All of the following subjects are covered in this Crypto Token: what it is, its history, its types, and how to create crypto token(with no-code or low-code options).

What is Crypto Token?

Blockchain-tokenized assets or interests are crypto tokens. Different from Bitcoin and Ethereum, crypto tokens are developed on blockchain platforms like Ethereum, Binance Smart Chain, Polkadot, Solana, or Harmony One. They use these blockchains’ design and security.

Also Read About What Are The Different Types Of Tokens In Blockchain?

Crypto Token History

Building on the framework established by Bitcoin in 2009, the idea of cryptocurrency tokens first surfaced in the early 2010s.

Mastercoin (2012)

Launched by J.R. Willet in 2012, Mastercoin was the first acknowledged Initial Coin Offering (ICO) and token. It connected its value to Bitcoin and was the first to use layers to improve cryptocurrency functioning.

Ethereum and Smart Contracts (2015)

2015 Programmers built DApps on Ethereum’s blockchain using smart contracts. Digital tokens’ real breakthrough occurred in 2017, when their values, media coverage, and popularity soared. ICOs, in which companies sold investors their own currencies and tokens, soared during this time.

ICO Boom (2017)

As investors realized the potential value increase of tokens, token offerings “skyrocketed” in 2017. Bypassing conventional fundraising and selling their unique tokens to investors directly, startups raised money through initial coin offerings (ICOs). ICOs from this era that are noteworthy include Filecoin, Tezos, and EOS.

ICO Bubble Burst (2018)

2018 saw the implosion of the initial coin offering (ICO) bubble, which gave rise to initial exchange offers (IEOs), in which exchanges enabled token launches and professed to screen projects. Warnings concerning the dangers of ICOs and IEOs because of scams were made by regulatory bodies. Even with increased regulatory attention, cryptocurrency tokens are still developed and utilized for ICO funding today.

How Crypto Tokens Work

Cryptocurrency tokens use distributed ledger technology and are protected on blockchain networks by encryption methods.

Creation (Minting)

A smart contract that specifies the token’s standard, total quantity, and functionality is executed to produce tokens. Solidity is the programming language used for smart contracts, which Ethereum popularized.

Distribution

After being created, tokens may be given out as network rewards, ICOs, or airdrops.

Storage

Cryptocurrency wallets are where tokens are stored. These could be hardware wallets, which are actual devices made especially for storing cryptocurrency, or software wallets, which run on PCs or mobile devices.

Transactions

A user must start a transaction from their wallet in order to transmit tokens. After that, the network receives this transaction for validation. Token exchanges mostly employ smart contracts, as opposed to Bitcoin, which uses public and private keys.

Validation

Network nodes PCs running blockchain software authorize transactions. They verify if the sender has enough balance and the transaction is legal under network rules.

Consensus

The transaction is included to a block after it has been verified. The block is added to the blockchain after the network has reached a consensus regarding its authenticity using a consensus technique (such as Proof of Work or Proof of Stake). Transactions become public and unchangeable as a result.

Interaction with Smart Contracts

The majority of tokens, especially those on Ethereum, have the ability to communicate with smart contracts, automating processes like lending, voting, and selling. Token regulations, including issuance, transfer, and other features, are defined by smart contracts. They provide safe ownership transfers without the involvement of third parties, allow for self-automated and transparent token production and distribution, control yield distribution in DeFi, and offer token holders decentralized governance.

Types of Crypto Tokens

Crypto tokens come in a variety of forms, each with a specific function in blockchain ecosystems:

Utility Tokens

In a decentralized application (DApp), utility tokens grant access to a particular good or service. Filecoin, Civic, and the Basic Attention Token (BAT) for Brave browser users are a few examples. Game environments can produce in-game products with fungible value to ENJ tokens. An Ethereum-based Oracle network is powered by Chainlink (LINK), which gives smart contracts access to external data.

Security Tokens

The ownership of an underlying asset, like as stock in a business, bonds, or tangible assets like real estate or artwork, is represented by security tokens. These tokens often follow securities rules and give investors rights and payouts.

Stablecoins

Stablecoins relate their price to fiat money (like the USD) or commodities (like gold) to combat cryptocurrency volatility. Examples include Binance USD, USD Coin, and Tether.

Governance Tokens

Give holders the ability to vote and make decisions for a project or decentralized autonomous organisation (DAO). They give token owners the ability to suggest and vote on modifications to the project’s governance framework or protocol. MKR in the MakerDAO project serves as an illustration.

Non-Fungible Tokens (NFTs)

A unique digital object, like digital art, collectibles, or goods in an online game, can be represented by Non-Fungible Tokens (NFTs). Since each NFT has unique features, they cannot be used interchangeably. They enable fractional ownership of tangible goods, actual ownership of in-game assets, and the use of smart contracts to ensure royalties to artists.

Mirrored Assets

Mirrored assets are tradable, artificially created replicas of assets (like equities) that use blockchain oracles to track and replicate the price of their primary assets.

Wrapped Tokens

Wrapped Tokens: Mostly used to transfer cryptocurrency between blockchain networks, these tokens have a price that is 1:1 correlated with another digital currency. One example is Wrapped Bitcoin (WBTC).

Payment tokens

Sometimes referred to as coins, are primarily used as a medium of trade. Bitcoin and the majority of cryptocurrencies are payment tokens.

DeFi Tokens

Cryptographic tokens that employ smart contracts and blockchain technology to build new financial institutions (loan, saving, and trading).

Crypto Rewards

Usually offered to investors who lend out their cryptocurrency funds on DeFi platforms, these rewards are profits or incentives provided in the form of cryptocurrency tokens.

Meme Coins

Jokes-based tokens, like Ethereum-based Dogecoin, that gain value mostly via popularity and speculative trade. Another example is the Shiba Inu.

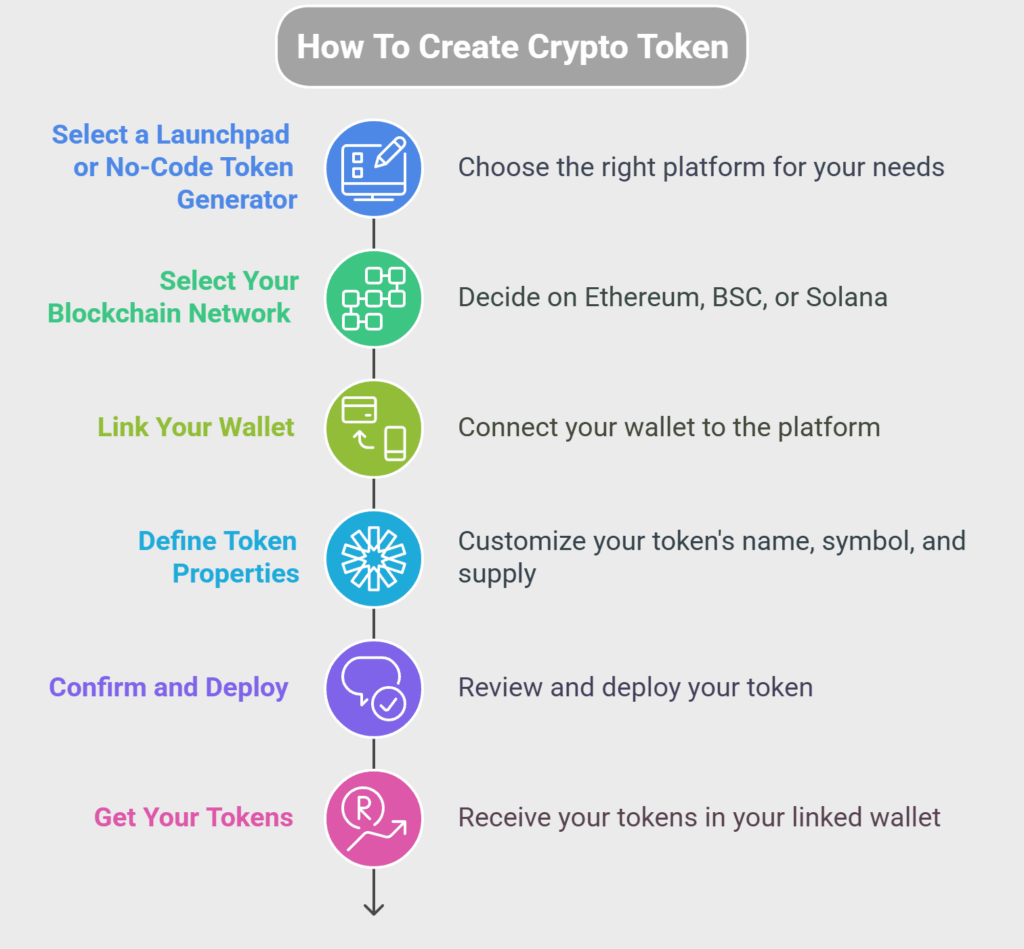

How to Create Crypto Token (No-Code/Low-Code Options)

The simplest method for creating a token for novices or people without coding skills is to use “token generators” or “crypto launchpads”:

Select a Launchpad or No-Code Token Generator:

- TokenTool by Bitbond, TokenMint, CoinTool, and more platforms provide easy-to-use interfaces that let you generate tokens by just completing a form.

- Certain launchpads, such as PancakeSwap SpringBoard (for BNB Chain) or Smithii (for Solana), are designed for particular blockchains and provide expedited procedures.

- Pre-audited smart contract templates are frequently offered by these tools, which lowers the possibility of mistakes and security flaws.

Select Your Blockchain Network:

The site will ask you to launch your coin on Ethereum, Binance Smart Chain, or Solana. Consider ecosystem support, speed, and transaction fees.

Link Your Wallet:

The program requires a suitable cryptocurrency wallet like MetaMask. For network and service expenses, fill your wallet with native cryptocurrency of the chosen blockchain (ETH for Ethereum, BNB for BSC, and SOL for Solana).

Define Token Properties:

- You can personalize your token here:

- The complete name of your token (such as “My Awesome Token”) is its token name.

- A brief, distinctive symbol (such as “MAT”) is called a ticker symbol.

- Total Supply: The most tokens that will ever be produced. Additionally, you can choose whether some can be burned or whether more can be minted later.

- Decimals: Your token’s degree of divisibility (most tokens have 18 decimal places, like 1 ETH).

- Optional Features: You may add features like burn functions, holder rewards (reflections), and transaction taxes/fees to a lot of platforms.

Also Read About Advanced Web3 eth Contract Programming & Best Practices

Confirm and Deploy:

- Go over all of the information you entered.

- Verify the purchase and settle any related costs (gas fees).

- After that, the platform will create and post your token’s smart contract on the selected blockchain.

Get Your Tokens:

The tokens are usually moved to the creator/owner’s address (your linked wallet) when they are deployed.

Beyond Creation (Important Considerations)

The token’s creation is only the beginning. You should also think about the following for a successful project:

- Use Case and Purpose: What issue is resolved by your token? What benefits do users receive from it? A well-defined goal is essential.

- Tokenomics Design: Organise the distribution of your token, the preservation of its value, and the incentives available to holders.

- Testing (on Testnet): To make sure everything functions as planned without jeopardising actual funds, it is strongly advised to test your token on a testnet, which is a duplicate of the blockchain used for testing, prior to deploying to the mainnet (live blockchain). This option is available from several token producers.

- Security Audits: Although audited templates are used by token generators, it is essential to hire a third party to conduct a smart contract audit in order to find and address any vulnerabilities for specific features or larger projects.

- Community Development & Marketing: To get your token adopted, build a community and promote its use case.

- Legal and regulatory compliance: Know your local cryptocurrency token laws. Legal professionals should be consulted because this is tricky.

- Listing on Exchanges: To facilitate trade, list your token on DEXs and maybe CEXs.

Making a crypto token has gotten much easier for people without a lot of programming experience to no-code token generation services. But keep in mind that developing a successful crypto enterprise involves more than simply technological innovation.