What is Ethereum 1.0?

Ethereum 1.0 premiered July 30, 2015. Vitalik Buterin presented a decentralised app creation white paper in November 2013. Buterin had an idea for a blockchain platform that would have “general-purpose flexibility” so that other people could create their own apps and programs.

By adding a Turing-complete programming language, Ethereum 1.0 was intended to build upon Bitcoin’s restricted capabilities and create “endless possibilities” for the development of decentralised applications. Beyond straightforward currency transfers, it permitted application-based blockchain transactions and made “programmable money” possible. Ethereum functions as a decentralised application platform that can execute code and record each state of its execution on a hash chain, in contrast to Bitcoin, which is exclusively focused on cryptocurrency transfers.

Consensus Mechanism

- Like Bitcoin, Ethereum 1.0 was first released in 2015 using a Proof-of-Work (PoW) consensus model.

- It had quicker block validation times (around 12 seconds as opposed to 10 minutes for Bitcoin).

- The ASIC-resistant PoW algorithm used was Ethash, which required a lot of RAM.

- Miners received Ether for validating transactions and blocks.

Key Components and Functionality

Ether (ETH)

Ethereum’s native cryptocurrency, Ether (ETH), is utilised as “gas” to cover network processing and transaction fees as well as a reward for miners. Ether is second only to Bitcoin in market cap.

Gas

The Ethereum Virtual Machine (EVM) uses gas to calculate the processing power needed to perform a transaction or execute smart contracts. Every operation has a distinct gas cost that is meant to be in line with the resources used by a node. Gas guarantees that computation is paid for and stops misuse of public resources.

Smart Contracts

Short computer programs known as “smart contracts” are kept on the blockchain and automatically carry out their commands when specific criteria are satisfied. They have replaced traditional contracts and are frequently referred to as the “killer application” of the bitcoin world. The most common Ethereum smart contract programming language is Solidity.

Ethereum Virtual Machine (EVM)

Ethereum transactions run in the Ethereum Virtual Machine (EVM). When smart contracts are compiled into bytecode, it serves as a virtual CPU that the EVM may read and run. Network consensus is made possible by the deterministic nature of the EVM, which guarantees that every node generates the identical post-transaction state. The Ethereum Yellow Paper outlines the official definition.

Decentralized Applications (DApps)

Applications that operate on the Ethereum blockchain and communicate with the network using smart contracts are known as decentralised applications, or DApps. Dapps store data immutably and operate similarly to regular apps, but they lack a single point of authority. Examples include Web3-related applications in the fields of banking, gaming, art, and collectibles.

Accounts

The primary components of the Ethereum blockchain are accounts, which are identified by pairs of private and public keys. These accounts allow users to engage with the blockchain through digitally signed transactions. User accounts (also known as externally-owned accounts) and contract accounts are the two categories.

Wallets and Clients

MetaMask, a popular browser extension, let users manage accounts and connect with Ethereum without a local node. Ethereum’s official Go implementation is Geth.

Network Types and Architecture

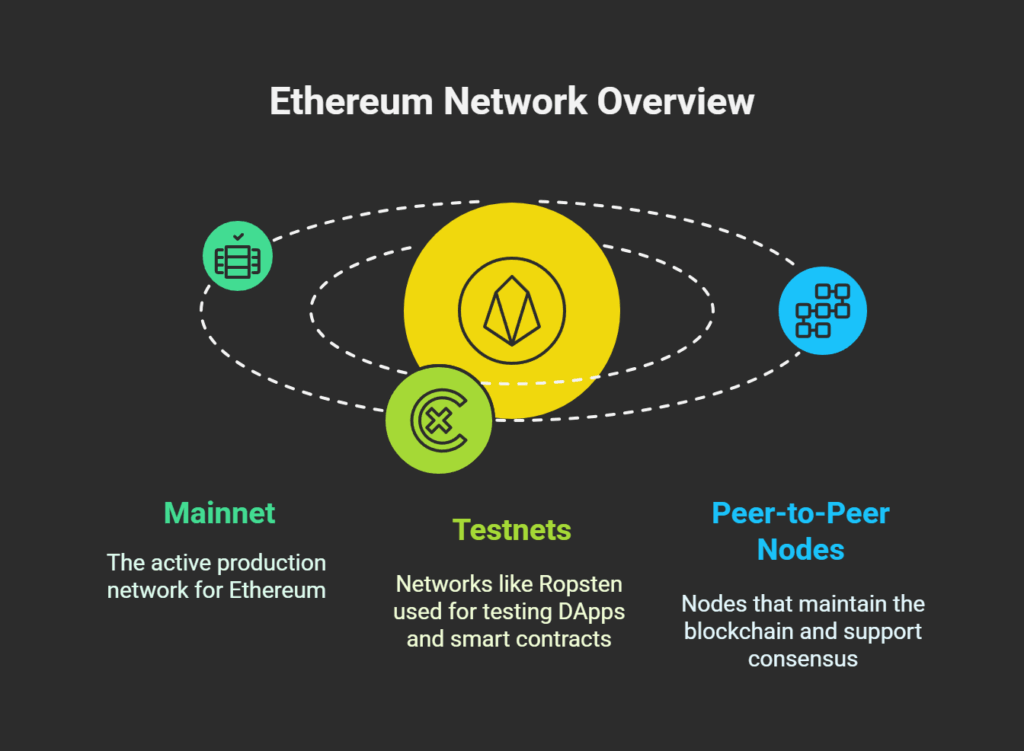

As a permissionless blockchain, Ethereum 1.0 allows anybody to utilise, run a node, create a wallet, and connect with it. The mainnet is the active production network, whereas testnets like Ropsten test DApps and smart contracts. Ethereum peer-to-peer nodes maintain the blockchain and support consensus.

Challenges and Maximal Extractable Value (MEV)

- Although popular, Ethereum 1.0 has scalability concerns, handling just 12–15 transactions per second. Slow network speeds and high transaction costs (gas fees) during periods of high usage could result from this.

- Another major worry was how much energy its PoW strategy used.

- A major failure was the 2016 DAO breach, which stole US$50 million in tokens. This contentious occurrence caused a “hard fork” of Ethereum into Ethereum Classic (which continued on the original chain) and Ethereum (which reversed the theft).

Maximal Extractable Value (MEV)

Miners in Ethereum 1.0 could profit from frontrunning, backrunning, and sandwiching since they controlled block transaction inclusion, exclusion, and ordering. This was called “Miner Extractable Value” at first.

Priority Gas Auctions (PGA)

In order to outbid rivals for priority, searchers (those seeking MEV possibilities) would submit comparable deals with progressively greater gas payments. Due to the inclusion of numerous high-fee transactions, including unsuccessful ones, this resulted in blockspace waste, network congestion, and bloating of the transaction mempool.

Bundle Auctions

These off-chain bidding methods were first used by Flashbots with MEV-Geth in January 2021. In sealed-bid auctions, searchers sent “bundles” groups of transactions to miners through a relay service. Although this reduced blockspace waste and mempool bloating, searchers had to have faith that miners or relays wouldn’t steal or rearrange their bundles.

Ethereum 2.0 (Serenity) was launched to circumvent these limits. This version will contain a PoS consensus mechanism, an improved virtual machine, and sharding for scalability.