The main purpose of Binance Coin (BNB) is to trade and pay fees on the Binance cryptocurrency market. The ecosystem of the BNB Chain is likewise powered by it. This article discussed the history, launch, and definition of BNB. The creators, uses and applications, The BNB Chain Ecosystem Benefits, Drawbacks, and the Mechanism of BNB Burn, when Will Pi Coin Launch On Binance?, Future Developments (2024), An Examination of Investing Factors, and Why Binance Is Important for Pi Coin?

What is BNB?

- The native coin of the decentralized BNB Chain, BNB, enables participation in governance, covers fees, and facilitates transactions.

- It supports a variety of applications and use cases and functions as a utility token both inside and outside of the Binance ecosystem.

- On July 3, 2025, one BNB is worth $659.65 USD. In terms of relative market capitalization, it ranks fifth in terms of popularity.

Launch and History

- Eleven days prior to the Binance Exchange opening for trading, between June 26th and July 3rd, 2017, BNB was introduced through an Initial Coin Offering (ICO).

- At ICO, one ETH was worth 2,700 BNB or one bitcoin 20,000 BNB. The public sale of 100 million BNB tokens for 15 cents garnered US$15 million in Bitcoin and Ethereum.

- Before its own blockchain, the BNB Chain, BNB was an Ethereum ERC-20 token.

- 35% of the ICO funds were utilized to upgrade the Binance platform and exchange system, 50% for marketing, branding, and innovator education, and 15% as a reserve.

The founders

- Changpeng Zhao (also known as CZ) and Yi He, a co-founder, founded Binance and, later, BNB.

- CZ was a co-founder and CTO of OKCoin, created BijieTech, and was formerly employed at Bloomberg. In 2013, he started taking an active interest in cryptocurrencies and blockchain.

- Yi Before joining CZ to develop Binance, he co-founded OKCoin and began his career as a TV anchor.

- Self-correction: CZ left Binance in April 2024 after pleading guilty to money laundering. To ensure accuracy, this information should be provided since it comes from the sources.

Also Read About Transaction Scheduling & Transaction Executor In Blockchain

Applications and Uses

BNB provides a variety of features both inside and beyond the Binance ecosystem:

- Decreased Trading costs: On the Binance Exchange, users can save up to 10% on futures trading costs and up to 25% on spot and margin trading expenses.

- Payments: Binance Card and Binance Pay can be used for both in-person and online transactions. Businesses may take BNB as payment.

- BNB can be used to book hotels, flights, and other travel services on Travala.com.

- BNB, a community utility token, enables games, DApps, and Binance Launchpad token sales. It is part of the Binance Chain Ecosystem.

- Transaction Fees: It covers the costs of transactions on the BNB Beacon Chain, BNB Smart Chain, and Binance DEX (Decentralized Exchange).

- Liquidity Provision: Binance Liquid Swap allows users to supply liquidity.

- Donations: Binance Charity accepts BNB as payment.

- Investment & Loans: Using BNB, several platforms enable stock, ETF, and other asset investments. Additionally, it can be pledged as security for loans.

- Entertainment: BNB can be used to purchase lottery tickets or virtual presents, for example.

- Airdrop Access & VIP Benefits: Having BNB entitles users to token airdrops (Launchpool, HODLer Airdrops, Megadrop) and raises their Binance VIP status, which opens up special advantages.

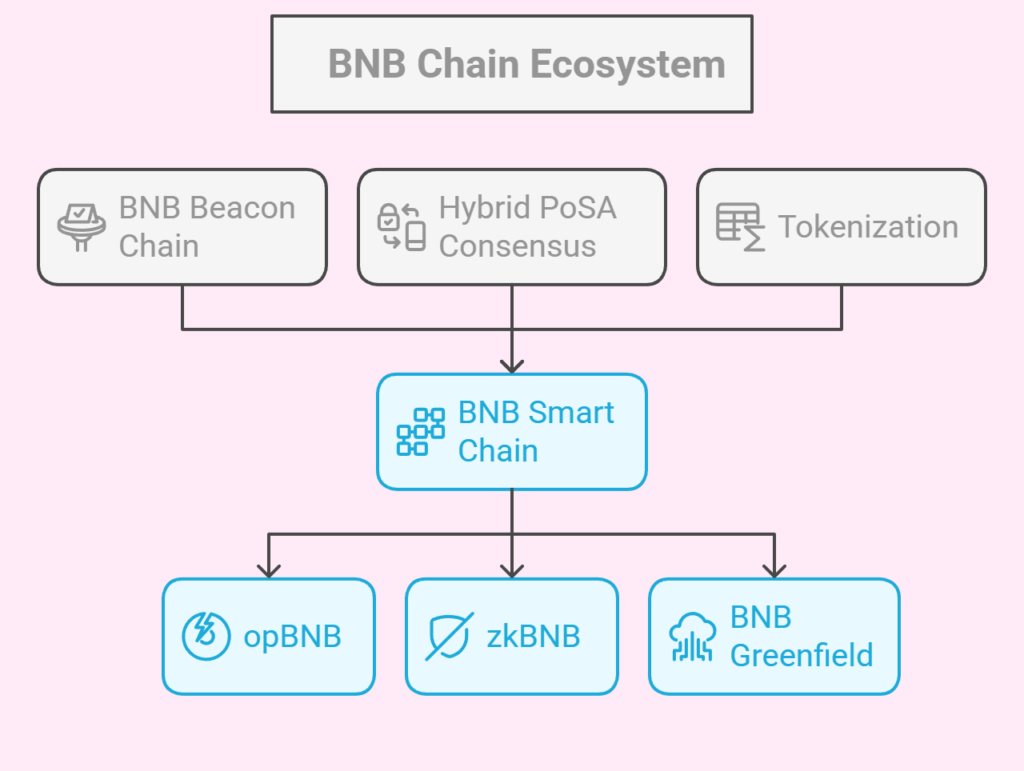

BNB Chain Ecosystem

A wide range of features are available on the Binance network, which consists of several linked blockchains:

- The BNB Beacon Chain manages voting, staking, and governance for network modifications. In June 2024, this chain will be discontinued, and its features will be transferred to the BNB Smart Chain.

- BNB Smart Chain (BSC): Manages the development and implementation of smart contracts. It will assume duties from the departing Beacon Chain. As of May 2024, BSC handled up to 3.5 million transactions a day, which is less than the high of over 32.6 million transactions per day set in December 2023. Compared to Ethereum, smart contracts on BSC are relatively less expensive to develop.

- opBNB: A Layer-2 solution based on the BNB Chain that seeks to reduce fees and increase transaction speeds (aiming for a capacity of 10,000 transactions per second).

- zkBNB: An additional Layer-2 scaling solution that uses zero-knowledge proofs to reduce fees and speed up transactions, particularly for social and gaming applications.

- BNB Greenfield: A new data economy and data ownership-focused decentralized storage solution.

- The BNB Chain employs a hybrid Proof of Stake Authority (PoSA) consensus process, which combines aspects of Proof of Authority (PoA) and Proof of Stake (PoS), to validate network transactions. Compared to networks like Ethereum, this paradigm sacrifices decentralization in favors of centralizing power among a few number of validators (who must stake at least 10,000 BNB and operate publicly). This allows for a larger transaction volume.

- Tokenization: The BNB Chain acts as Layer 1 for other crypto projects, whose native tokens are BEP-2 tokens (soon to be BSC-standard), to ensure ecosystem communication.

Mechanism of BNB Burn

- In order to raise the value of BNB and produce a deflationary impact, Binance uses a special coin-burning process to gradually decrease the total supply of BNB.

- Auto-Burn Program: To gradually deplete its whole supply to 100 million BNB, BNB employs an auto-burn mechanism. A calculation based on the total number of blocks generated on the Binance Smart Chain and the average dollar-denominated price of BNB over the course of the quarter is used to determine how many tokens are burned.

- Quarterly Burns: Binance regularly carries out “coin burns” in which a portion of BNB is burned and taken out of circulation. The objective of this initiative, which began in late 2017, was to destroy up to 100 million BNB tokens, or 50% of the original supply.

- Burns of Transaction Fees: On the BNB Chain, some of the tokens used for transaction fees are also burned.

- Binance had destroyed almost 38 million BNB tokens through 20 BNB coin burn events as of July 2022, cutting its initial 200M supply by 19.34%. As of May 2024, the most recent BNB burn occurred on April 24, burning 1.94 million BNB, or $670.78 million. This was Binance’s 27th quarterly BNB burn.

- Criticism: Since no dividends are distributed, some opponents contend that this burning process does not actually amount to an equity buyback for token holders, effectively keeping the “income per token” at $0.

Benefits and Originality

- BNB, the utility token of the largest cryptocurrency exchange by trade volume, has a solid use case and high adoption rate.

- The BNB Chain’s PoSA consensus process allows it can handle more transactions with less computational effort and validator participation, resulting in lower costs than Ethereum.

- Programmability: BSC’s usage of smart contracts makes the network extremely programmable, facilitating smooth communication between protocols and dApps.

- Beyond NFTs, tokenization can be applied to any digital asset on the BNB Chain, including real estate and the arts.

Drawbacks and Criticisms

- Centralization: The PoSA mechanism of the BNB Chain, which is associated with the private firm Binance, centralizes transaction verification among a limited number of public validators. This goes against the fundamental principles of cryptocurrency and establishes a centralized point of failure.

- Cyberattack Target: Although the BNB Chain is cryptographically safe, hackers have often attacked the Binance exchange. For instance, in 2022, $570 million was stolen due to a weakness in the Binance bridge.

How to get a coin listed on Binance

- You can use a debit or credit card to buy BNB straight from Binance.

- On the Binance Exchange, it may also be exchanged for other cryptocurrencies.

- BNB can be obtained by users through purchasing, earning, or staking (while staking as a validator is costly, users can assign their stake).

- BNB can be held in a number of methods, such as custodian services, hot wallets (connected to the internet, making quick transactions simpler), or cold wallets (disconnected from the internet, safer for rarely traders).

Also Read About Types Of Blockchain Wallets: Hot, Cold, Hardware And More

Prospective Advancements (2024)

- As part of its “One BNB” multi-chain paradigm, Binance plans to retire the Beacon Chain and move its functions to BSC.

- Their goal is to boost opBNB’s throughput to 10,000 transactions per second.

- AvengerDAO’s efforts are also helping Binance reduce hacking frauds.

A Look at Investment Considerations

- The price of cryptocurrencies is very volatile and susceptible to market risk.

- The decision to invest in BNB is influenced by personal preferences, outlook, risk tolerance, and investment objectives. A financial counsellor should be consulted.

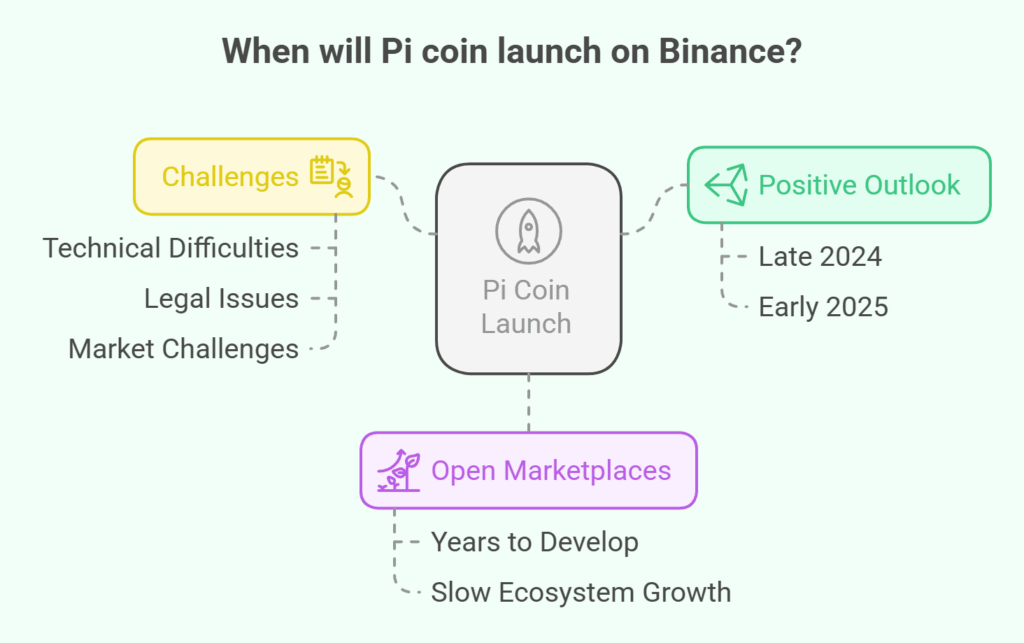

When will pi coin launch on Binance?

An official schedule for Pi Network’s move to the open mainnet and listing on any exchanges, including Binance, has not yet been disclosed. However, industry patterns suggest the following:

- Positive Outlook: Pi Coin may launch on exchanges in late 2024 or early 2025 if the team works rapidly and accomplishes targets.

- Open marketplaces may take years since developers construct the ecosystem slowly.

- Technical, legal, and market difficulties often delay crypto ventures, thus these timeframes must be approached cautiously.

Why Does Binance Matter for Pi Coin?

- Binance is a significant cryptocurrency exchange. It trades hundreds of coins daily with millions of traders. As a “seal of approval” for cryptocurrencies, Binance listings expose them to a global audience and boost crypto market liquidity.

- Pi Coin inclusion on Binance would be a milestone for the ecosystem. It will boost the project’s legitimacy and allow Pi holders to trade or invest.