Stellar Lumens platforms

What are Stellar Lumens (XLM)?

Stellar is a blockchain network that connects banks, payment systems, and ordinary citizens for low-cost, cross-border, cross-asset financial transactions. It is one of several networks that transport and store bitcoins, mostly for businesses to provide speedier payment services globally.

Stellar Lumens are the native coin of Stellar. The network “Stellar” uses “Lumens” or “XLM” as its cryptocurrency. XLM has two important functions in the Stellar network:

- Covering transaction and account setup costs. This lessens the likelihood that malicious actors would flood the network with void transactions.

- Facilitating seamless currency exchanges. By enabling users to transfer one currency and having it received as another, this enables the network to automatically complete foreign exchange conversions, making cross-border payments effective and economical.

The main idea behind Stellar is to use Lumens to make it easier for users to move anything from conventional currencies to tokens that represent both new and existing assets (such dollars, euros, Bitcoin, stocks, or gold). The ultimate goal is to make money transfers as simple and quick as email transactions.

History

Jed McCaleb, who co-founded Mt. Gox and Ripple, started Stellar in 2014. After McCaleb quit Ripple over disagreements, he and his collaborator Joyce Kim created the Stellar system, which is a fork of the Ripple source. One of the project’s declared objectives was to process a sizable percentage of cross-border payments in particular areas. Stripe and other donations provided the first funding for Stellar, which is run by the non-profit Stellar Development Foundation (SDF).

How Stellar Works?

On the blockchain, Stellar functions as a decentralized network of servers, each of which runs autonomously. Every two to five seconds, all nodes in the network update the distributed ledger it maintains. This indicates that while every node is connected, no central source is keeping an eye on them. By syncing and coming to an agreement, transactions are permitted, distributing the ledger equitably and widely.

The Stellar Consensus system (SCP), a consensus system developed from a 2014 modification of the Ripple codebase, is a crucial differentiator for Stellar. Stellar’s SCP approves transactions without the need for proof-of-work or the full miner network, in contrast to Bitcoin. Rather, the Federated Byzantine Agreement (FBA) algorithm is employed.

- Rather than using a network-wide competition to propose blocks, this approach uses quorum slices, or a section of the network, to approve and validate transactions.

- Every node in the Stellar network selects a group of “trustworthy” nodes, and a transaction is deemed validated when it is accepted by every node in this group.

- Stellar’s network can handle thousands of network activities per second to this streamlined procedure. It takes two to five seconds to conduct a transaction.

- Stellar uses “anchors” to make it practical in the real world.

Anchors are reliable financial partners or organizations that serve as intermediaries between fiat money and cryptocurrencies. An anchor deposits funds on Stellar, creating a digital currency. This allows businesses to accept payments in multiple currencies without traditional banking infrastructure and makes cross-border payments easy. Verifiability and fraud reduction are ensured by a decentralized, open, and visible ledger for every transaction.

Benefits

Stellar Lumens provides a number of noteworthy benefits:

Minimal Transaction Fees

On the Stellar network, transactions normally cost 0.00001 XLM, which is nearly nothing. It is significantly less expensive than conventional banking systems because it is only a tiny fraction of a cent. Costs are kept low even when there is network congestion.

High Speed

Stellar handles payments in under five seconds. The network handles 1,000 TPS.

Energy-Efficient

The lightweight consensus mechanism of Stellar’s consensus protocol (FBA/SCP) consumes less energy than Bitcoin’s heavy mining. This makes it a green blockchain option.

Multi-Asset Support

Stellar supports all currencies, tokenized assets, cryptocurrencies, and stablecoins. Automated currency conversion simplifies cross-border payments.

Complete Decentralization (Theoretical)

Stellar is a fully decentralized network where anyone can be a validator node, notwithstanding centralization concerns highlighted by sceptics. SCP, its consensus system, is more decentralized than other proof-of-work blockchains and attempts to facilitate effective scaling.

Usability

The network is made to be simple to use.

Integrated Compliance solutions

Stellar’s KYC and AML solutions help financial institutions verify users and prevent fraud to meet regulatory compliance.

Smart contracts

Stellar supports simple smart contracts, allowing enterprises to automate conditional transactions, escrow services, and payments without Ethereum’s complexity. It has Soroban, a Rust-based smart contract developer platform.

Drawbacks

Despite its advantages, Stellar has many drawbacks.

Centralization Issues

Stellar blockchain is centered on the Stellar Development Foundation (SDF), which formerly held a sizable portion of the lumen tokens and continues to do so. Some investors are concerned about the implicit manipulation of a coin burn, which decentralized systems are supposed to guard against, even though the SDF destroyed 55 billion lumens in 2019 to allay worries about possible dilution of investor holdings. The SDF has considerable power over the coin and its value because it owns roughly 60% of the XLM supply.

Node Centralization and Vulnerability

The network’s reliance on a limited number of nodes, many of which are under SDF control, raises issues. Even while there are more than 50 validators at the moment, this is still a small number, making the network more susceptible to node cooperation and other processing-capability Attacks. Two of the SDF-controlled nodes unexpectedly collapsed in 2019, causing the Stellar blockchain to stall for more than an hour.

Less Popularity/Fewer Participants

The blockchain may have security vulnerabilities because it is less well-known and has fewer users than more well-known blockchains.

Limited Incentives to Hold XLM

Since Stellar does not provide crypto staking, users have little reason to hold its XLM tokens aside from the 1 XLM minimum needed for each Stellar wallet to exist.

Also Read About Bitcoin API (Application Programming Interfaces) Functions

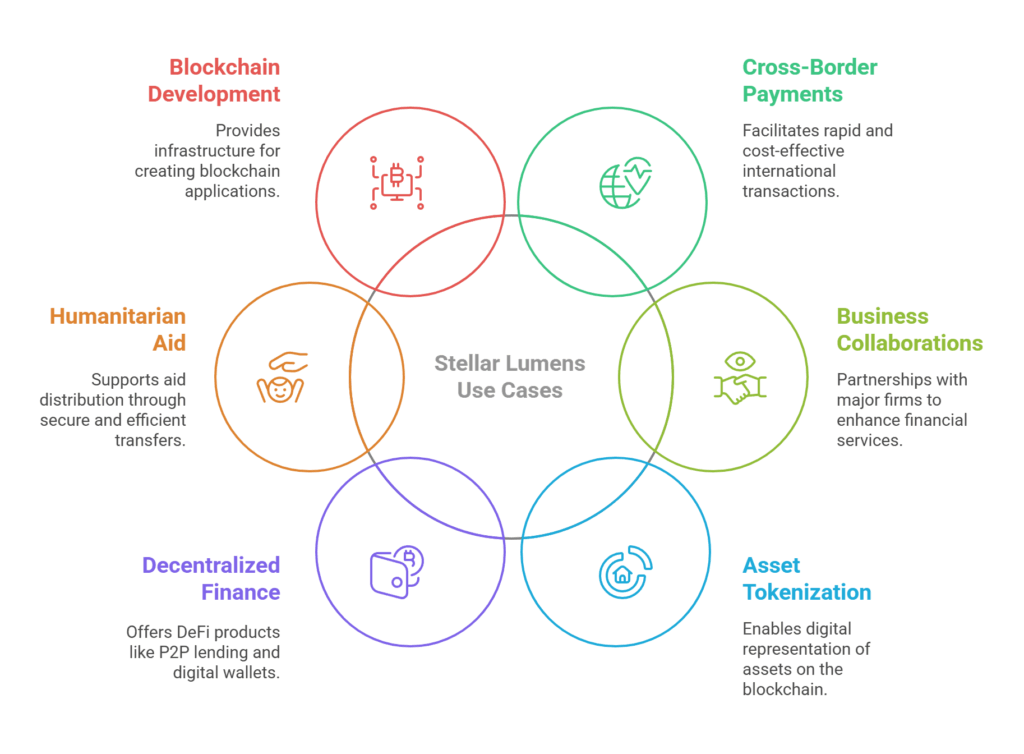

Stellar lumens use case

Global finance is being actively transformed by Stellar Lumens, which makes transactions easier, faster, and less expensive. Developing economies are its main focus, especially when it comes to remittances and bank loans to those who don’t have access to standard financial services. Both people and organisations are not charged by Stellar to use the network.

Among the main uses are:

Cross-Border Payments & Remittances

Stellar solves the costly and delayed nature of conventional international transfers by drastically reducing transaction costs and completing transactions in a matter of seconds. Stellar would process 60% of cross-border payments in Australia, Fiji, and Tonga. To facilitate cross-border payments, it partners with over 70 nations.

Collaborations and Business Adoption

- IBM chose Stellar for its World Wire global payments system in 2019 to improve cross-border payments by enabling transactions at a fraction of the time and cost of traditional banking.

- In order to integrate its network with Stellar and enable customers to convert USD Coin (USDC) to cash and vice versa with nearly instantaneous backend settlement capabilities, MoneyGram International teamed up with the Stellar Development Foundation in 2021. Cash can now be deposited and withdrawn from digital assets at MoneyGram outlets.

- PayPal USD (PYUSD) intends to leverage Stellar for new ‘PayFi’ solutions, remittances, and regular payments.

- Circle introduced USDC on Stellar, allowing for quick and inexpensive transactions.

- Other noteworthy integrations and partners include Smartlands, Stripe, Wirex, Samsung Mobile, TransferTo, Deloitte (payments app), and SureRemit.

Asset Tokenization

On Stellar, companies can produce digital representations of fiat money, real estate, and other assets. Central Bank Digital Currencies (CBDCs) on Stellar’s network are also being investigated by governments.

Decentralized Financial Services (DeFi)

Stellar offers DeFi products such as digital wallets that provide easy money storage, sending, and receiving, peer-to-peer (P2P) lending without middlemen, and microloans. With scalable decentralized finance, it is constructing the financial access of the future.

Sustainability-minded firms use Stellar to track and trade Verra-certified carbon credits to prevent fraud.

Help Distribution

Humanitarian groups like the UN’s World Food Program have used Stellar for direct payment transfers to refugees to reduce fraud and ensure help arrives fast and safely.

Building Blockchain Applications

Stellar is an open-source network, so enterprises may use and enhance its infrastructure to create blockchain wallets, applications, and cryptocurrency tokens.

NFT minting and smart contracts are among the applications that the Stellar Development Foundation has sponsored. Additionally, it provides funding for initiatives through grants such as the Stellar Community Fund (SCF), which has backed email payment wallets, voting systems, gaming/NFT marketplaces, and document signing services.

Supply and Circulation

100 billion Lumens (XLM) were distributed at launch. After a 1% annual inflation rate at first, Stellar users chose to stop these programming supply increases in late 2019. In order to solve centralization issues, the SDF destroyed 55 billion lumens in 2019, which decreased the overall supply. 50 billion lumens is currently the maximum supply. By the end of 2024, there will be about 27.3 billion coins in use. To be active, each Stellar wallet must have a minimum balance of one XLM. In order to stop network spam, a tiny fee of 0.00001 XLM (100 Stroops) is also burned with each transaction.

Value and Outlook

XLM’s usefulness in enabling affordable and effective cross-border digital asset transfers accounts for the majority of its value. Its value increased significantly in early 2021, more than five times from $0.13 to $0.73 before falling. By the end of 2024, the lumen token was worth roughly $0.53. Even if its value has changed, it still has a respectable 24-hour trading volume. XLM might hit $1 if investor sentiment and market conditions coincide. Its value by 2030 may be anywhere from $1.3 to $10.8, with an average of about $6. If acceptance continues, this could represent a gain of approximately 2,100% from current levels. Stellar may be an undervalued cryptocurrency investment due to its established links and real-world usability. Stellar payments rose 378% in 2020–2021. Like all cryptocurrencies, XLM is volatile and may fail.

Passive revenue

Although Stellar does not provide conventional cryptocurrency staking, the Ultra Stellar product does allow for the generation of passive revenue. Utilizing the Stellar network, Ultra Stellar releases yield-generating tokens like yXLM, yUSDC, yBTC, and yETH, each of which is backed one-to-one by its equivalent token. Users can receive interest payments every day by exchanging their ordinary XLM for yXLM.

Purchasing and Storage

XLM is available for purchase on a number of centralized cryptocurrency exchanges (CEXs), including eToro, Binance, Coinbase, Crypto.com, and Kraken. StellarTerm can be traded on P2P platforms or DEXs. Hardware wallets like the Ledger Nano S and X store private keys offline for optimal security. Easy access is offered by software wallets such as Lobstr, StellarTerm, and Solar Wallet. Enabling 2FA and withdrawal whitelisting is advised since, although it is feasible to store XLM on exchange wallets, doing so entails dangers owing to possible hacks. Since XLM’s whole supply is predetermined and in use, there is no mining going on.

Also Read About What Is BNB? And When Will Pi Coin Launch On Binance?