Unspent Transaction Outputs (UTXOs)

Many cryptocurrencies, including Bitcoin, use Unspent Transaction Outputs (UTXOs), a basic accounting concept, to process transactions and keep track of balances. The UTXO concept functions more like actual currency than typical banking, which has a single account balance.

What is a UTXO?

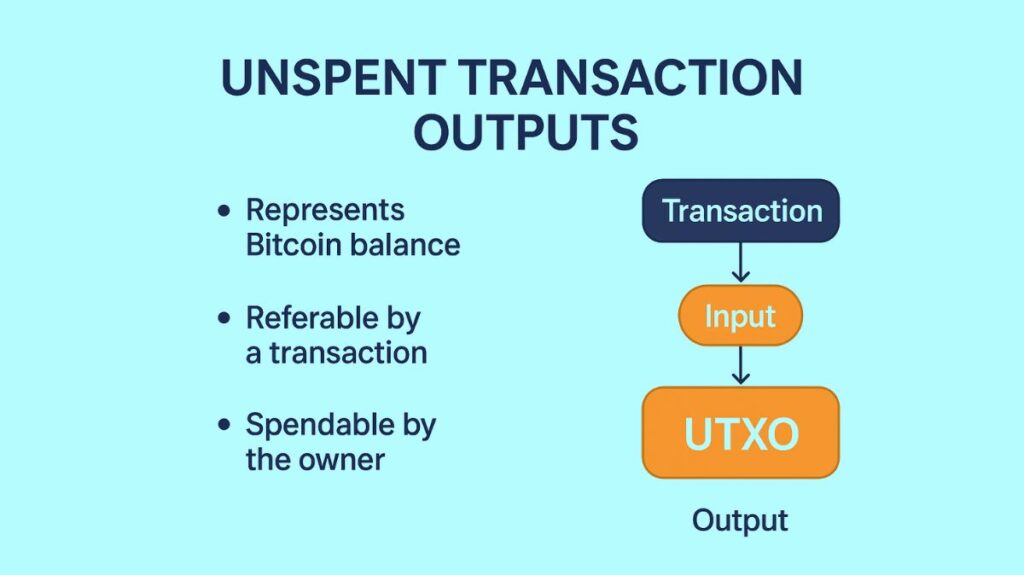

Meaning: Explicit account balances are not recorded in the UTXO paradigm. Any “coins” or digital assets you “own” instead come from past transactions where you acquired them but haven’t yet used them.

Unspent transaction outputs, or UTXOs, can be used as inputs for subsequent transactions. It stands for a certain quantity of cryptocurrency that a user has at their disposal. It’s similar to having separate bills in your wallet, each with a distinct worth.

Output of a Transaction: In UTXO, the word “output” denotes that it was produced as an output from a prior transaction. You don’t get an update to a central balance when someone transfers you Bitcoin; instead, you get a UTXO.

Unspent: You can spend this particular quantity of cryptocurrency because it hasn’t been used as an input in a new transaction yet, as shown by the “unspent” section.

Indivisible: Bitcoin units known as UTXOs are indivisible. A UTXO must be used in its entirety. The “change” is given back to you as a new UTXO if you choose to send less than the value of a UTXO. This is comparable to using a $10 bill to pay for a $5 item and getting $5 in change you can’t tear the $10 bill in two.

Wallet Balance: The amount of all your unused UTXOs is the balance in your Bitcoin wallet. For instance, UTXOs such as 0.2, 0.15, and 0.17 BTC may make up a balance of 0.52 BTC.

How are UTXOs Created and Used in Transactions?

Creation: When transactions use up current UTXOs, new ones are produced. Coinbase transactions, which miners utilize to add fresh Bitcoin to the system as payment for mining a block, start this cycle. A coinbase transaction generates initial UTXOs as outputs but has no inputs. One or more coinbase transaction outputs can ultimately be linked to each and every UTXO.

Transaction Process:

- Inputs and Outputs: An input and an output are components of every Bitcoin transaction. While outputs create new UTXOs, inputs consume existing ones.

- Wallet Selection: Your wallet software chooses one or more of your current UTXOs to cover the transaction amount plus any fees whenever you make a new transaction. The inputs for your new transaction are these chosen UTXOs.

- Spending: Using your private key, you cryptographically “unlock” these input UTXOs, demonstrating your entitlement to spend them. A UTXO is deemed “spent” if it has been utilized as an input and cannot be used again.

- New UTXOs: New outputs are then produced by the transaction. The recipient receives one output, which serves as a new UTXO for them and represents the amount they are getting. A “change” output, which also becomes a new UTXO for you, is generated and sent back to an address managed by your wallet if the total of your input UTXOs exceeded the amount sent.

- Transaction Fees: The transaction fee, which is paid to the miner, is the difference between the entire value of inputs and outputs. The number and size of the UTXOs involved affect the fee; utilizing a large number of little UTXOs raises the transaction size and expense. A billion-dollar transaction might cost the same as a $10 transaction if their data volumes are comparable, so a huge transaction amount does not always translate into a higher price.

UTXO Set

- The collection of all UTXOs on the Bitcoin blockchain at any one time is known as the UTXO set.

- In order to identify current coins and their owners and avoid double-spending, Bitcoin nodes keep track of this set.

- Every transaction adds newly created UTXOs (outputs) to this collection and subtracts spent UTXOs from it.

Why are UTXOs Important? (Benefits)

Double-Spend Prevention: The UTXO paradigm prohibits double-spending because each UTXO can only be spent once. To preserve digital currency, this is crucial.

Transparency and Auditability: Audits are simpler and more transparent because the blockchain is public and allows UTXO history monitoring.

Security: To increase security, a Private Key must be used to sign a transaction before money may be transferred. The immutability of each UTXO improves security.

Privacy: The UTXO model can improve privacy by making it more difficult to track down a user’s whole financial history by creating new “change addresses” for returned UTXOs.

Efficiency and Scalability: Since nodes only need to keep track of recent UTXOs rather than complete account histories, the UTXO paradigm enables stateless validation. Because they deal with independent units, transactions may be processed and verified more readily in parallel, which helps with scalability.

UTXO Model vs. Accounts Model

UTXO Model (e.g., Bitcoin):

- Records discrete Bitcoin units (UTXOs) rather than modifying a stored balance figure with every transaction.

- The sum of all unspent outputs is the amount in a user’s wallet.

- Less storage-intensive and typically thought to be more secure.

- Makes it possible to pinpoint the precise coin history.

- Although transactions are easier to compute, they could need more store space.

Accounts Model (e.g., Ethereum):

- A balance-based strategy akin to conventional banking.

- The system immediately modifies balances by taking money out of one account and putting money to another when a transaction takes place.

- It is impossible to audit the entire supply.

- Users run the risk of overdrawn accounts and chargebacks.

- increases the fungibility of assets since it becomes more difficult to trace the history of a particular coin once it is included in a general balance.

- Requires careful account status checking throughout transactions, which may result in mistakes.

| Feature | UTXO Model (e.g., Bitcoin) | Account Model (e.g., Ethereum) |

| Balance | Sum of all unspent transaction outputs (UTXOs) | A single balance associated with an account address |

| Transactions | Consume existing UTXOs as inputs, create new UTXOs as outputs | Directly modify account balances (deduct from sender, add to recipient) |

| Privacy | Can offer better privacy by using new addresses for change outputs, making it harder to link all transactions to one user | All transactions for a given account are linked to that single account address, potentially offering less privacy |

| Complexity | Transactions can be more complex to construct (managing inputs/outputs/change) | Simpler to understand, similar to traditional banking |

| Scalability | Can be more efficient for parallel transaction processing due to independent UTXOs | State management can become more complex as the network scales |

| Smart Contracts | Less directly suited for complex smart contract logic, though advancements like EUTXO (Extended UTXO) are changing this (e.g., Cardano) | Well-suited for complex smart contract interactions due to direct state management |

Bitcoin Dust

- The term “Bitcoin dust” describes UTXOs with a value so low that it is not cost-effective to spend them because transaction costs would be greater than the value of Bitcoin.

- The risk of generating Bitcoin dust, which renders Bitcoin practically unspendable and damages your portfolio, is increased when you accumulate an excessive number of little UTXOs, particularly from frequent minor receipts. As a general rule, a UTXO should have at least 500,000 satoshis.

UTXO Management

Purpose: The systematic managing of UTXOs to increase transaction efficiency and lower future transaction fees is known as UTXO management. It is especially important for people who actively transact or receive little sums of Bitcoin on a regular basis.

Consolidation: UTXO consolidation, which combines several small UTXOs into one larger UTXO, is a crucial management strategy. To accomplish this, send yourself a transaction that adds up all of your previous UTXOs and outputs the sum as a new, single UTXO.

Best Practices

- To reduce the cost of consolidation, combine while network prices are low.

- Make bigger withdrawals from exchanges to cut down on the quantity of little UTXOs you get.

- Certain wallets (like Trezor and Sparrow Wallet) have “coin control” features that let users manually choose and manage particular UTXOs.

Considerations

Although UTXO aggregation lowers future fees, privacy may suffer when unrelated transactions are linked together. Privacy and fee optimization must be balanced. Although there are still costs for channel transfers, the Lightning Network may be a viable substitute for on-chain UTXO administration for small transactions.

Hal Finney’s “Reusable Proofs of Work” proposal, which in turn was based on Adam Back’s Hashcash proposal, is where the idea of UTXOs initially emerged. In 2009, Bitcoin became the first widely used UTXO. Cryptocurrencies like Cardano use a more sophisticated variant called the Extended UTXO (EUTXO) model, which enables UTXOs to be connected to arbitrary data and smart contracts, increasing flexibility while maintaining security and predictability.

Summary Table

| Feature | UTXO Explanation |

|---|---|

| Definition | Unspent output from a previous transaction |

| Represents | Spendable funds |

| Spent by | Using it as an input in a new transaction |

| Balance calculation | Sum of all UTXOs owned by an address |

| Blockchain type | Used in Bitcoin, Litecoin, and similar UTXO-based blockchains |