Multi sig meaning

Multi-signature, also known as “multi-sig,” is a cryptographic technique used in blockchain that necessitates the usage of numerous distinct keys from a collection of entities in order to authorize a transaction or sign a single message. An alternative term for it is “multiparty signatures”. This idea improves security by needing numerous signatures to authorize a transaction, much like a safe deposit box that requires several keys to access, each of which is kept by a separate individual.

Prior to its use in cryptocurrencies, multi-sig has been employed for decades in conventional legal and financial institutions, such as requiring several signatures for company checks or wire transactions. Following incidents like the FBI’s Silk Road collapse, which brought attention to the necessity for improved security against theft and confiscation of digital assets, its popularity in the cryptocurrency space grew.

How Multi-Signature Works (M-of-N Concept)

“M-of-N” is the most widely used term to characterise a multi-sig configuration, where:

- A multi-sig wallet or address has a total of N private keys configured for it.

- M is the bare minimum of private keys (signatures) needed to authorize a transaction.

For example:

- A “2-of-3 multi-signature contract” requires the signatures of any two of the three specified addresses in order for the transaction to be completed. This arrangement is frequently advised since it enables a mediator to mediate conflicts or in the event that a key is misplaced.

- A “3-of-5 multi-sig” means that at least three of the five private keys are required to authorise a transaction.

- To approve a transaction, a “2-of-2 multi-sig” needs both private keys (out of two total). For extra protection, a single person holding both keys on separate devices can also employ this setup.

Step-by-Step Process

- Wallet Creation/Setup: The blockchain, which “knows” the entire number of keys (N) and the necessary signatures (M), generates a distinct multi-sig address. The public keys of all N participants are linked to this multi-sig address, and each participant creates their own private and public key pair.

- Starting a Transaction: A transaction (such as transmitting cryptocurrency) can be started by any participant who has one of the N keys. The deal goes into “pending” status.

- Gathering Signatures: Using their unique private keys, the necessary number of participants (M) must sign the started transaction. After reviewing the transaction information, if each signer agrees, they digitally sign it.

- Transaction Execution: A transaction is deemed completely authorised after it has gathered the bare minimum of M signatures. After the transaction is finished and has all required signatures, it is sent to the blockchain network for processing. These signatures are combined into a single signature by the blockchain.

By integrating many signatures into a single one, certain cryptographic techniques, such as the Schnorr algorithm and BLS multisignature, might help disguise some data and lower the overall transaction size, potentially increasing efficiency.

Advantages of Multi Signatures

Improved Security

- Eliminates Single Point of Failure: By needing numerous approvals, multi-sig considerably lowers the danger of a single private key being lost or compromised, which is a problem with single-key wallets. To take control of the money, an attacker would have to compromise several private keys.

- Protection Against Loss: As long as the other accessible keys satisfy the “M” criterion, the money are not always lost in the event that one key is misplaced or rendered inaccessible.

- Minimises Cyber-attack Vulnerabilities: Multi-sig reduces potential sources of vulnerability by dispersing private keys among several devices or places.

Accountability & Control Sharing

- Joint Accounts: When several parties need to agree before taking any action, multi-sig is very helpful for managing joint assets or funds for families, corporations, organisations, or partners. This stops anyone from transferring money on their own.

- Corporate control requires that financial choices and expenditures be approved by a number of managers or executives.

- Multi-sig plays a crucial role in DAO governance frameworks, guaranteeing democratic and transparent fund management and safeguarding community funds from unscrupulous individuals.

Enhanced Transparency and Trust

Investor trust can be raised by making the code for multi-signature wallets publicly available, as is the case with initial coin offerings (ICOs). The blockchain’s clear record of who authorised each transaction promotes organisational openness and deters illegal activities.

Fraud Prevention

Since an insider or external attacker would have to conspire with or compromise numerous people, it would be far more difficult for them to conduct fraud.

Escrow Services

Escrow services can be provided using a 2-of-3 multi-sig, in which the buyer, seller, and an impartial third party (arbitrator) each possess one key. This ensures that money is only released upon agreement or the settlement of a dispute.

Customisable Policies

Depending on their risk tolerance and security requirements, users can select an M-of-N configuration.

Estate Planning and Inheritance

People can make sure their digital assets are safely transferred in the event of an emergency by allocating keys to executors or trustworthy family members.

Two-Factor Authentication (2FA)

Multi-sig wallets work similarly to two-factor authentication (2FA) systems in that they need several confirmations for transactions and access.

Alos Read About What Are The Blockchain Transaction Steps And Types?

Limitations and Considerations

Although multi-signature has many benefits, there are some disadvantages as well:

- Complexity: Multi-sig wallet setup and management can be more complicated than single-key wallets, particularly for novice users, and call for technical knowledge.

- Coordination: In order to approve a transaction, all signers must work together, which occasionally takes longer than a transaction with only one signature. The transaction may be delayed or blocked if one or more participants are unwilling or unavailable.

- Lost Keys: Although it guards against a single lost key, the funds may become permanently inaccessible if too many keys more than N-M are lost. Because it can be necessary to import several recovery phrases from different devices, the recovery procedure can be time-consuming and complex.

- Transaction Fees and Speed: Several signatures may cause transactions to take longer. Every signature adds information to the transaction, making it larger and perhaps resulting in greater “gas” or network fees.

- Smart Contract Vulnerabilities: A lot of multi-sig wallets are implemented as smart contracts, which, if not developed properly, can bring a number of possible vulnerabilities of their own (in some Parity multi-signature wallets, for example).

- Absence of Legal Custodian: In the event of an emergency, it may be challenging to obtain legal assistance because multi-sig wallets lack a legal custodian for funds in shared wallets.

- False Collusion: Recovering money could be extremely challenging if all of the signers agree to carry out a false transaction.

- Compatibility: Not all blockchain platforms or cryptocurrencies allow for multi-signature capabilities, which could restrict their applicability in some situations.

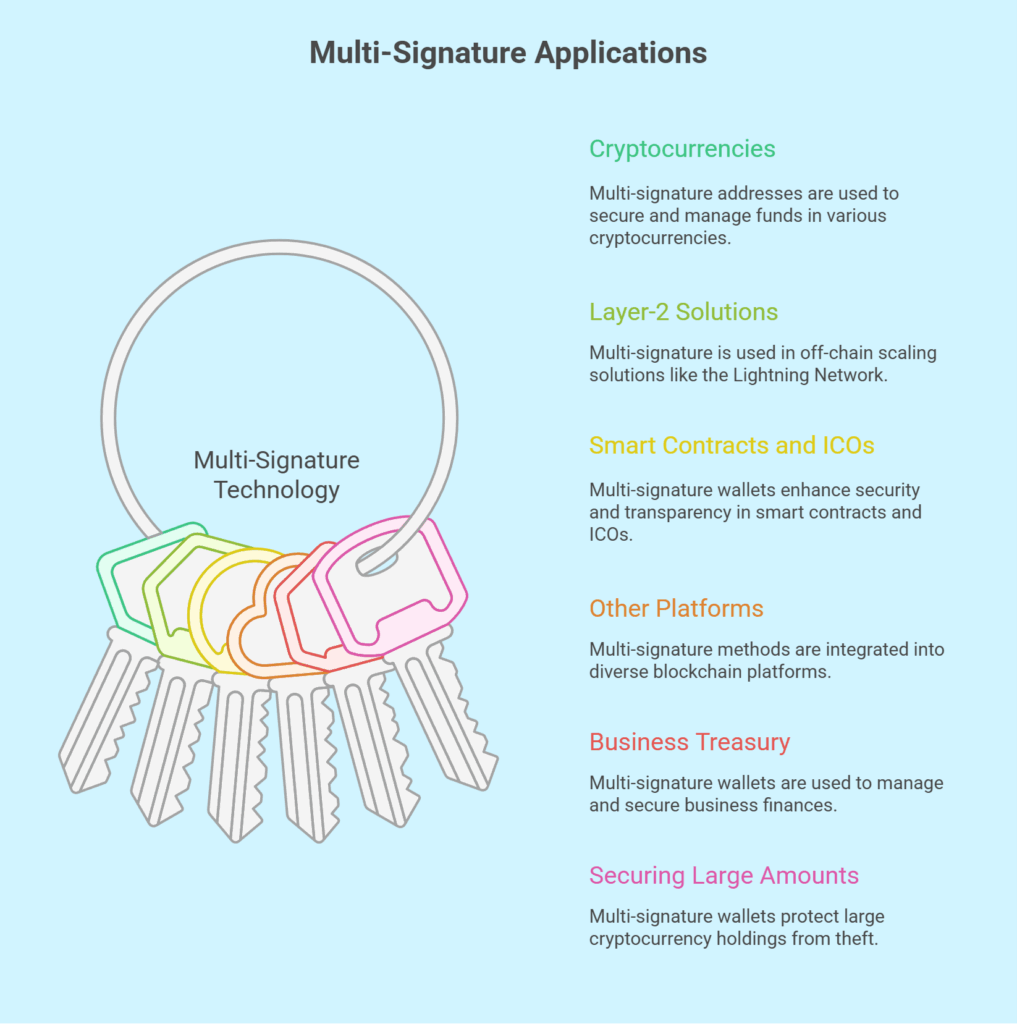

Multi-signature Applications

Because of its strong security features, multi-signature is commonly used across a variety of cryptocurrencies and platforms:

Cryptocurrencies

A certain number of secret keys are required to release funds using multi-signature addresses, like Bitcoin. Multisignature is also used by Litecoin, Ripple, Bytecoin, Dash, and Stratis.

Layer-2 Solutions

A multi-signature system is used by the Lightning Network, an off-chain scaling option for Bitcoin. Multi-signature addresses are also used by the federated sidechain known as the Liquid Network of Bitcoin to store and move money. Lightning wallets are multisig, meaning that each transaction in the Lightning Network requires the consent of both parties, each of whom holds their own private key.

Smart Contracts and ICOs

Ethereum’s smart contracts have the ability to execute multi-signature wallet contracts, which is relevant to initial coin offerings (ICOs). To improve security and transparency for investors, initial coin offerings (ICOs) frequently collect monies raised into multi-signature wallets.

Other Platforms

Multi-signature methods are also integrated into Openchain and Multichain blockchains.

Managing Business Treasury

To lower the danger of misappropriation, businesses and decentralized applications divide financial control among important decision-makers using shared wallets.

Securing Large Amounts of Cryptocurrency

By distributing keys across several devices or locations, multi-sig wallets help institutional investors and high-net-worth people reduce theft and unauthorised access.

Differentiating Threshold Signatures

Although several parties are involved in both threshold and multi-signature signatures, the methods used to handle signatures are different:

- Multi-signature: Usually indicates that each signer provides a unique signature, all of which the recipient must confirm. It enables asynchronous signing, which eliminates the need for parties to be online at the same time.

- Threshold Signatures: Create a single digital signature that the verifier only needs to verify once by combining the private key into shares. In order for the single signature to be generated, it is frequently necessary for all signers to be online at the same time.