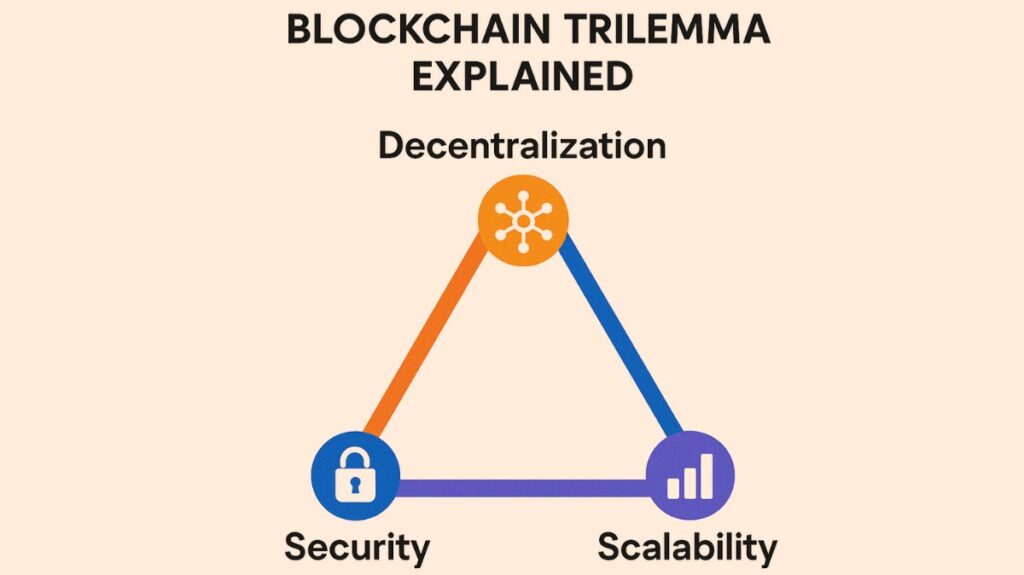

Blockchain Trilemma Explained

The Cap Theorem, often known as the Blockchain Scalability Trilemma, is a major difficulty with blockchain technology. It implies that a blockchain network can only optimize two of the three fundamental characteristics decentralization, security, and scalability at a time, forcing developers to compromise. Vitalik Buterin popularized it. It highlights the difficulty of optimizing all three at once.

Below is a thorough breakdown of every element and the associated trade-offs:

Decentralization

This feature makes sure there isn’t a single central authority or point of failure by distributing control and decision-making authority throughout the network. Peer-to-peer transactions and fully distributed control are characteristics of a decentralized system, which allows everyone to participate and gives everyone access to the same data. Free entry for ledger writers is encouraged on permissionless blockchains, such as Bitcoin or Ethereum, which is important for competition because it keeps writers from conspiring. However, because information must be shared and processed across numerous nodes, the nature of these distributed systems, which necessitate consent from a wide variety of participants, can result in long transaction times.

Security (or Consistency)

Securing the network from malicious attacks promotes data integrity and consensus even when actors are dishonest. Blockchain security is provided by cryptography and Bitcoin’s Proof of Work. The network would rapidly detect any attempt to modify previous data since it would change a block’s digital signature, or hash. It is often more difficult for a single individual or group to control more than 50% of the network’s computational capacity (a 51% attack) when there are more members (nodes). Without security, an attacker may take over and make the chain ineffective.

Scalability

Scalability is the capacity of a blockchain to handle transactions, store information, and come to a consensus when more users join the network. It includes the network’s ability to manage an increasing number of transactions quickly and effectively. Transactions per second (TPS) are frequently used to measure it. Visa processes hundreds each second, while Bitcoin handles 7–10 TPS. Scalability is essential for blockchain networks to compete with traditional computer systems and handle real-time data for high-value use cases. Long processing times, high fees, and a poor user experience hinder adoption when a network cannot handle transaction demand.

The Trilemma’s Trade offs

The fundamental problem with the trilemma is that enhancing one of these qualities frequently necessitates sacrificing another.

- Prioritizing Decentralization and Security: Blockchains like Bitcoin are decentralized and safe with Proof-of-Work consensus mechanisms. High costs, slow confirmation times, and low transaction throughput come from their inability to scale. PoW’s computational cost is the cost of decentralization and the removal of social costs through the removal of third parties.

- Prioritizing Scalability and Security: By taking a more centralized approach (e.g., fewer validators or known, authorized entities), certain networks may favour security and scalability over decentralization.

- Prioritizing Decentralization and Scalability: There are frequently security trade-offs associated with attempts to create decentralized, massively scalable blockchains.

In contrast to blockchains, traditional computer environments frequently function centrally and do not promote decentralization. Although this enables them to accomplish high speed and cheap cost, their trust model is vulnerable to chokepoints and unauditable procedures since it depends on brand and legal contracts rather than cryptography and game theory.

Addressing the Trilemma

To solve the trilemma and strike a balance between these three attributes, extensive research and development is being conducted. Frequently, solutions can be divided into multiple categories:

- Layer-1 (On-chain) Solutions: These alter the fundamental structure of the blockchain.

- Segregated Witness (SegWit): Modifies data storage to make room for additional block transactions.

- Sharding: Divides the blockchain network into parallel data sets (shards) that handle transactions independently to boost transaction performance.

- Hard Forks: Alterations to the blockchain system that are fundamental, like making blocks bigger or creating them faster.

- Layer-2 (Off-chain) Solutions: These reduce congestion by adding more layers to the current blockchain to process transactions off-chain and settle them on the main chain on a regular basis.

- Sidechains: Separate blockchains linked to the main chain improve transaction processing.

- State Channels and Payment Channels: These enable simultaneous, cost-free, and nearly instantaneous off-chain transactions with only the final state recorded on the main blockchain.

- Modular Blockchains (Rollups): Offload transaction execution and state to zk-rollups or optimistic rollups to reduce cost, leanness, and throughput while maintaining Layer-1 blockchain security.

- Scalable Consensus Mechanisms: Investigating different consensus methods that are more scalable and efficient than Proof-of-Work.

- Proof-of-Stake (PoS): Because validators are chosen according to their stake, transactions can be processed more quickly and with less energy usage. Proof of Stake was adopted by Ethereum in order to improve scalability.

- Delegated Proof-of-Stake (DPoS): Holders of tokens choose a small group of reliable nodes to verify transactions.

- Proof-of-Authority (PoA): A consensus based on reputation in which transactions can only be authenticated by specific nodes.

- Byzantine Fault Tolerance (BFT): a method for distributed systems to come to a consensus in spite of malevolent actors.

Hybrid Solutions

To improve protocol performance and boost transaction throughput, combine several strategies, such as sharding with Layer 2 solutions. The Core DAO Network, which blends aspects of DPoS and Proof-of-Work, is one example.

Interoperability Solutions

Protocols that link blockchain networks and enable data and currency exchange boost the blockchain ecosystem.

Every solution doesn’t work for everyone, but regular advances are trying to mainstream blockchain across industries by enhancing security, decentralisation, and scalability.