What is a Meme coin?

Often influenced by online memes or other well-known cultural phenomena, meme coins are a kind of cryptocurrency that blends pop culture with digital assets. Their charming nature and hilarious society distinguish them. Bitcoin and Ethereum are powered by blockchain networks or technology, whereas meme coins are mostly valued by social media and virality.

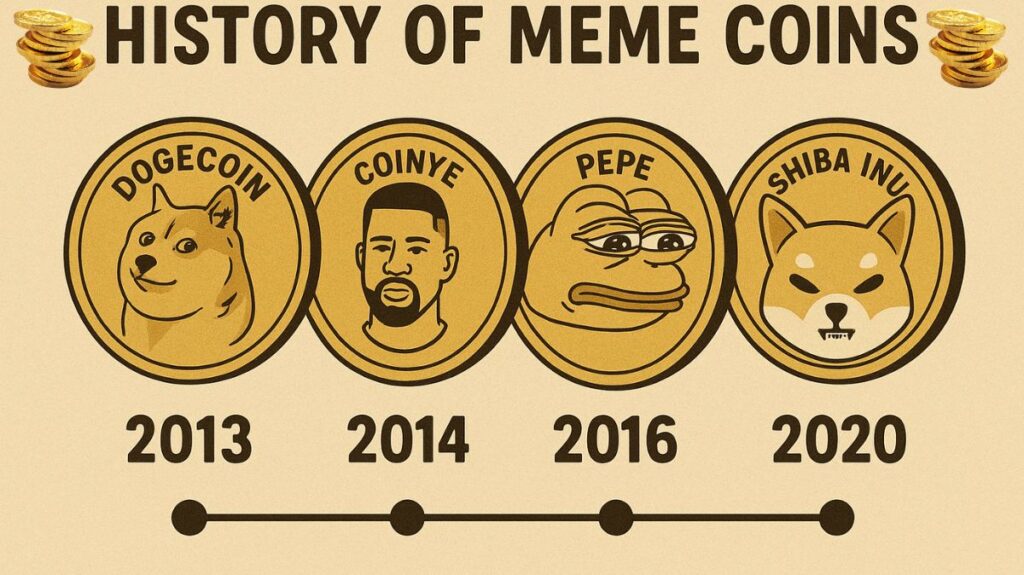

History of Meme Coins

Though brief, meme coins have had a significant impact:

- 2013 saw the creation of Dogecoin (DOGE), the first meme coin, as a prank to mock the excitement surrounding Bitcoin. It gained popularity quickly to its Shiba Inu mascot.

- 2014: Using “COINYE” cryptocurrency.

- 2016: Using cryptocurrency in this period “PEPE”.

- 2020: Using the Ethereum network, Shiba Inu (SHIB) made its debut as a “Dogecoin killer,” amassing a sizable social media following.

- 2021 New meme coins grew as excitement increased, but the late 2021 cryptocurrency bear market plummeted. Musk’s sponsorship boosted Dogecoin’s 2021 and 2022 popularity.

- Pepe (PEPE) debuted in 2023 as Bitcoin’s value rose and social media and community development gained prominence.

- Recent Developments: In the wake of political events, meme coins have been popular again, with celebrities like Doland Tremp and Jeo Boden taking advantage of election-related frenzy. There have even been cases where national meme coins have crashed, like $CAR, which was introduced by the president of the Central African Republic.

How Meme Coins Work?

Meme coins, like other cryptocurrencies, employ blockchain for secure, decentralized transactions. Meme coins can be bought, held, or exchanged on cryptocurrency exchanges; supply and demand determine their worth. Many meme coins leverage Ethereum smart contracts for staking and community prizes. Dogecoin runs on a separate blockchain, although Solana and Ethereum use pre-existing ones.

Origin and Purpose

The strong meme culture on the internet and the quick development of cryptocurrencies are the direct causes of meme coins. They started off as entertaining initiatives intended to draw attention and build a community by leveraging the virality of online memes. Their creation was also motivated by the goal of lowering the barrier to entry into the cryptocurrency market so that more people may take part and possibly profit from market gains without requiring a thorough understanding of the technology. Despite their unusual beginnings, meme coins have demonstrated the ability to reach substantial market capitalization, even though some of them began as jokes.

Also Read About Benefits Of Bitcoin, Disadvantages And Characteristics

Characteristics of Meme Coins

Meme coins are unique in cryptocurrencies for various reasons:

Cultural occurrences and Humour

Crypto depicts cyber culture’s fun and playfulness through viral occurrences and memes.

Community and Belonging

Meme coins create lively, often funny communities that unite investors and followers and develop a shared identity.

Speculation and Investment

Though hilarious, some meme currencies are attractive investments with great speculative potential. Rapid popularity increase can produce big but erratic gains.

Marketing and Prominence

Elon Musk and other celebrities might invest or reference meme coins to promote popularity and value.

Educational and Experimental Uses

They can provide as testing grounds for new technologies or governance models, providing a fun setting for their development. They can also provide low-stakes education on blockchain and cryptocurrencies.

Absence of Utility or Intrinsic Value

A lot of meme currencies are made with no particular purpose other than being convertible and marketable. They do not produce a dividend or transfer rights to future revenue, earnings, or business assets, and they are not connected to any specific use. Traditional assets, on the other hand, get their value from an underlying business.

High Volatility

Their value growth is highly susceptible to swings, which are largely impacted by prevailing opinion in the cryptocurrency community or social media trends.

Easy to Create

Even for people without coding skills, the process of creating meme coins is automated by numerous websites, lowering the entry barrier.

Typically, Short Lifespan

Most meme coins lose popularity fast, but some last for years.

Prone to Copycats

Popular meme coins often inspire copycats, which sometimes parody them.

Notable Meme Coin Examples

Among the most popular meme coins are:

- The original, Dogecoin (DOGE), is well-known for its community and Elon Musk’s backing.

- Known as the “Dogecoin killer,” Shiba Inu (SHIB) is an Ethereum-based platform that prioritizes community and decentralized financial services.

- Based on the “Pepe the Frog” meme, Pepe (PEPE) was revived in 2023 and quickly became well-known.

- The more recent meme coin, Bonk (BONK), was added to the Solana blockchain in 2022 and provides NFTs as a means of usefulness.

- Elon Musk’s dog inspired the name FLOKI (FLOKI), which aims for a wide range of uses beyond a straightforward meme coin, such as NFT games and an educational ecosystem.

- The primary token of Memeland, Memecoin (MEME), provides useful applications for buying, cultivating, and staking NFTs inside its ecosystem.

- Some of the more recent meme currencies are Smog ($SMOG), Sponge V2 ($SPONGEV2), Dogwifhat (WIF), Turbo ($TURBO), and Dogecoin20 ($DOGE20).

- Trump, Doland Tremp, and Jeo Boden are examples of political meme coins. Fartcoin, PNUT, HAWK, Melania, CAR, and LIBRA are a few more examples.

Also Read About Understanding Cryptography Mechanisms In The Blockchain

Benefits and Drawbacks of Meme Coins

Benefits

- Possibility of immediate financial gain: Some meme coins have quickly attained extremely large market capitalizations as a result of their virality and robust community development.

- Reduced barrier to entry: They may make bitcoin investing easy for beginners.

- They enable community engagement by connecting like-minded enthusiasts.

Drawbacks

- Meme coin prices fluctuate greatly due to mood and social media trends, making them dangerous and speculative. Past performance does not guarantee future results.

- Lack of inherent value: Hype rather than utility determines their value, hence their price may drop to zero.

- Scams and Fraud: Rug pulls, in which founders disappear with investors’ money, and pump-and-dump scams, in which influencers boost prices before selling their shares, leave latecomers with losses, make the market vulnerable.

- Security Risks: Many meme currencies are developed quickly, sometimes by non-technical persons, so smart contracts and security may be flawed.

- Due to their speculative nature, meme coins may be subject to tight laws as the legal landscape for digital assets develops frequently. As “akin to collectibles” as opposed to securities, meme coins usually don’t produce returns or transfer ownership of company assets, according to the U.S. SEC. Nonetheless, prosecution is still possible for fraud pertaining to their offering and sale.

- Low Liquidity: It may be challenging to trade less well-known meme currencies due to their low liquidity.

- Overhyping: Market manipulation and exaggerated claims are frequent.

Also Read About ByzCoin: Scalable & Consistent Blockchain Consensus Protocol

Conclusion and Investment Advice

Meme coins have introduced a varied and frequently amusing substitute for conventional digital assets. Be careful with them. Approach cautiously. Think about risks and rewards before buying. Experts warn against using them as your main bitcoin holdings. Research, risk assessment, and investing just what you can afford to lose are crucial. They’re nice to use but more like collectibles than cryptocurrency investments.