whale?

Here are some examples, however there isn’t a formal threshold:

| Cryptocurrency | Approximate Whale Level |

|---|---|

| Bitcoin (BTC) | ≥ 1,000 BTC |

| Ethereum (ETH) | ≥ 10,000 ETH |

| Smaller tokens | ≥ 1–5% of total supply |

On smaller-cap coins, even holding a few million tokens might make someone a whale.

Summary Table:

| Feature | Details |

|---|---|

| Who? | Large holders of crypto — individuals, institutions, exchanges. |

| Why important? | They can move the market significantly. |

| How tracked? | On-chain monitoring tools and blockchain explorers. |

| Effect? | It can cause volatility, trends, and psychological impacts on traders. |