What is Peercoin

Developed under a pseudonym by Scott Nadal and Sunny King, Peercoin was launched in August 2012. By November 2013, Sunny King was the only core developer because Scott Nadal had reduced his commitment. Peercoin’s technology and code are largely inspired by Bitcoin. A hybrid consensus procedure combining PoW and PoS is unique to this cryptocurrency.

Hybrid Consensus Mechanism (PoW + PoS)

Peercoin’s hybrid consensus technique, developed to address Bitcoin’s energy consumption and ensure long-term survival, is its most notable feature.

Proof-of-Work (PoW):

- Like Bitcoin, Peercoin started with PoW.

- Miners use computer power to solve complex cryptographic riddles (SHA-256 hash function) to verify transactions and create new blocks.

- In the beginning, this method was mainly employed to disperse new coins, guaranteeing a reasonable initial distribution of the cryptocurrency.

- Peercoin mining is possible on any device that can mine Bitcoin.

- Long-term energy usage is meant to be reduced by reducing the block reward as more people mine.

- PoS will eventually take over as the main form of coin creation, gradually replacing PoW as difficulty rises and block rewards fall.

- The proof-of-work block reward is cut in half for every 16 network expansions.

Proof-of-Stake (PoS):

- Proof-of-Stake was initially implemented by Peercoin.

- Users using Peercoins can “mint” new blocks in PoS. Their “coin age” and the quantity of PPC they possess determine their chances of being chosen to manufacture a block.

- A novel idea in Peercoin is Coin Age, in which unused coins accrue “coin days” (number of coins multiplied by times they have been stored). The age of coins is reset when they are used to mint a block. This encourages holding over the long run.

- Compared to PoW, this procedure uses a lot less energy because it doesn’t use as many computer resources. About market capitalization, energy consumption falls as PoS takes over as the main coin generation.

- PoS is used to protect the network; in the event of a blockchain split, the chain with the longest PoS currency age wins.

- In addition to transaction fees, minters also get a tiny portion of freshly created PPC.

- Since very few coins are regularly staked, individual stakers usually receive a 3-5% annual payout to reach the worldwide 1% annual inflation rate. This reward consists of a static half (25%) that is determined by the percentage of the current total coin supply that is created each year, and a dynamic half (75%) that is determined by the quantity of coins, their unspent age, and worldwide staking participation. A PoS block’s static reward as of December 2024 is roughly 1.4 PPC.

You can also read What Is BakerySwap Coin And How Does BakerySwap Work

Economic Model

Peercoin’s economic model differs from Bitcoin’s in several key ways:

Steady Inflation: Peercoin does not have a hard cap on the total amount of coins that can be created, unlike Bitcoin. Eventually, it is intended to achieve a 1% annual inflation rate. A combination of the PoS minting mechanism and the scaling of mining difficulty with popularity is responsible for this planned inflation. In part, this “limitless” money supply was created to deal with an expanding population. According to Sunny King, the inventor, a certain amount of inflation is required to give miners a continuous financial incentive to protect the network.

Transaction Fees: Peercoin has a protocol-defined transaction fee (currently 0.01 PPC/kb). This fee is destroyed (burned) instead of going to miners. This deflationary aspect is intended to offset inflation, self-regulate transaction volume, and prevent network spam. A challenge with this fixed fee is that it doesn’t evolve with currency value and requires a hardfork to adjust.

Key Objectives and Design Principles

Peercoin was designed with several goals in mind:

- Energy Efficiency: To significantly cut down on the amount of energy needed to secure a blockchain system.

- Security: The hybrid model, combined with features like checkpointing, aims to provide robust security against attacks, such as 51% attacks. Checkpointing was introduced in 2013 and allows users to opt out since v0.6.0 (November 2017).

- Sustainability and Long-Term Viability: Miners are continuously encouraged financially by the dynamic inflation rate.

- Decentralization: Peercoin sought to encourage a more decentralized network by authorizing coin holders to generate blocks.

- User Governance: By enabling currency holders to directly vote on protocols, the PoS method promotes user governance by determining the future course of the network.

- Fair Distribution: PoW increases decentralization by distributing new PPC freely before selling it to new stakeholders who can use it for PoS minting.

- Trustless Base Layer: Peercoin focuses on being a simple, secure, and modular base layer settlement network to ensure scalability and trustless security.

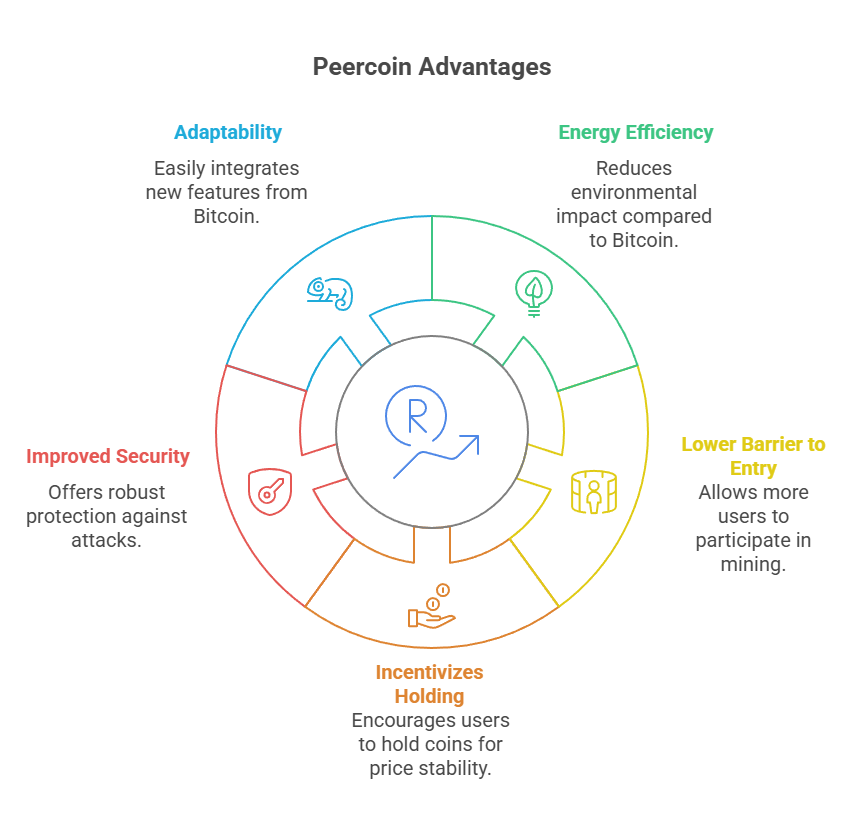

Advantages of Peercoin

- Energy Efficiency: Much lower than that of pure proof-of-work cryptocurrencies like Bitcoin.

- Lower Barrier to Entry: More users can participate in mining with PoS since it doesn’t require costly or specialized hardware.

- Incentivizes Holding: The “coin age” approach may result in more steady price action by encouraging consumers to hold their PPC.

- Improved Security: The hybrid model, combined with checkpointing, provides robust security against various attacks, including 51% attacks.

- Adaptability: Being based on the Bitcoin framework, Peercoin can easily port new features and leverage supporting infrastructure from Bitcoin’s development.

Disadvantages and Challenges

- “Nothing at Stake” Problem (Theoretical): Since validating on several competing chains in a fork costs validators nothing, this is a common critique of early PoS systems. By resetting the coin age after minting, Peercoin solves this issue.

- Potential for Centralization (Debatable): Some argue PoS can lead to centralization as users with larger holdings have a higher chance of minting blocks. However, Peercoin’s design aims to mitigate this with coin age resets.

- Less Widespread Adoption: Despite its historical significance and innovative features, Peercoin has not achieved the same level of mainstream adoption or market capitalization as Bitcoin or Ethereum. As of August 2023, its market capitalization was $10.06 million, ranking 740th on CoinMarketCap.com.

- Competition: Newer projects frequently offer more sophisticated features or aggressive marketing, because to the fierce competition in the cryptocurrency market.

- Development Pace: Although active, the community involvement and pace of development may not be as high as that of some major cryptocurrencies.

You can also read Venus Protocol in Blockchain, Key Features, and How it Works

Transactions and Addresses

- Transactions: Peercoin uses SHA-256 to manage its issuance, balances, and transactions via a peer-to-peer network. The majority of customers have the Peercoin blockchain, which is where transactions are recorded.

- Block Time: The blockchain adds a new block with a 10-minute target time.

- Confirmations: Although smaller transactions may require fewer blocks for sufficient security, a transaction is often deemed complete after six blocks, or sixty minutes.

- Addresses: Payments are made to addresses, which are strings of 34 numbers and letters that always begin with the letter ‘P’. One can create as many addresses as needed without spending any Peercoins, and it is common to use one address per purpose.

- Irreversible Transactions: Because Peercoin transactions are irreversible, they are typically not purchased using reversible transactions (such as credit cards) because of the risk of chargebacks.

Storage and Purchase

Storing Peercoin:

- Although exchange wallets are convenient, their online nature makes them more susceptible to hacking threats.

- Hardware cold wallets, which are physical devices not connected to the internet, and paper wallets, which are offline solutions for the highest level of protection, are examples of cold wallets.

- Provided by developers on the official website is the official Peercoin wallet. It can be glitchy, according to users, which is why many people save their money in exchange accounts.

Buying Peercoin:

- Peercoin can be bought and sold on Bittrex, HitBTC, Livecoin, Yobit.net, Cryptopia, MEXC Global, and Finexbox.

- PPC is usually only available with Bitcoin, therefore you must buy Bitcoin first.

- In Europe, fiat gateways like LiteBit, AnycoinDirect, or The Rock Trading might permit direct bank wire or debit card purchases. In the United States, it is customary to purchase another cryptocurrency, such as Bitcoin, using fiat money and then move it to an exchange that supports peercoins. Additionally, services such as Changelly can make it easier to purchase bitcoins using credit or debit cards.

Historical Significance

Peercoin is notable for being the first Proof of Stake blockchain. It affected Ethereum’s planned PoS security model switch (Ethereum 2.0/Serenity). The cryptocurrency reached $162 million in market value between November 2013 and January 2018 as the fourth-largest. The Peercoin community is constantly improving the platform, such as “Cold Staking,” which lets users stake coins without their wallets online.

By enabling PeerAssets, a blockchain-neutral protocol for issuing and exchanging assets like bonds and equities, Peercoin allows DAOs and DACs with shareholder voting rights and dividends. On the Peercoin blockchain, Indicium is a financially motivated token-issuance DAC that uses PeerAssets to issue assets worth cryptocurrency basket values and grants its holders Peercoin dividends and voting rights.

| Feature | Details |

|---|---|

| Launch Year | 2012 |

| Founders | Sunny King & Scott Nadal |

| Consensus | Hybrid (PoW + PoS) |

| Native Token | PPC |

| Inflation | ~1% per year (from staking) |

| Energy Usage | Very low (PoS) |

| Supply Limit | No fixed cap, but controlled inflation |

| Purpose | Sustainable, decentralized cryptocurrency |

You can also read Oracle Blockchain Chainlink Essential Data to Smart Contract