Non-fungible tokens (NFTs)

Non-fungible tokens (NFTs), which stand for distinct and non-transferable digital goods, are a noteworthy invention in the field of digital assets. Non-fungible tokens’ definition and characteristics, market growth and history, how NFTs operate, standards and technical underpinnings, use cases, advantages and disadvantages of NFTs, and future prospects were all discussed in this blog.

Meaning of NFT

‘Non-fungible token’ is NFT. If something is unique and cannot be replaced with another of the same sort and value, it is “non-fungible”. Conversely, ‘fungible’ things like currency or Bitcoin are interchangeable and worth the same.

What NFTs Represent

Cryptographic NFTs represent objects. Photos, videos, audio recordings, artwork, comic books, sports memorabilia, trade cards, games, real estate, identities, and property rights are some of the tangible and intangible things they may represent.

Characteristics

Digital Signature/Identifier

Each NFT includes a digital signature or number to identify and verify ownership. This information makes it simple to verify ownership and move tokens between owners. NFTs’ distinct, non-transferable identification has led to comparisons to digital passports.

Indivisibility

In contrast to a dollar or other fungible tokens, NFTs are usually only offered as a single, whole unit and cannot be split into smaller quantities. Fractional ownership of NFTs has been introduced by certain platforms recently, though, enabling an NFT to be split up into smaller NFTs that can be sold to several customers.

Scarcity

One of the factors influencing the value of NFTs is their potential scarcity. Developers can limit NFTs to create scarcity.

Immutability

Blockchain-encoded NFTs are immutable. The immutability of blockchain-verified things ensures their authenticity.

Ownership and Authenticity

NFTs prove digital asset ownership and authenticity. Their unique metadata confirms their origin, ownership, and transaction history. Owners feel safer and more assured.

Extensibility

Cryptocurrency “breeding” involves combining NFTs to generate a third NFT.

Transparency

Decentralized and unchangeable public distributed ledgers allow buyers to check NFT legality by inspecting token issuance, transfers, and activity records.

Interoperability

An NFT can be bought, sold, or exchanged between Distributed Ledger Technologies utilising a central custodian service or decentralized bridge.

History and Market Growth

- Kevin McCoy and Anil Dash produced “Quantum,” the first NFT, in 2014. Early initiatives include CryptoKitties (2017), Rare Pepes (2016), and Etheria (2015). Many think CryptoKitties invented the ERC-721 standard and popularised NFTs, perhaps taking over Ethereum.

- NFTs become popular in 2020, especially in digital art. Their trade value rose from $250 million to US$17 billion in 2021. “Everydays: The First 5000 Days” made $69 million and “Merge” $91.8 million.

- From 2021 to May 2022, daily NFT sales fell 90%. A research suggested that 95% of NFT collections were worthless by September 2023.

How NFTs Work

Cryptographic assets called NFTs are stored on a blockchain. A distributed public ledger known as a blockchain keeps track of transactions in a way that makes them hard to hack or swindle.

Usually, the procedure entails

Minting

Encrypted asset data is stored on a blockchain during minting, creating NFTs. This requires constructing a new block, verifying NFT data, then closing it.

Smart Contracts

To manage NFT transfers and allocate ownership, this minting procedure frequently uses smart contracts. The terms and conditions of an agreement are encoded directly into the code of autonomous smart contracts. They establish the attributes of the NFT, including transferability and ownership.

Ownership Verification

Every token that is created is given a distinct number that is connected to a single blockchain address, allowing ownership details to be made public. Even if multiple NFTs of the same object are produced, each token has a unique identity. Blockchain’s digital signature certifies the work’s authenticity.

Value and Trading

Like tangible goods, NFTs can be purchased and sold, and their value is decided by supply and demand in the market. Because of its erratic highs and lows, the NFT market is regarded as high risk.

Standards and Technical Foundations

Ethereum, a popular smart contract blockchain, powers NFTs.

- The 2017–2018 ERC-721 non-fungible token standard is the most popular. It became popular with CryptoKitties. ERC-721 maps IDs to addresses to verify ownership.

- This improved standard, approved six months after ERC-721, lets smart contracts support fungible and non-fungible coins. This standard allows several token transfers in one transaction, lowering transaction costs and network effect.

- Non-Ethereum Standards: Although Ethereum is commonly used to create NFTs, developers have turned to alternative public DLTs like Hedera because to performance problems and growing “gas fees” (transaction prices). For example, Hedera provides more final native NFT minting and transfer at a lower cost. Ordinals are a type of NFT exclusive to Bitcoin.

Use Cases

Although digital art and collectibles accounted for a large portion of the early industry, NFTs have expanded to include a variety of uses:

Collectibles and Digital Art

This is still a popular software that lets users buy and monitor digital trading cards and original artwork like CryptoPunks and Bored Ape Yacht Club.

Gaming

NFTs are unique objects, avatars, and virtual land parcels in Decentraland, making them vital to in-game commerce.

Real-World Assets

NFTs can represent stocks, bonds, real estate, oil, and cars. Tokenising these assets can decrease fraud and increase the efficiency of trading, purchasing, and selling. High-value tangible assets, such as real estate or paintings, can also be owned fractionally.

Digital content and intellectual property

NFTs allow content producers to use their digital works, such as research papers, music, movies, drawings, and architecture, and they may be able to receive royalties from future resales.

Also Read About What Is Bitcoin Cash (BCH)? & How Does Bitcoin Cash Works?

Identification and Certification

NFTs can include distinct data for granting licenses, credentials, or identities, allowing for the traceability and authenticity check of documents such as medical records or college degrees.

Social Tokens

These tokens, which enable users to redeem interactions or make predictions about future worth, are issued by communities or individuals to symbolise ownership in the success of an organisation or an individual.

Decentralized Domains

As demonstrated by Ethereum Name Service (ENS) and Handshake, NFTs can serve as easily readable substitutes for digital wallet addresses and payment channels, representing ownership of blockchain domains.

Additional Uses

NFTs have been linked to software licensing, source code copyright transfer, exclusive club access, and internet memes (like Nyan Cat and Doge). NFTs are used in patented systems by companies such as Nike to confirm the legitimacy of their products.

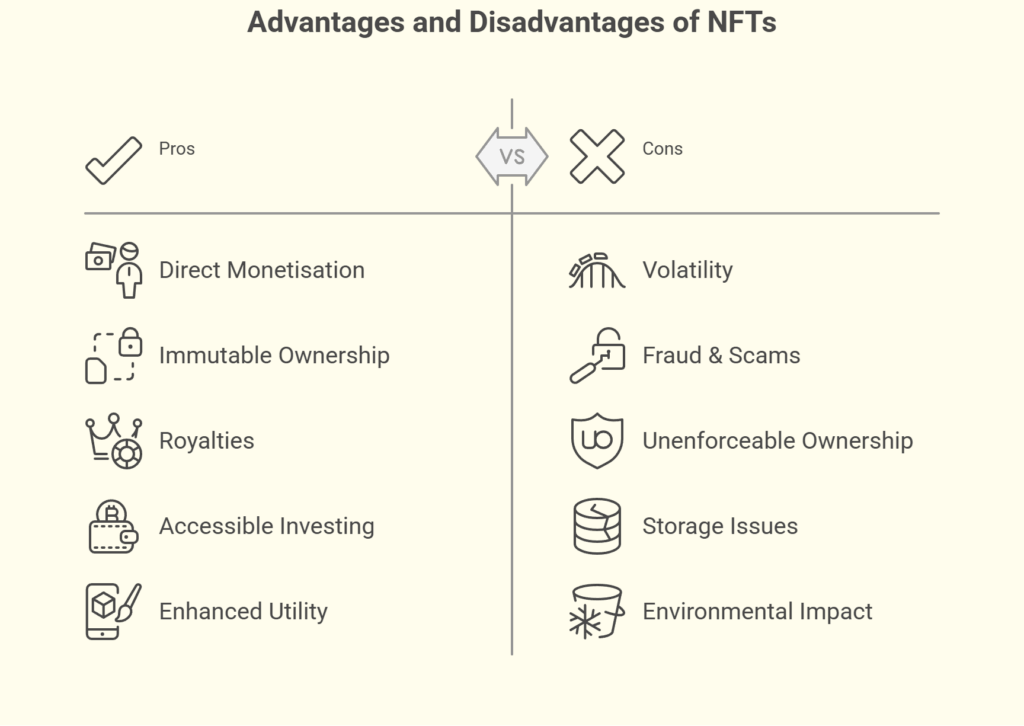

Advantages and Disadvantages of NFTs

Advantages of NFTs

- Direct Monetisation: Without the usage of galleries or auction houses, NFTs let digital artists and creators to make money off of their creations by selling them directly on internet marketplaces.

- Immutable Ownership and legitimacy: By using immutable blockchain records, NFTs offer unquestionable evidence of a digital asset’s ownership and legitimacy.

- Royalties: When artists’ work is resold on secondary markets, they can program royalties into their NFTs to guarantee a portion of future sales.

- Accessible Investing and Fractional Ownership: NFTs make it possible for several people to jointly own a digital asset through fractional ownership. This makes high-value goods more available to a wider spectrum of collectors, democratizing investment in them.

- Enhanced Utility and Interactivity: To encourage client loyalty and offer distinctive user experiences, certain NFTs provide interactive features or give access to special events, experiences, or digital material.

- Market Efficiency: By eliminating middlemen and streamlining sales procedures, tokenising tangible assets can increase market efficiency.

Also Read About Understanding Bitcoin Cash Vs Bitcoin: What’s Differences?

Disadvantages of NFTs

Volatility and Speculation

With sharp price swings, the NFT market is extremely speculative and volatile. The NFT market has drawn comparisons from critics to economic bubbles such as the tulip mania of the 17th century.

Fraud & Scams

There are several frauds that can target the NFT space:

- Phishing Scams: False NFT projects or markets are promoted via misleading links and pop-ups on social media to fool users into disclosing private information or sending money.

- Catfishing: Fake social media, marketplace websites, and celebrity impersonators promote NFT collections.

- Fake NFTs: Scammers pass off others’ work as their own, leaving purchasers unable to tell.

- Pump-and-Dump Schemes: Scammers hype an NFT before selling it, leaving investors with nothing.

- Free Mint Scams: Consumers are tricked into falling for fraudulent “mints” in which they unintentionally give over control of their private keys or their wallets.

- “Rug Pull” exit scams occur when developers exaggerate a project before abruptly selling out all of their tokens and giving up, devaluing it.

- Insider Trading: Reports of workers purchasing NFTs prior to being promoted by their employer have surfaced, underscoring the absence of oversight.

Unenforceability of Content Ownership

Copyright or intellectual property rights to the related digital material are not always conferred by owning an NFT. The “right-clicker mentality” makes it easy to copy digital work, yet because of anonymity, it might be challenging to take legal action against plagiarism.

Storage Off-Chain and Link Rot

NFTs frequently just save a web URL pointing to the digital asset, not the item itself, because of big file sizes and blockchain restrictions. This leaves the artwork open to “link rot” in the event that the hosting company shuts down or deletes the file.

Environmental Issues

Early NFTs were critiqued for their high energy usage and carbon footprint, particularly those on Ethereum that used a proof-of-work mechanism. However, Ethereum’s energy consumption was greatly decreased when it switched to proof-of-stake in 2022.

Artist and Buyer costs

For lower-value NFTs, sales platforms may impose costs that are higher than the sale price for minting, listing, and secondary sales.

Security flaws

Because some NFTs are off-chain, they have been used to steal users’ IP addresses without their knowledge, especially on platforms that support HTML files.

Money Laundering

Because transactions are anonymous, NFTs, like other blockchain securities and conventional art sales, may be used for money laundering, including “wash trading” the practice of making fraudulent sales to raise prices. To counter this, regulatory agencies are preparing actions.

The Prospects for NFTs

The idea of NFTs is viewed as a development of cryptocurrencies, allowing digital representations of assets and reimagining financial infrastructure in spite of present difficulties. The underlying non-fungible token architecture is anticipated to endure, especially for maintaining online identity and address spaces, even though the art-related “mania” may fade. The perception of their utilitarian value and their capacity to establish strong bonds with investors and collectors will determine their long-term survival. Future applications, such as safeguarding patient data and establishing digital ownership in virtual reality environments, are likewise connected to the metaverse and healthcare.