This blog post discusses Bitcoin Cash’s applications, Challenges, and comparison to Bitcoin Cash vs Bitcoin, as seen below.

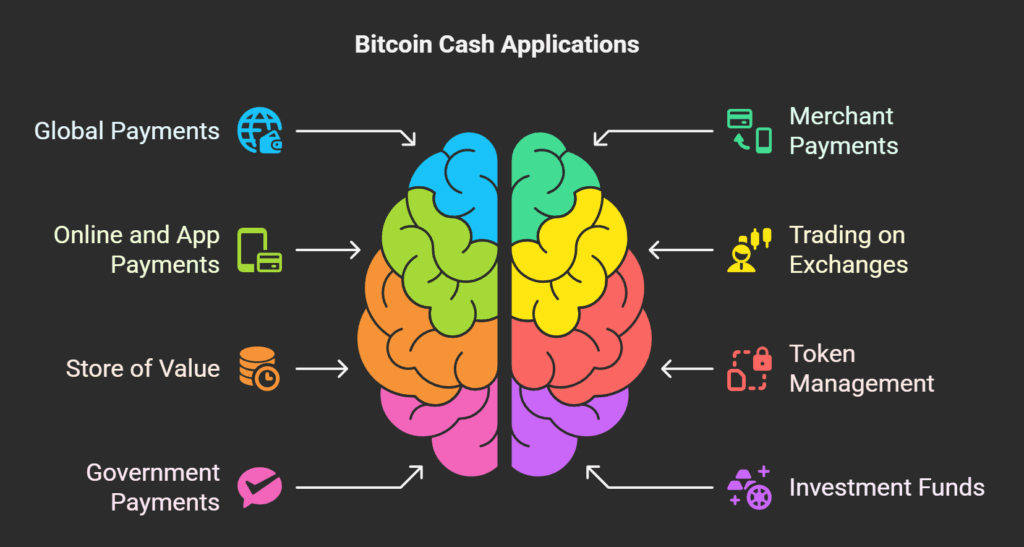

Bitcoin Cash Applications

Bitcoin Cash is designed to be used for a number of purposes, most notably as a medium of exchange:

Global Payments

It allows you to send money to anybody, anywhere, at any time, and without authorization.

Merchant Payments

Customers are increasingly choosing businesses that accept Bitcoin Cash as a form of payment. Businesses that accept Bitcoin Cash payments include BitPay, Robinhood, and Revolut. BCH is accepted as payment by the Dallas Mavericks.

Online and App Payments

Users can now purchase, sell, hold, and eventually move Bitcoin Cash to external wallets using PayPal and Venmo.

Trading on Exchanges

The BCH currency code is used to trade Bitcoin Cash on digital currency exchanges. It is listed on websites such as eToro and EDX Markets. In April 2024, Coinbase Derivatives expects to launch Bitcoin Cash futures trading.

Store of Value

In 2017, former chief Bitcoin developer Gavin Andresen praised Bitcoin Cash as “a store of value AND means of exchange,” highlighting its twofold capabilities.

Token Management

Token protocols are supported by the Bitcoin Cash blockchain and can be used to store and manage assets more transparently and securely.

Government Payments

In 2022, Colorado started taking Bitcoin Cash as payment for state taxes and fees. The legislature of New York is considering a law that would permit governmental organizations to use Bitcoin Cash and other cryptocurrencies as payment.

Investment Funds

Greyscale sought to have its Bitcoin Cash Trust (BCHG) become SEC-reporting, and Bitcoin Cash is a part of Grayscale’s Digital Large Cap (GDLC) fund.

Also Read about Benefits Of Bitcoin, Disadvantages And Characteristics

Challenges

Limited Market Dominance and Adoption in Relation to Bitcoin

- In general, Bitcoin Cash has not been able to attract the same amount of interest and participation from investors and the larger cryptocurrency community as Bitcoin. The “first-mover advantage” of Bitcoin is largely responsible for this.

- In comparison to Bitcoin, it has a smaller network, a lesser market capitalization, and a far lower amount of daily transactions. There were more than 521,000 active Bitcoin addresses as of May 12, 2024, compared to about 23,000 for Bitcoin Cash.

- In the past, Bitcoin Cash has had far fewer daily transactions than Bitcoin. As of May 2018, for instance, its daily transaction volume was roughly a tenth of that of Bitcoin. Bitcoin regularly has much more transactions per day than the Bitcoin Cash blockchain, which hardly ever averages more than 250,000.

- Bitcoin Cash does not enjoy quite the same level of popularity and volume as Bitcoin, even if its bigger block size restriction is intended to boost transaction capacity. The average block size of Bitcoin Cash for the course of its existence has been approximately 29.6KB, which is substantially smaller than the average block size of Bitcoin, which is approximately 1.6MB. This suggests that Bitcoin Cash’s higher capacity is frequently underutilized.

- Given the abundance of other cryptocurrencies available on the market, it is still debatable whether Bitcoin Cash will be able to sustain a significant value in the long run.

Also Read About How To Sell USDC On Blockchain And USD Coin Explained

Risks to Security and Liquidity

- Bitcoin Cash is seen as less secure and maybe more vulnerable to assaults because of its smaller network in comparison to Bitcoin and some other cryptocurrencies. Smaller blockchains are prone to this problem until attackers find them to be unprofitable targets.

- Because of the liquidity risk associated with its smaller trading volume, it may be more challenging to add or exit positions rapidly without having a major effect on the price. As an example, OKEx eliminated a number of Bitcoin Cash trading pairs in March 2018 because of “inadequate liquidity”.

Price volatility and internal divisions

- Controversial hard forks have occurred in Bitcoin Cash itself, revealing internal conflicts akin to those that gave rise to it. It divided into Bitcoin Satoshi Vision (BSV) and Bitcoin Cash (BCH) in November 2018. In November 2020, there was another contentious hard split that resulted in the development of BCHA (now called “eCash” or “XEC”) from the Bitcoin ABC node implementation.

- Bitcoin Cash’s value fluctuated greatly in the first week of trading, exhibiting substantial price volatility from the start. From an intraday peak in December 2017 to August 2018, its price fell by 88%.

- Because of its Emergency Difficulty Adjustment (EDA) algorithm, Bitcoin Cash experienced mining difficulty instability early on, occasionally causing the network to be thousands of blocks ahead of Bitcoin. In order to guarantee stability, a new Difficulty Adjustment Algorithm (DAA) had to be put into place in November 2017.

- Although it was repaired, a weakness in the Bitcoin ABC software was discovered in 2018 that would have enabled an attacker to produce a block that would have caused a chain split.

- The U.S. Securities and Exchange Commission (SEC) does not have authority over Bitcoin Cash since it does not “appear to trigger the Howey Test,” who have stated that it should be under commodities supervision.

Also Read About How To Create Crypto Token(No Coding Required) Simple Guide

Bitcoin Cash vs Bitcoin

| Feature | Bitcoin (BTC) | Bitcoin Cash (BCH) |

|---|---|---|

| Launch Year | 2009 | 2017 (via hard fork from Bitcoin) |

| Purpose | Digital gold, store of value | Peer-to-peer digital cash |

| Block Size | 1 MB (can go up to 4 MB with SegWit) | 32 MB |

| Transaction Speed | Slower (approx. 3–7 TPS) | Faster (approx. 100+ TPS) |

| Transaction Fees | Higher (especially during congestion) | Lower and more stable |

| SegWit Support | Yes | No |

| Smart Contract Support | Limited (via Layer 2 or scripting) | Limited |

| Security | Very high (more miners and hash power) | High, but lower than BTC |

| Adoption & Recognition | Most recognized and widely accepted cryptocurrency | Less adopted, fewer merchants |

| Ticker Symbol | BTC | BCH |

| Community Focus | Store of value, long-term holding | Fast, cheap everyday transactions |

| Development Teams | Bitcoin Core | Multiple (e.g., Bitcoin ABC, Bitcoin Unlimited) |

Also Read About BNB Smart Chain Blockchain History, Use cases, Pros & Cons

In conclusion, a fundamental dispute within the Bitcoin community gave rise to Bitcoin Cash, which opposed Bitcoin’s development into a “store of value” and instead prioritized on-chain scalability through bigger block sizes to function as a workable electronic cash system. Compared to Bitcoin, it has difficulties in gaining traction and maintaining network security, despite its notable benefits in transaction speed and cost.